DEFA14A: Additional definitive proxy soliciting materials and Rule 14(a)(12) material

Published on October 2, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission Only

(as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X] Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

Chimera Investment Corporation

(Name of Registrant as Specified In Its Charter)

________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X] No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

_______________________

(2) Aggregate number of securities to which transaction applies:

_______________________

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which

the filing fee is calculated and state how it was determined):

_______________________

(4) Proposed maximum aggregate value of transaction:

_______________________

(5) Total fee paid:

_______________________

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule

0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number,

or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

_______________________

(2) Form, Schedule or Registration Statement No. :

_______________________

(3) Filing Party:

_______________________

(4) Date Filed:

_______________________

October 2, 2014

Dear Fellow Stockholder,

Your Board of Directors has unanimously recommended that stockholders vote FOR all of the proposals on the agenda for the important Annual Meeting of the stockholders of Chimera Investment Corporation to be held on October 23, 2014.

Your vote is important, no matter how many or how few shares you may own. Please vote TODAY to ensure that your votes are validly received prior to the Annual Meeting.

In particular, we believe that the diligent efforts of the independent members of our Board of Directors merit voting FOR the re-election of all of the independent members of our Board of Directors. The actions of the independent members of our Board of Directors include oversight of the positive investment performance of Chimera despite the challenges posed during the period that it was not current on its filings with the Securities and Exchange Commission as well as conscientious efforts to remedy Chimera’s weaknesses over internal controls.

As detailed in our recent filings with the Securities and Exchange Commission, in 2012, Chimera discovered that it needed to restate its previously issued (i) Consolidated Statements of Financial Condition included in its Annual Report on Form 10-K as of December 31, 2010 and (ii) Consolidated Statements of Operations and Comprehensive Income (Loss), Consolidated Statements of Changes in Stockholders’ Equity, and Consolidated Statements of Cash Flows for the year ended December 31, 2010, including the cumulative effect of the Restatement on Retained earnings (accumulated deficit) (the “Restatement”). We have completed the Restatement and are now current on all of our filings with the Securities and Exchange Commission.

In connection with the Restatement, we identified several material weaknesses in our internal controls over financial reporting. We believe that we have largely addressed the material weaknesses identified to date. As detailed below, we have strengthened our financial and accounting operations and staff, replaced our former auditor, and are implementing a third party vendor’s accounting software. The accounting software implementation is the final remediation action and is designed to reduce overreliance on spreadsheets and provide further enhancement of review and approval controls.

We have been in the process of implementing software over the past six months and expect the complete implementation of this software and the related systems to be fully operational in the first quarter of 2015. Our Audit Committee, which is comprised of each of the independent members of our Board of Directors, has overseen the remediation of these internal controls and implementation of the upgraded systems and processes.

In addition, since October 31, 2013, our Audit Committee has supervised the filing of two annual reports on Form 10-K and seven quarterly reports on Form 10-Q. This includes the most recent quarterly report on Form 10-Q, which was filed with the Securities and Exchange Commission on a timely basis. Among other measures, the independent members of our Board of Directors have also taken the following decisive actions:

Conducted a Full Review of the Restatement

|

●

|

Commissioned an independent investigation into the Restatement by the law firm Dechert LLP;

|

|

●

|

Approved the hiring of Dechert LLP’s forensic accounting advisors FTI Consulting in the independent investigation into the Restatement;

|

Appointed a New Independent Registered Accounting Firm

|

●

|

Dismissed Deloitte & Touche LLP as our independent registered public accounting firm;

|

|

●

|

Approved the appointment of Ernst & Young LLP as our new independent registered public accounting firm;

|

Strengthened our Financial and Accounting Operations

|

●

|

Appointed Robert Colligan as our Chief Financial Officer;

|

|

●

|

Approved of an entire re-staffing of the accounting department since the beginning of 2013;

|

|

●

|

Oversaw the establishment of a middle office department focused on the review, testing and validation of our asset valuations;

|

Protected Shareholder Value

|

●

|

Strengthened company rights and improved flexibility in our management agreement, including achievement of a management fee reduction;

|

|

●

|

Initiated pursuit of company rights in accordance with our dispute resolution agreement with our former auditors;

|

Enhanced our Infrastructure

|

●

|

Directed the update of numerous policies and procedures and implementation of information technology and accounting systems designed to remediate the material weaknesses;

|

|

●

|

Oversaw the expansion of our manager’s information technology department, including its appointment of a chief technology officer;

|

Expanded Shareholder Transparency

|

●

|

Commenced providing supplemental financial information on our website;

|

|

●

|

Enhanced the disclosures contained in our filings with the Securities and Exchange Commission; and

|

|

●

|

Engaged in outreach programs to our shareholders to address concerns.

|

2

During this period, the independent members of our Board of Directors have declared both regular dividends each quarter as well as an additional one-time special dividend, which aggregate to a per share amount of $1.30. Additionally, the independent members of our Board of Directors have ensured that our common stock remains listed for trading on the New York Stock Exchange.

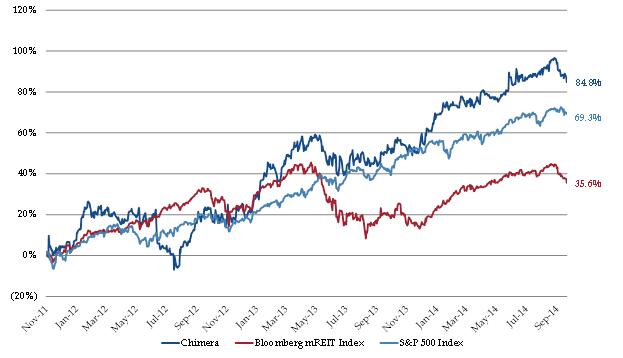

Furthermore, under the active guidance and direction of the independent members of our Board of Directors, we have been able to earn strong return despite the challenge of operating until recently without the benefit of current financial statements. Our total returns over this period are detailed below:

|

Total Returns From 11/10/2011 – 9/30/2014

|

|

Source: Bloomberg as of September 30, 2014.

|

|

Note: Bloomberg mREIT Index represented by BBREMTG Index and S&P 500 Index represented by SPX Index.

|

To address and successfully resolve these issues on behalf of our stockholders, since the beginning of 2012 the independent members of our Board of Directors and Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee, each of which is comprised solely of all of the independent members of our Board of Directors, have met numerous times as noted in the chart below:

|

Full Board of

Directors

|

Audit

Committee

|

Compensation

Committee

|

Nominating and

Corporate

Governance

Committee

|

Additional

Non-Management

Director

Meetings

|

|

|

2012

|

42

|

26

|

4

|

1

|

2

|

|

2013

|

28

|

17

|

2

|

3

|

5

|

|

2014(1)

|

9

|

9

|

1

|

0

|

0

|

|

Total

|

79

|

52

|

7

|

4

|

7

|

|

(1)

|

January 2014 through September 2014

|

3

Each of the independent members of our Board of Directors remains fully committed and devoted to the best interests of our stockholders and we recommend voting FOR the re-election of all of the independent members of our Board of Directors.

Your vote is important, no matter how many or how few shares you may own. If you have not already done so, please vote TODAY by telephone, via the Internet, or by signing, dating and returning the enclosed proxy card in the envelope provided to ensure that your votes are validly received prior to the Annual Meeting.

|

Thank you for your support.

|

|

|

Sincerely,

|

|

|

|

|

Matthew Lambiase

|

|

|

Chief Executive Officer

|

|

REMEMBER:

|

|

You can vote your shares by telephone, or via the Internet.

|

|

Please follow the easy instructions on the enclosed card.

|

|

If you have any questions, or need assistance in voting

|

|

your shares, please call our proxy solicitor,

|

|

INNISFREE M&A INCORPORATED

|

|

TOLL-FREE, at 1-888-750-5834.

|

4