EXHIBIT 99.2

Published on November 10, 2014

Exhibit 99.2

CONFERENCE NAME GOES HERE

00 Information is unaudited, estimated and subject to change.

WWW.ANNALY.COM WWW.CHIMERAREIT.COM CHIMERA INVESTMENT CORPORATION Q3

2014 Supplemental Financial Information November 10, 2014

CONFERENCE NAME GOES HERE

11 Information is unaudited, estimated and subject to change. Disclaimer

This material is not intended to be exhaustive, is preliminary in nature

and may be subject to change. In addition, much of the information

contained herein is based on various assumptions (some of which are

beyond the control of Chimera Investment Corporation, the “Company”) and

may be identified by reference to a future period or periods or by the

use of forward-looking terminology, such as “believe,” “expect,”

“anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,”

“would,” “projected,” “will” or similarexpressions, or variations on

those terms or the negative of those terms. The Company’s

forward-looking statements are subject to numerous risks, uncertainties

and other factors. Furthermore, none of the financial information

contained in this material has been audited or approved by the Company’s

independent registered public accounting firm. 1

CONFERENCE NAME GOES HERE

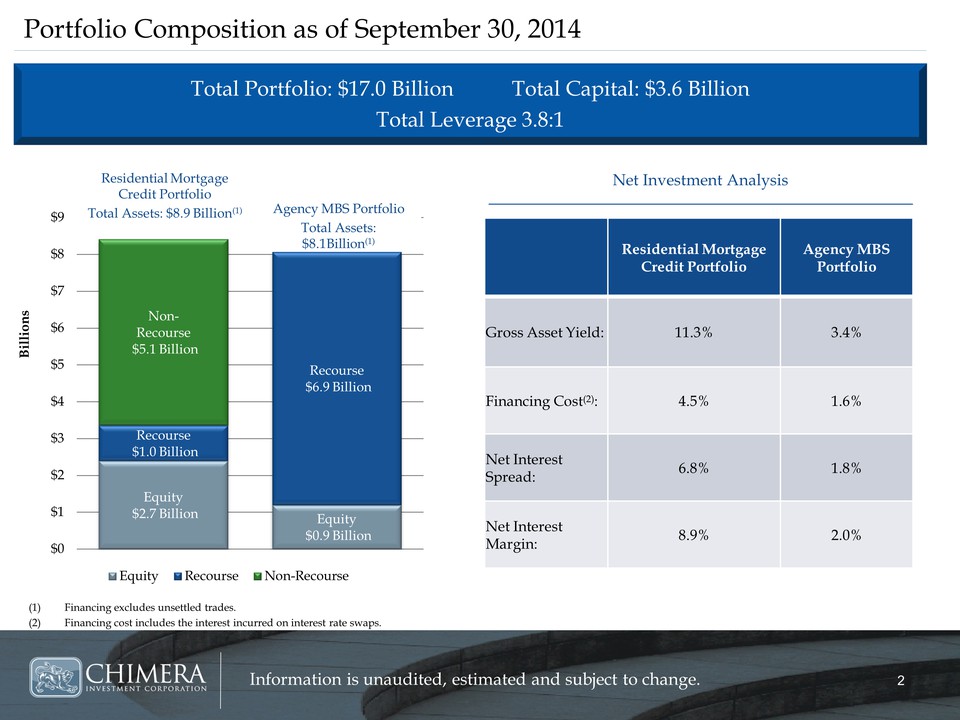

22 Information is unaudited, estimated and subject to change. Equity$2.7

Billion Equity Recourse $1.0 BillionRecourse $6.9 BillionNon- Recourse

$5.1 Billion$0 $1 $2 $3 $4 $5 $6 $7 $8 $9 Billions Equity Recourse

Non-Recourse Portfolio Composition as of September 30, 2014 Residential

Mortgage Credit Portfolio Agency MBS Portfolio Gross Asset Yield: 11.3%

3.4 Financing Cost(2): 4.5% 1.6%Net Interest Spread: 6.8% 1.8% Net

Interest Margin: 8.9% 2.0% (1) Financing excludes unsettled trades.,(2)

Financing cost includes the interest incurred on interest rate swaps.

Total Portfolio: $17.0 Billion Total Capital: $3.6 Billion Total

Leverage 3.8:1 Net Investment Analysis Residential Mortgage Credit

Portfolio Total Assets: $8.9 Billion(1) Agency MBS Portfolio Total

Assets: $8.1Billion(1) 2

CONFERENCE NAME GOES HERE

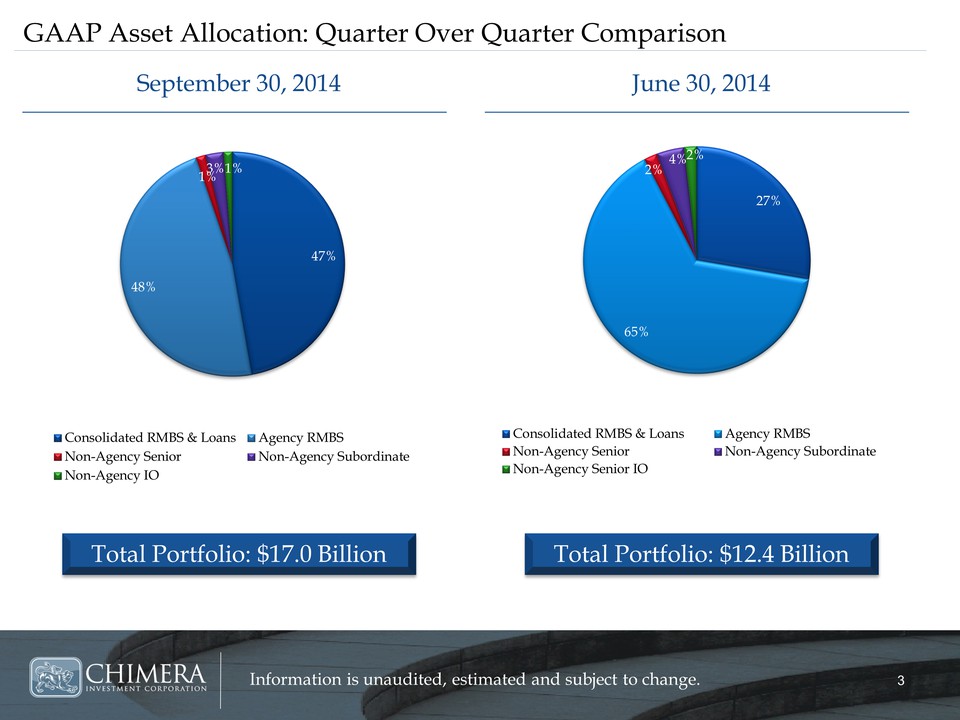

33 Information is unaudited, estimated and subject to change. September

30, 2014 June 30, 2014 GAAP Asset Allocation: Quarter Over Quarter

Comparison Total Portfolio: $12.4 Billion Total Portfolio: $17.0 Billion

27% 65% 2% 4%2% Consolidated RMBS & Loans Agency RMBS Non-Agency Senior

Non-Agency Subordinate Non-Agency Senior IO 47% 48% 1%3%1% Consolidated

RMBS & Loans Agency RMBS Non-Agency Senior Non-Agency Subordinate

Non-Agency IO 3

CONFERENCE NAME GOES HERE

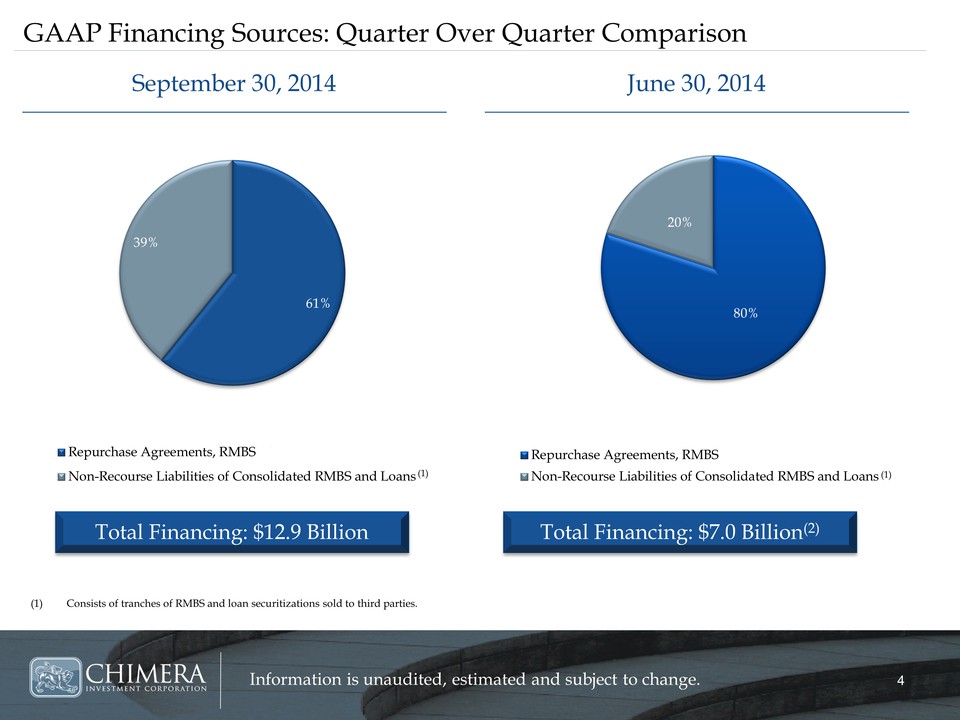

44 Information is unaudited, estimated and subject to change. 80% 20%

Repurchase Agreements, RMBS Non-Recourse Liabilities of Consolidated

RMBS and Loans (1) Consists of tranches of RMBS and loan securitizations

sold to third parties. September 30, 2014 June 30, 2014 GAAP Financing

Sources: Quarter Over Quarter Comparison Total Financing: $7.0

Billion(2) (1) Total Financing: $12.9 Billion 61% 39% Repurchase

Agreements, RMBS (1) Non-Recourse Liabilities of Consolidated RMBS and

Loans(1) 4

CONFERENCE NAME GOES HERE

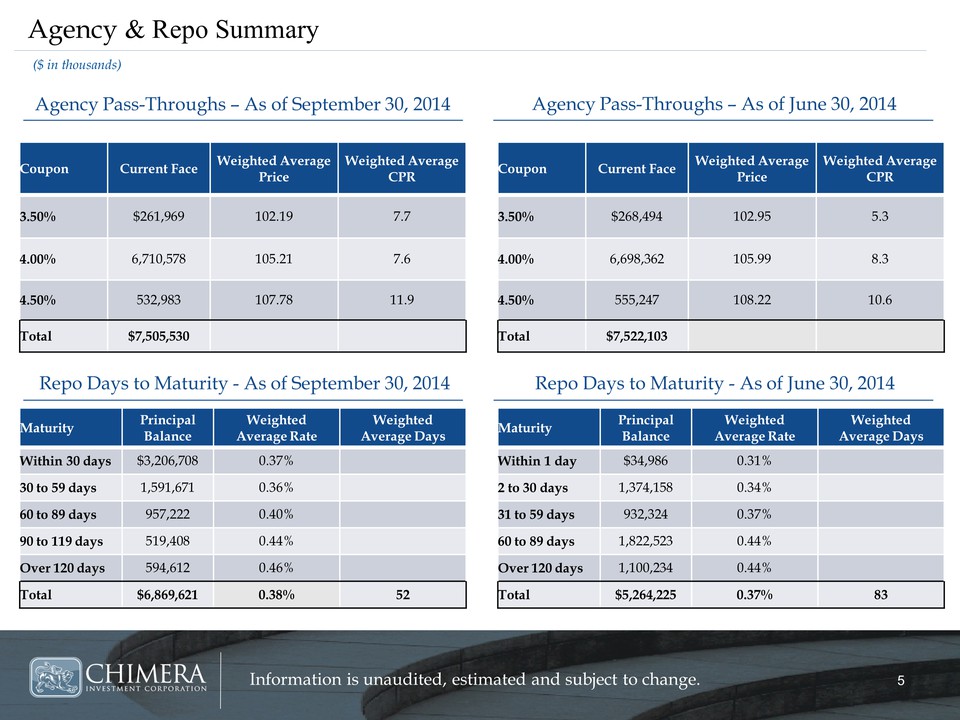

55 Information is unaudited, estimated and subject to change. Agency &

Repo Summary Agency Pass-Throughs – As of September 30, 2014 Repo Days

to Maturity - As of September 30, 2014 Agency Pass-Throughs – As of June

30, 2014 Maturity Principal Balance Weighted Average Rate Weighted

Average Days Within 1 day $34,986 0.31% 2 to 30 days 1,374,158 0.34% 31

to 59 days 932,324 0.37% 60 to 89 days 1,822,523 0.44% Over 120 days

1,100,234 0.44% Total $5,264,225 0.37% 83 Repo Days to Maturity - As of

June 30, 2014 ($ in thousands) Coupon Current Face Weighted Average

Price Weighted Average CPR 3.50% $268,494 102.95 5.3 4.00% 6,698,362

105.99 8.3 4.50% 555,247 108.22 10.6 Total $7,522,103 Maturity Principal

Balance Weighted Average Rate Weighted Average Days Within 30 days

$3,206,708 0.37% 30 to 59 days 1,591,671 0.36% 60 to 89 days 957,222

0.40% 90 to 119 days 519,408 0.44% Over 120 days 594,612 0.46% Total

$6,869,621 0.38% 52 Coupon Current Face Weighted Average Price Weighted

Average CPR 3.50% $261,969 102.19 7.7 4.00% 6,710,578 105.21 7.6 4.50%

532,983 107.78 11.9 Total $7,505,530 5

CONFERENCE NAME GOES HERE

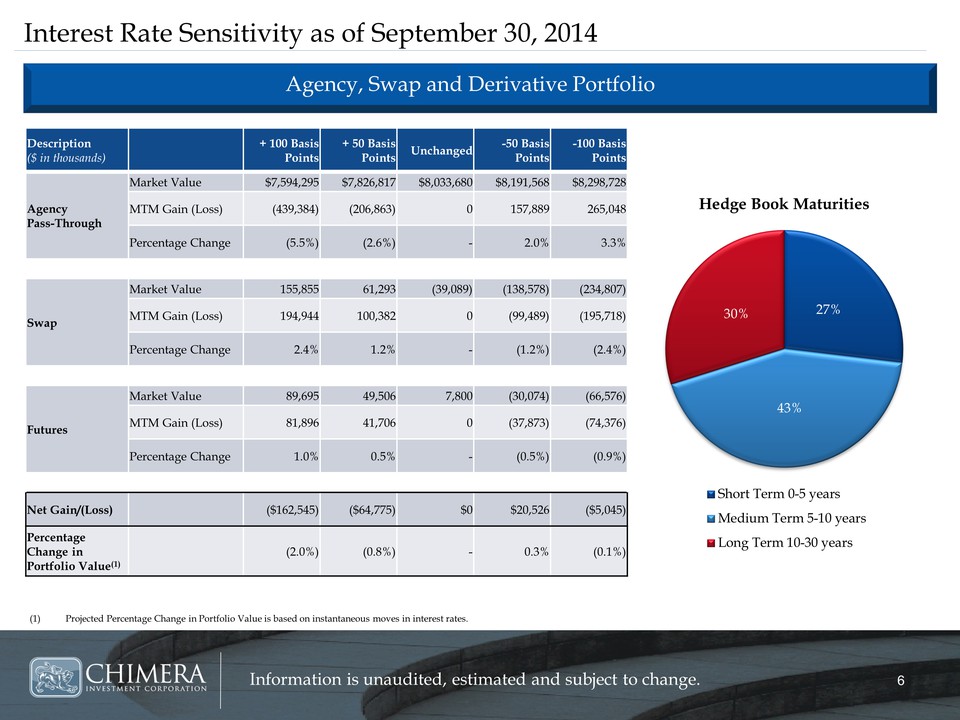

66 Information is unaudited, estimated and subject to change. Interest

Rate Sensitivity as of September 30, 2014 Agency, Swap and Derivative

Portfolio Description ($ in thousands) + 100 Basis Points + 50 Basis

Points Unchanged -50 Basis Points -100 Basis Points Agency Pass-Through

Market Value $7,594,295 $7,826,817 $8,033,680 $8,191,568 $8,298,728 MTM

Gain (Loss) (439,384) (206,863) 0 157,889 265,048 Percentage Change

(5.5%) (2.6%) - 2.0% 3.3% Swap Market Value 155,855 61,293 (39,089)

(138,578) (234,807) MTM Gain (Loss) 194,944 100,382 0 (99,489) (195,718)

Percentage Change 2.4% 1.2% - (1.2%) (2.4%) Futures Market Value 89,695

49,506 7,800 (30,074) (66,576) MTM Gain (Loss) 81,896 41,706 0 (37,873)

(74,376) Percentage Change 1.0% 0.5% - (0.5%) (0.9%) Net Gain/(Loss)

($162,545) ($64,775) $0 $20,526 ($5,045) Percentage Change in Portfolio

Value(1) (2.0%) (0.8%) - 0.3% (0.1%) (1) Projected Percentage Change in

Portfolio Value is based on instantaneous moves in interest rates. 27%

43% 30% Hedge Book Maturities Short Term 0-5 years Medium Term 5-10

years Long Term 10-30 years 6

CONFERENCE NAME GOES HERE

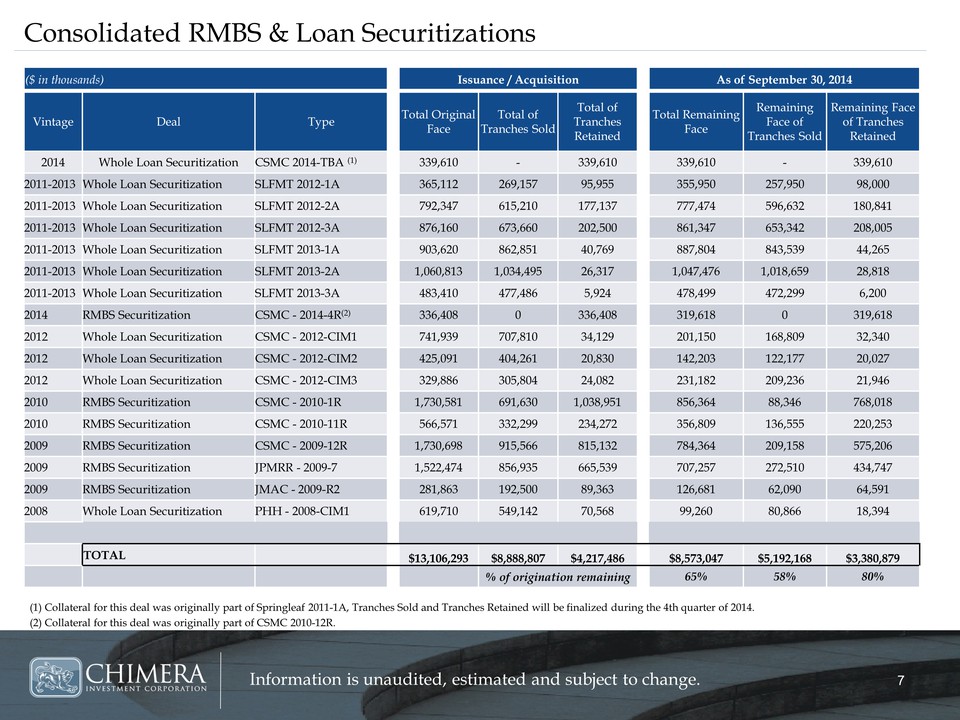

77 Information is unaudited, estimated and subject to change.

Consolidated RMBS & Loan Securitizations ($ in thousands) Issuance /

Acquisition As of September 30, 2014 Vintage Deal Type Total Original

Face Total of Tranches Sold Total of Tranches Retained Total Remaining

Face Remaining Face of Tranches Sold Remaining Face of Tranches Retained

2014 Whole Loan Securitization CSMC 2014-TBA (1) 339,610 - 339,610

339,610 - 339,610 2011-2013 Whole Loan Securitization SLFMT 2012-1A

365,112 269,157 95,955 355,950 257,950 98,000 2011-2013 Whole Loan

Securitization SLFMT 2012-2A 792,347 615,210 177,137 777,474 596,632

180,841 2011-2013 Whole Loan Securitization SLFMT 2012-3A 876,160

673,660 202,500 861,347 653,342 208,005 2011-2013 Whole Loan

Securitization SLFMT 2013-1A 903,620 862,851 40,769 887,804 843,539

44,265 2011-2013 Whole Loan Securitization SLFMT 2013-2A 1,060,813

1,034,495 26,317 1,047,476 1,018,659 28,818 2011-2013 Whole Loan

Securitization SLFMT 2013-3A 483,410 477,486 5,924 478,499 472,299 6,200

2014 RMBS Securitization CSMC - 2014-4R(2) 336,408 0 336,408 319,618 0

319,618 2012 Whole Loan Securitization CSMC - 2012-CIM1 741,939 707,810

34,129 201,150 168,809 32,340 2012 Whole Loan Securitization CSMC -

2012-CIM2 425,091 404,261 20,830 142,203 122,177 20,027 2012 Whole Loan

Securitization CSMC - 2012-CIM3 329,886 305,804 24,082 231,182 209,236

21,946 2010 RMBS Securitization CSMC - 2010-1R 1,730,581 691,630

1,038,951 856,364 88,346 768,018 2010 RMBS Securitization CSMC -

2010-11R 566,571 332,299 234,272 356,809 136,555 220,253 2009 RMBS

Securitization CSMC - 2009-12R 1,730,698 915,566 815,132 784,364 209,158

575,206 2009 RMBS Securitization JPMRR - 2009-7 1,522,474 856,935

665,539 707,257 272,510 434,747 2009 RMBS Securitization JMAC - 2009-R2

281,863 192,500 89,363 126,681 62,090 64,591 2008 Whole Loan

Securitization PHH - 2008-CIM1 619,710 549,142 70,568 99,260 80,866

18,394 TOTAL $13,106,293 $8,888,807 $4,217,486 $8,573,047 $5,192,168

$3,380,879 % of origination remaining 65% 58% 80% (1) Collateral for

this deal was originally part of Springleaf 2011-1A, Tranches Sold and

Tranches Retained will be finalized during the 4th quarter of 2014. (2)

Collateral for this deal was originally part of CSMC 2010-12R. 7