EXHIBIT 99.2

Published on November 2, 2017

FINANCIAL

SUPPLEMENT

NYSE: CIM

3rd Quarter 2017

Information is unaudited, estimated and subject to change.

DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the UnitedStates Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates andprojections and, consequently, readers should not rely on these forward-looking statements as predictions of future

events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,”

“may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify

such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that

could cause actual results to differ materially from expected results, including, among other things, those described in

our Annual Report on Form 10-K for the year ended December 31, 2016, and any subsequent Quarterly Reports on Form

10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the

state of credit markets and general economic conditions; changes in interest rates and the market value of our assets;

the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and

timing of credit losses within our portfolio; the credit risk in our underlying assets; declines in home prices; our ability to

establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target

assets; our ability to borrow to finance our assets and the associated costs; changes in the competitive landscape within

our industry; our ability to manage various operational risks and costs associated with our business; interruptions in or

impairments to our communications and information technology systems; our ability to acquire residential mortgage

loans and successfully securitize the residential mortgage loans we acquire; our ability to oversee our third party sub-

servicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the

foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our

business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to

maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status

under the Investment Company Act of 1940.

Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the

date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any

forward-looking statement to reflect any change in its expectations or any change in events, conditions or

circumstances on which any such statement is based. Additional information concerning these and other risk factors is

contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written

and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its

behalf are expressly qualified in their entirety by the cautionary statements above.

This presentation may include industry and market data obtained through research, surveys, and studies conducted by

third parties and industry publications. We have not independently verified any such market and industry data from

third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or

investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This

presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of

the terms of an offer that the parties or their respective affiliates would accept.

Readers are advised that the financial information in this presentation is based on company data available at the time of

this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

Information is unaudited, estimated and subject to change. 2

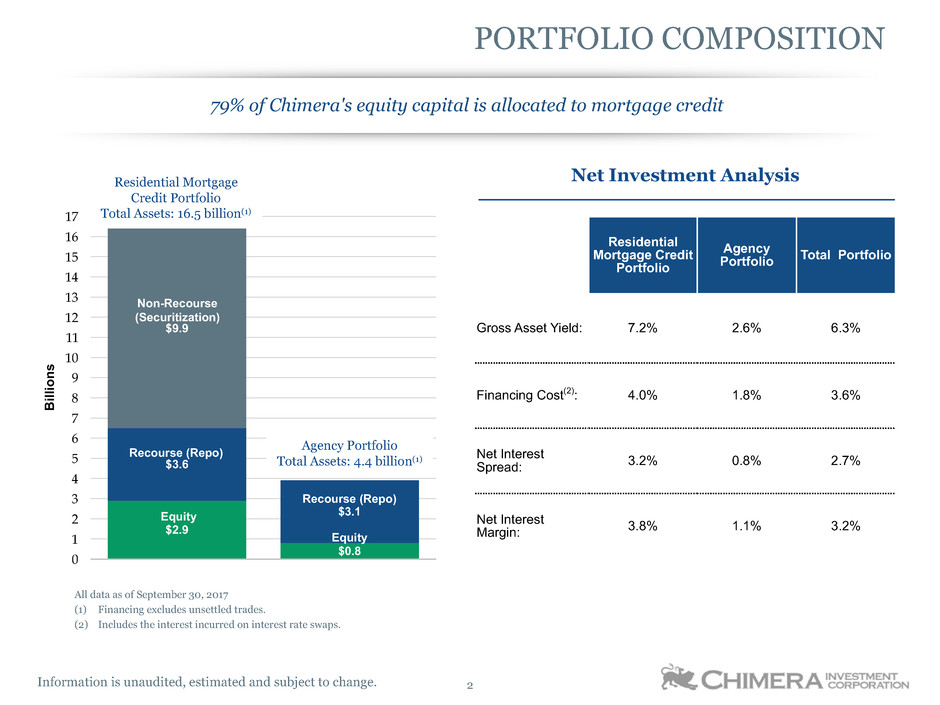

PORTFOLIO COMPOSITION

Residential

Mortgage Credit

Portfolio

Agency

Portfolio Total Portfolio

Gross Asset Yield: 7.2% 2.6% 6.3%

Financing Cost(2): 4.0% 1.8% 3.6%

Net Interest

Spread: 3.2% 0.8% 2.7%

Net Interest

Margin: 3.8% 1.1% 3.2%

All data as of September 30, 2017

(1) Financing excludes unsettled trades.

(2) Includes the interest incurred on interest rate swaps.

Net Investment Analysis

17

16

15

14

13

12

11

10

9

8

7

6

5

4

3

2

1

0

B

ill

io

ns

$2.9

$0.8

$3.6

$3.1

$9.9

Non-Recourse

(Securitization)

Recourse (Repo)

Recourse (Repo)

Equity

Equity

Agency Portfolio

Total Assets: 4.4 billion(1)

Residential Mortgage

Credit Portfolio

Total Assets: 16.5 billion(1)

79% of Chimera's equity capital is allocated to mortgage credit

Information is unaudited, estimated and subject to change. 3

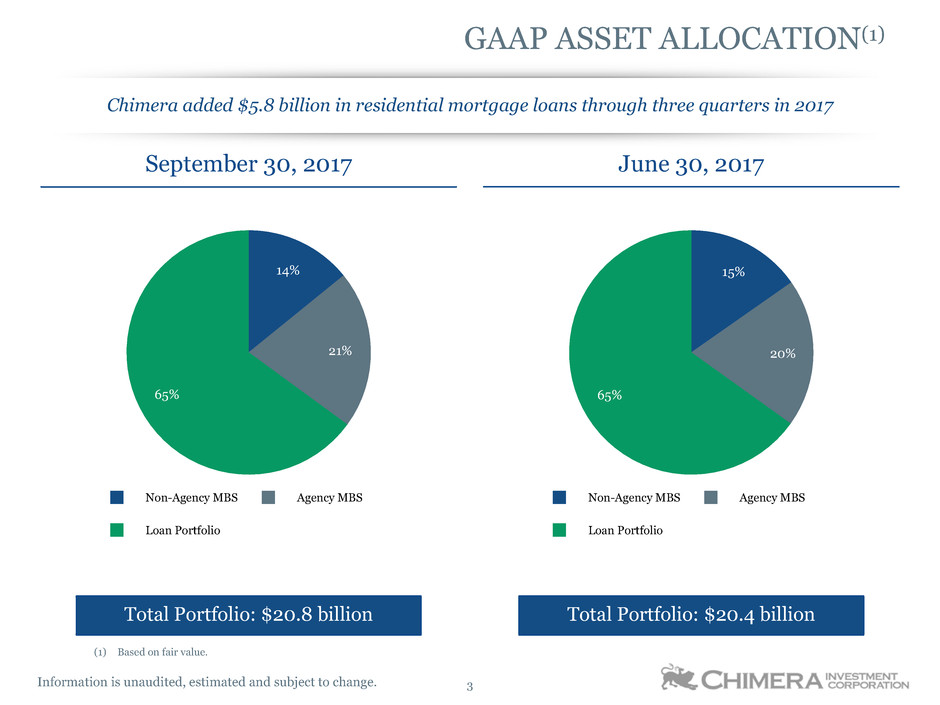

September 30, 2017 June 30, 2017

Total Portfolio: $20.8 billion Total Portfolio: $20.4 billion

Non-Agency MBS Agency MBS

Loan Portfolio

14%

21%

65%

Non-Agency MBS Agency MBS

Loan Portfolio

15%

20%

65%

GAAP ASSET ALLOCATION(1)

(1) Based on fair value.

Chimera added $5.8 billion in residential mortgage loans through three quarters in 2017

Information is unaudited, estimated and subject to change. 4

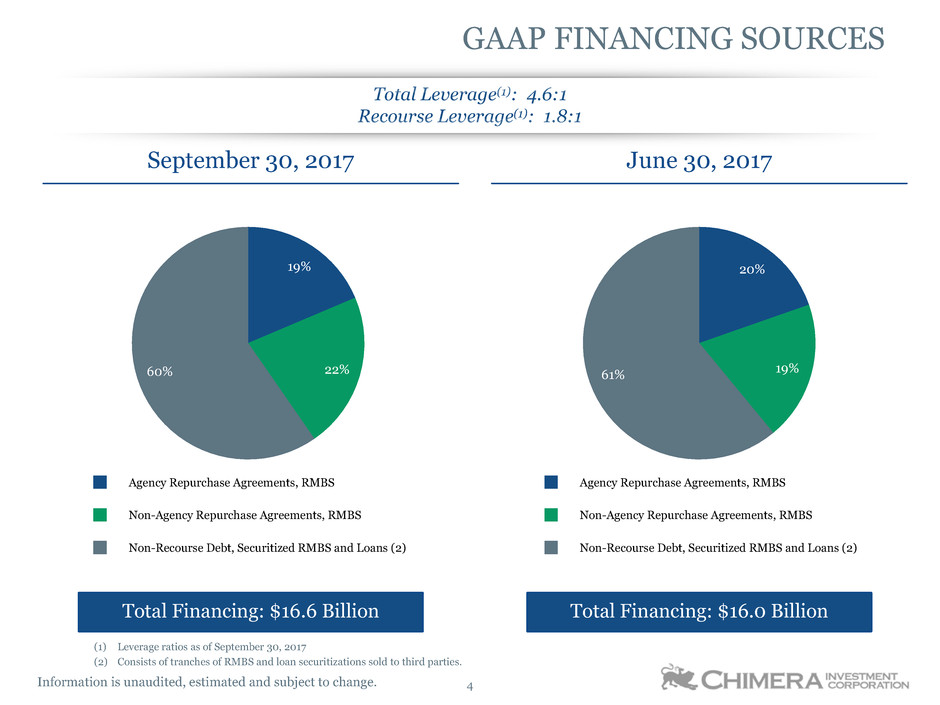

September 30, 2017 June 30, 2017

Total Financing: $16.6 Billion Total Financing: $16.0 Billion

Agency Repurchase Agreements, RMBS

Non-Agency Repurchase Agreements, RMBS

Non-Recourse Debt, Securitized RMBS and Loans (2)

19%

22%60%

Agency Repurchase Agreements, RMBS

Non-Agency Repurchase Agreements, RMBS

Non-Recourse Debt, Securitized RMBS and Loans (2)

20%

19%61%

GAAP FINANCING SOURCES

(1) Leverage ratios as of September 30, 2017

(2) Consists of tranches of RMBS and loan securitizations sold to third parties.

Total Leverage(1): 4.6:1

Recourse Leverage(1): 1.8:1

Information is unaudited, estimated and subject to change. 5

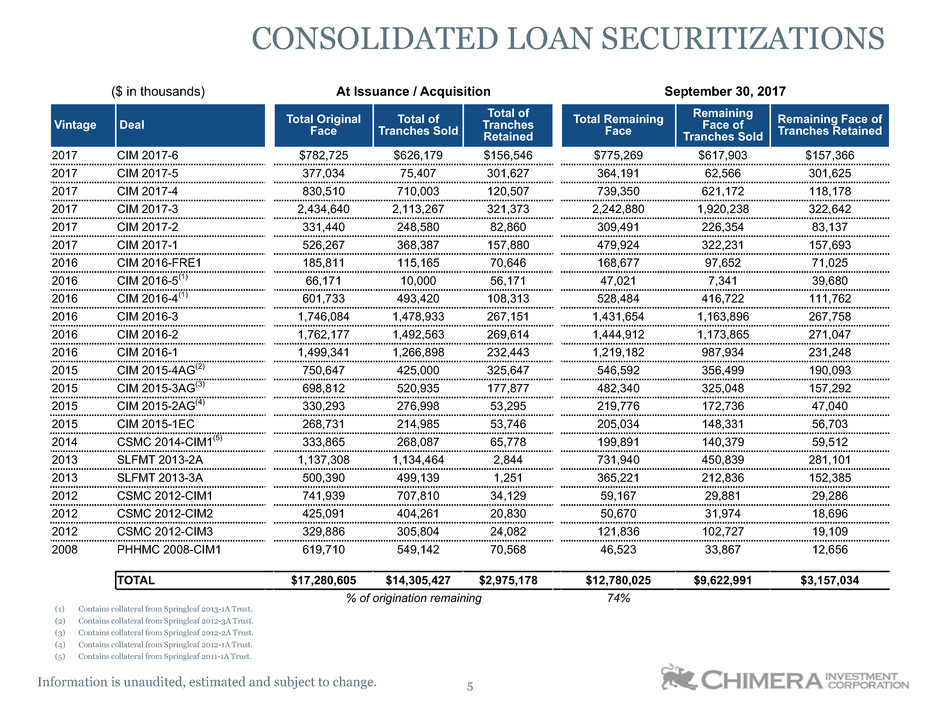

($ in thousands) At Issuance / Acquisition September 30, 2017

Vintage Deal Total OriginalFace

Total of

Tranches Sold

Total of

Tranches

Retained

Total Remaining

Face

Remaining

Face of

Tranches Sold

Remaining Face of

Tranches Retained

2017 CIM 2017-6 $782,725 $626,179 $156,546 $775,269 $617,903 $157,366

2017 CIM 2017-5 377,034 75,407 301,627 364,191 62,566 301,625

2017 CIM 2017-4 830,510 710,003 120,507 739,350 621,172 118,178

2017 CIM 2017-3 2,434,640 2,113,267 321,373 2,242,880 1,920,238 322,642

2017 CIM 2017-2 331,440 248,580 82,860 309,491 226,354 83,137

2017 CIM 2017-1 526,267 368,387 157,880 479,924 322,231 157,693

2016 CIM 2016-FRE1 185,811 115,165 70,646 168,677 97,652 71,025

2016 CIM 2016-5(1) 66,171 10,000 56,171 47,021 7,341 39,680

2016 CIM 2016-4(1) 601,733 493,420 108,313 528,484 416,722 111,762

2016 CIM 2016-3 1,746,084 1,478,933 267,151 1,431,654 1,163,896 267,758

2016 CIM 2016-2 1,762,177 1,492,563 269,614 1,444,912 1,173,865 271,047

2016 CIM 2016-1 1,499,341 1,266,898 232,443 1,219,182 987,934 231,248

2015 CIM 2015-4AG(2) 750,647 425,000 325,647 546,592 356,499 190,093

2015 CIM 2015-3AG(3) 698,812 520,935 177,877 482,340 325,048 157,292

2015 CIM 2015-2AG(4) 330,293 276,998 53,295 219,776 172,736 47,040

2015 CIM 2015-1EC 268,731 214,985 53,746 205,034 148,331 56,703

2014 CSMC 2014-CIM1(5) 333,865 268,087 65,778 199,891 140,379 59,512

2013 SLFMT 2013-2A 1,137,308 1,134,464 2,844 731,940 450,839 281,101

2013 SLFMT 2013-3A 500,390 499,139 1,251 365,221 212,836 152,385

2012 CSMC 2012-CIM1 741,939 707,810 34,129 59,167 29,881 29,286

2012 CSMC 2012-CIM2 425,091 404,261 20,830 50,670 31,974 18,696

2012 CSMC 2012-CIM3 329,886 305,804 24,082 121,836 102,727 19,109

2008 PHHMC 2008-CIM1 619,710 549,142 70,568 46,523 33,867 12,656

TOTAL $17,280,605 $14,305,427 $2,975,178 $12,780,025 $9,622,991 $3,157,034

% of origination remaining 74%

(1) Contains collateral from Springleaf 2013-1A Trust.

(2) Contains collateral from Springleaf 2012-3A Trust.

(3) Contains collateral from Springleaf 2012-2A Trust.

(4) Contains collateral from Springleaf 2012-1A Trust.

(5) Contains collateral from Springleaf 2011-1A Trust.

CONSOLIDATED LOAN SECURITIZATIONS

Information is unaudited, estimated and subject to change. 6

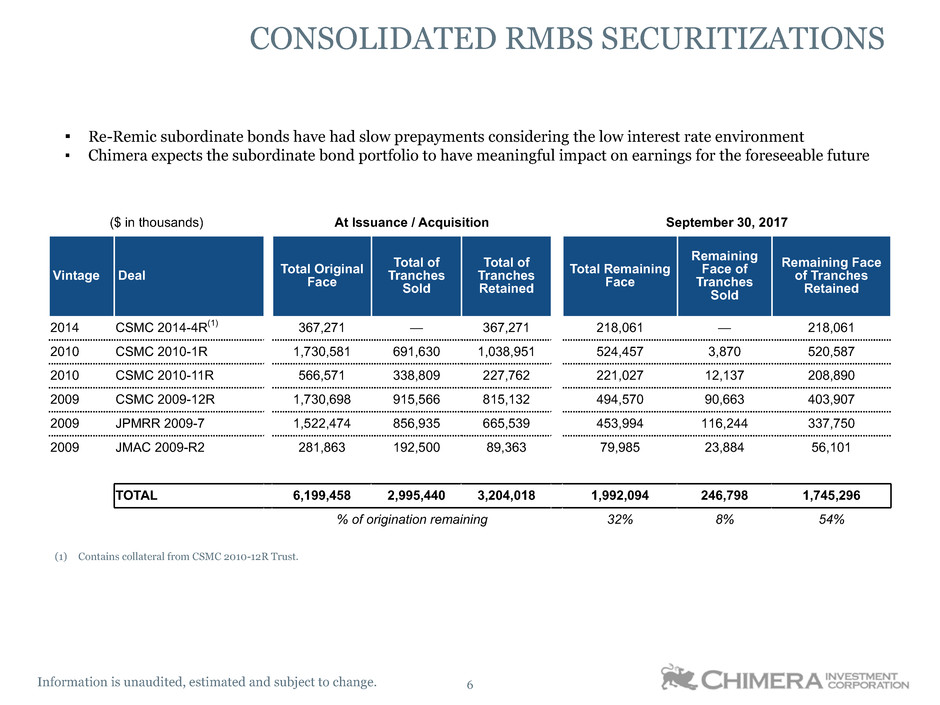

($ in thousands) At Issuance / Acquisition September 30, 2017

Vintage Deal Total OriginalFace

Total of

Tranches

Sold

Total of

Tranches

Retained

Total Remaining

Face

Remaining

Face of

Tranches

Sold

Remaining Face

of Tranches

Retained

2014 CSMC 2014-4R(1) 367,271 — 367,271 218,061 — 218,061

2010 CSMC 2010-1R 1,730,581 691,630 1,038,951 524,457 3,870 520,587

2010 CSMC 2010-11R 566,571 338,809 227,762 221,027 12,137 208,890

2009 CSMC 2009-12R 1,730,698 915,566 815,132 494,570 90,663 403,907

2009 JPMRR 2009-7 1,522,474 856,935 665,539 453,994 116,244 337,750

2009 JMAC 2009-R2 281,863 192,500 89,363 79,985 23,884 56,101

TOTAL 6,199,458 2,995,440 3,204,018 1,992,094 246,798 1,745,296

% of origination remaining 32% 8% 54%

CONSOLIDATED RMBS SECURITIZATIONS

▪ Re-Remic subordinate bonds have had slow prepayments considering the low interest rate environment

▪ Chimera expects the subordinate bond portfolio to have meaningful impact on earnings for the foreseeable future

(1) Contains collateral from CSMC 2010-12R Trust.

Information is unaudited, estimated and subject to change. 7

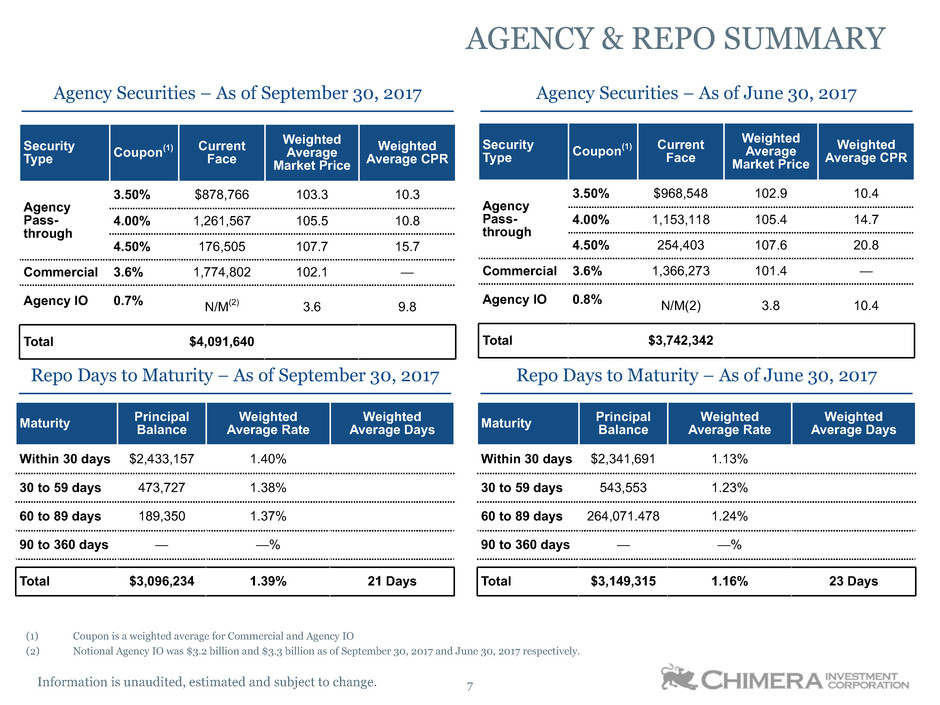

Agency Securities – As of September 30, 2017

Repo Days to Maturity – As of September 30, 2017

Agency Securities – As of June 30, 2017

Repo Days to Maturity – As of June 30, 2017

Maturity PrincipalBalance

Weighted

Average Rate

Weighted

Average Days

Within 30 days $2,341,691 1.13%

30 to 59 days 543,553 1.23%

60 to 89 days 264,071.478 1.24%

90 to 360 days — —%

Total $3,149,315 1.16% 23 Days

(1) Coupon is a weighted average for Commercial and Agency IO

(2) Notional Agency IO was $3.2 billion and $3.3 billion as of September 30, 2017 and June 30, 2017 respectively.

Security

Type Coupon

(1) Current

Face

Weighted

Average

Market Price

Weighted

Average CPR

Agency

Pass-

through

3.50% $878,766 103.3 10.3

4.00% 1,261,567 105.5 10.8

4.50% 176,505 107.7 15.7

Commercial 3.6% 1,774,802 102.1 —

Agency IO 0.7% N/M(2) 3.6 9.8

Total $4,091,640

Maturity PrincipalBalance

Weighted

Average Rate

Weighted

Average Days

Within 30 days $2,433,157 1.40%

30 to 59 days 473,727 1.38%

60 to 89 days 189,350 1.37%

90 to 360 days — —%

Total $3,096,234 1.39% 21 Days

Security

Type Coupon

(1) Current

Face

Weighted

Average

Market Price

Weighted

Average CPR

Agency

Pass-

through

3.50% $968,548 102.9 10.4

4.00% 1,153,118 105.4 14.7

4.50% 254,403 107.6 20.8

Commercial 3.6% 1,366,273 101.4 —

Agency IO 0.8% N/M(2) 3.8 10.4

Total $3,742,342

AGENCY & REPO SUMMARY

Information is unaudited, estimated and subject to change. 8

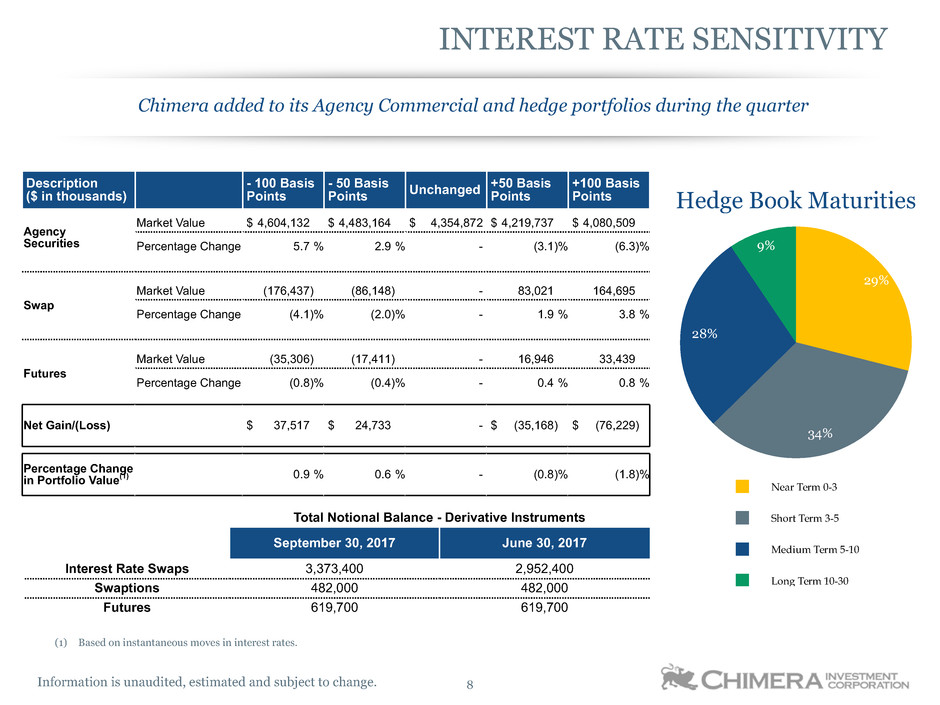

Description

($ in thousands)

- 100 Basis

Points

- 50 Basis

Points Unchanged

+50 Basis

Points

+100 Basis

Points

Agency

Securities

Market Value $ 4,604,132 $ 4,483,164 $ 4,354,872 $ 4,219,737 $ 4,080,509

Percentage Change 5.7 % 2.9 % - (3.1)% (6.3)%

Swap

Market Value (176,437) (86,148) - 83,021 164,695

Percentage Change (4.1)% (2.0)% - 1.9 % 3.8 %

Futures

Market Value (35,306) (17,411) - 16,946 33,439

Percentage Change (0.8)% (0.4)% - 0.4 % 0.8 %

Net Gain/(Loss) $ 37,517 $ 24,733 - $ (35,168) $ (76,229)

Percentage Change

in Portfolio Value(1) 0.9 % 0.6 % - (0.8)% (1.8)% Near Term 0-3

Short Term 3-5

Medium Term 5-10

Long Term 10-30

Hedge Book Maturities

29%

34%

28%

9%

INTEREST RATE SENSITIVITY

Chimera added to its Agency Commercial and hedge portfolios during the quarter

Total Notional Balance - Derivative Instruments

September 30, 2017 June 30, 2017

Interest Rate Swaps 3,373,400 2,952,400

Swaptions 482,000 482,000

Futures 619,700 619,700

(1) Based on instantaneous moves in interest rates.

chimerareit.com