EXHIBIT 99.2

Published on August 5, 2015

Exhibit 99.2

PRESS RELEASE

NYSE: CIM

CHIMERA INVESTMENT CORPORATION

1211 Avenue of the Americas

New York, New York 10036

_________________________________________________________________________________________________

FOR FURTHER INFORMATION

Investor Relations

866-315-9930

www.chimerareit.com

FOR IMMEDIATE RELEASE

CHIMERA INVESTMENT CORPORATION ANNOUNCES INTERNALIZATION OF MANAGEMENT, $250 MILLION STOCK BUY-BACK PLAN INCLUDING IMMEDIATE REPURCHASE OF SHARES FROM ANNALY AND RELEASES 2nd QUARTER 2015 EARNINGS:

|

●

|

NET INCOME OF $116 MILLION OR $0.57 PER SHARE

|

|

●

|

CORE EARNINGS OF $109 MI LLION OR $0.53 PER SHARE

|

|

●

|

GAAP BOOK VALUE OF $16.73 PER SHARE

|

New New York – August 5, 2015 – Chimera Investment Corporation (NYSE: CIM) (“Chimera” or the “Company”) and Annaly Capital Management, Inc. (“Annaly”) jointly announced that, effective today, Chimera is internalizing its management function. The independent directors on Chimera’s Board agreed to the internalization with Annaly in order to accelerate growth and realize cost efficiencies. Chimera will continue to be led by its key professionals including President and Chief Executive Officer Matthew Lambiase, Chief Financial Officer Rob Colligan and Chief Investment Officer Mohit Marria. In addition, Chimera’s head of structured products, Choudhary Yarlagadda, was appointed Chief Operating Officer and Phillip J. Kardis II, a partner at the law firm K&L Gates LLP, was appointed General Counsel. All other personnel that focus their efforts on Chimera’s business became employees of Chimera.

“This transaction is an exciting new chapter in the growth of Chimera,” said Matt Lambiase, Chimera’s President and Chief Executive Officer. “Chimera is strongly positioned to take advantage of the market opportunities in the residential mortgage credit space and the internalization represents an opportune time to transition to a standalone infrastructure company as the portfolio continues to grow. The internalization will ensure continuity of the leadership team while enhancing the Company’s ability to drive shareholder value through a lower cost base, simplified structure and more focused strategy.”

In connection with the internalization, Chimera entered into a transition services agreement with its external manager, Fixed Income Discount Advisory Company (“FIDAC”), a wholly owned subsidiary of Annaly. Under the transition services agreement, FIDAC will continue to provide the Company with certain transition services related to business support through the end of the year. No termination fee was paid by Chimera in connection with internalization.

As part of the agreement, Chimera will purchase Annaly’s 4.4% stake in Chimera for a purchase price of $126.4 million ($14.05 per share) as part of a new $250 million share repurchase program authorized by the Chimera Board. Purchases made pursuant to the program will be made in either the open market or in privately negotiated transactions from time to time as permitted by securities laws and other legal requirements. The timing, manner, price and amount of any repurchases will be determined by the Company in its discretion and will be subject to economic and market conditions, stock price, applicable legal requirements and other factors. The authorization does not obligate the Company to acquire any particular

amount of common shares and the program may be suspended or discontinued at the Company’s discretion without prior notice

2nd Quarter 2015 Financial Results and Highlights

“We continued to make strong progress executing against our strategy in the second quarter. Chimera reduced its Agency portfolio by over $2.5 billion since the beginning of the year, significantly reducing our interest rate exposure and enhancing our risk profile. The Company continues to produce solid returns while operating at lower leverage and we are well placed to manage any increase in volatility in the quarters ahead.” said Mr. Lambiase.

| ● |

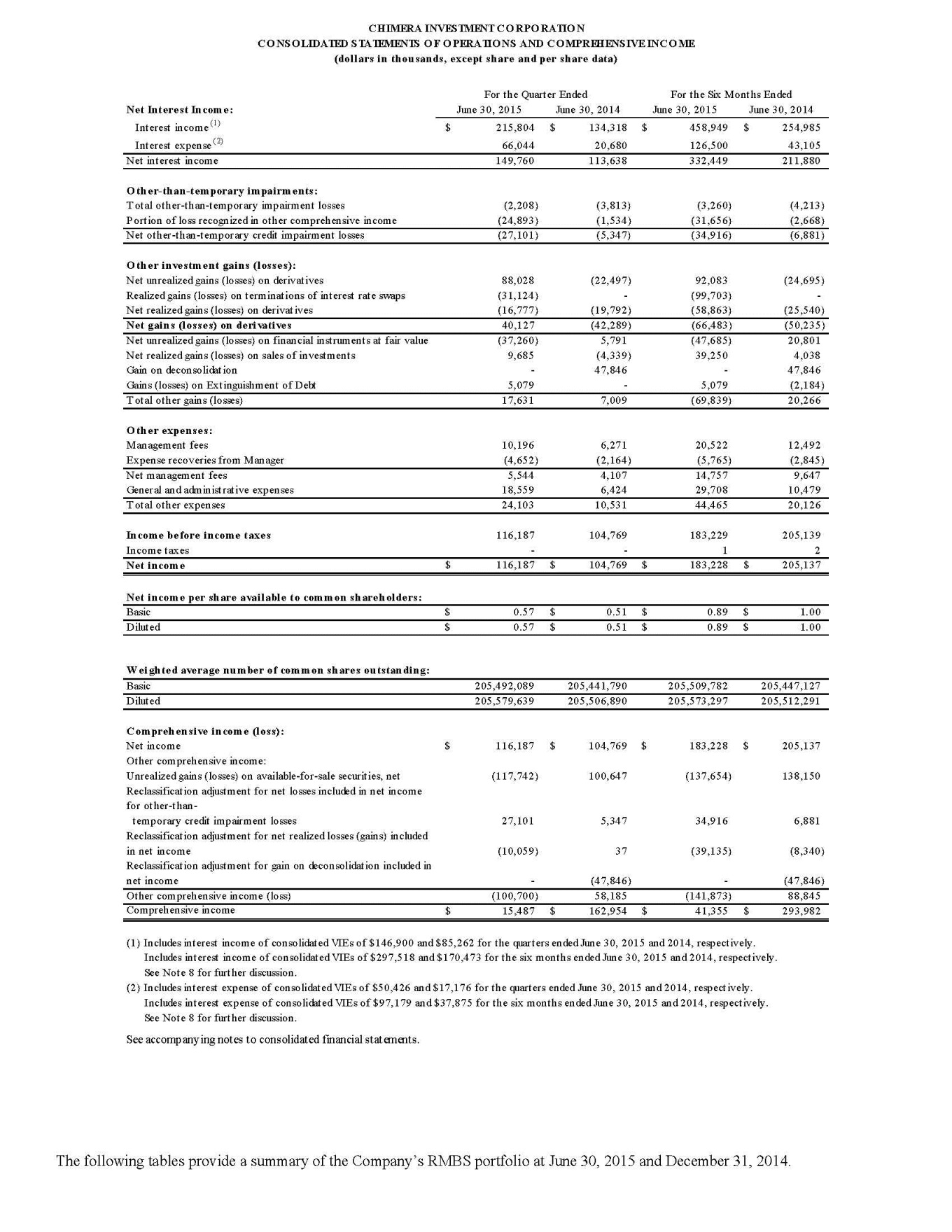

Net Income of $116 million, up from $67 million earned in the 1st quarter of 2015 and $105 million earned in the 2nd quarter of 2014

|

| ● |

Core earnings of $0.53 per share down from $0.59 earned in the 1st quarter of 2015 and up from $0.41 earned in the 2nd quarter of 2014(1)

|

| ● |

Net interest income of $150 million, down from $183 million in the 1st quarter of 2015 and up from $114 million in the 2nd quarter of 2014

|

| ● |

GAAP book value of $16.73 per share, down from $17.14 per share for the 1st quarter of 2015 and down from $16.75 per share in the 2nd quarter 2014

|

| ● |

GAAP book value of $16.73 per share, down from $17.14 per share for the 1st quarter of 2015 and down from $16.75 per share in the 2nd quarter 2014

|

| ● |

Managed assets down to $15.4 billion from $16.0 billion at March 31, 2015 based on amortized cost

|

(1) Core earnings is a non-GAAP measure and is defined as GAAP net income (loss) excluding unrealized gains on the aggregate portfolio, impairment losses, realized gains on sales of investments, gain on deconsolidation, extinguishment of debt and certain other non-recurring gains or losses. Core earnings includes interest income and expense as well as realized gains or losses on derivatives used to hedge interest rate risk. Core earnings is provided for purposes of comparability to other peer issuers, but has important limitations. Therefore, core earnings should not be viewed in isolation and is not a substitute for net income or net income per basic share computed in accordance with GAAP.

The Company previously declared a common stock dividend of $0.48 per share for the quarter ended June 30, 2015. The annualized dividend yield on the Company’s common stock for the quarter ended June 30, 2015 was 14%.

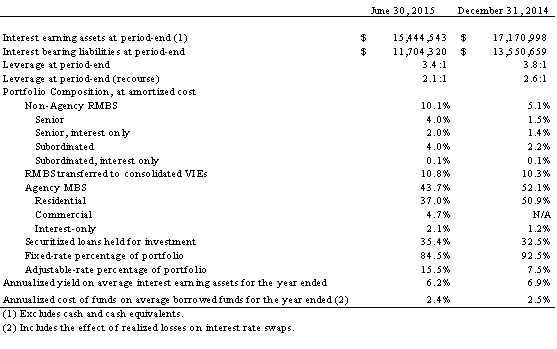

Leverage was 3.4:1 and recourse leverage was 2.1:1 at June 30, 2015.

Other Information

Chimera Investment Corporation invests in residential mortgage loans, residential mortgage-backed securities, real estate-related securities and various other asset classes. The Company’s principal business objective is to generate income from the spread between yields on its investments and its cost of borrowing and hedging activities. The Company is a Maryland corporation that has elected to be taxed as a real estate investment trust (“REIT”).

Please visit www.chimerareit.com and click on Investor Relations for additional information about the Company.

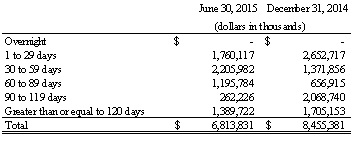

At June 30, 2015 and December 31, 2014, the repurchase agreements collateralized by RMBS had the following remaining maturities.

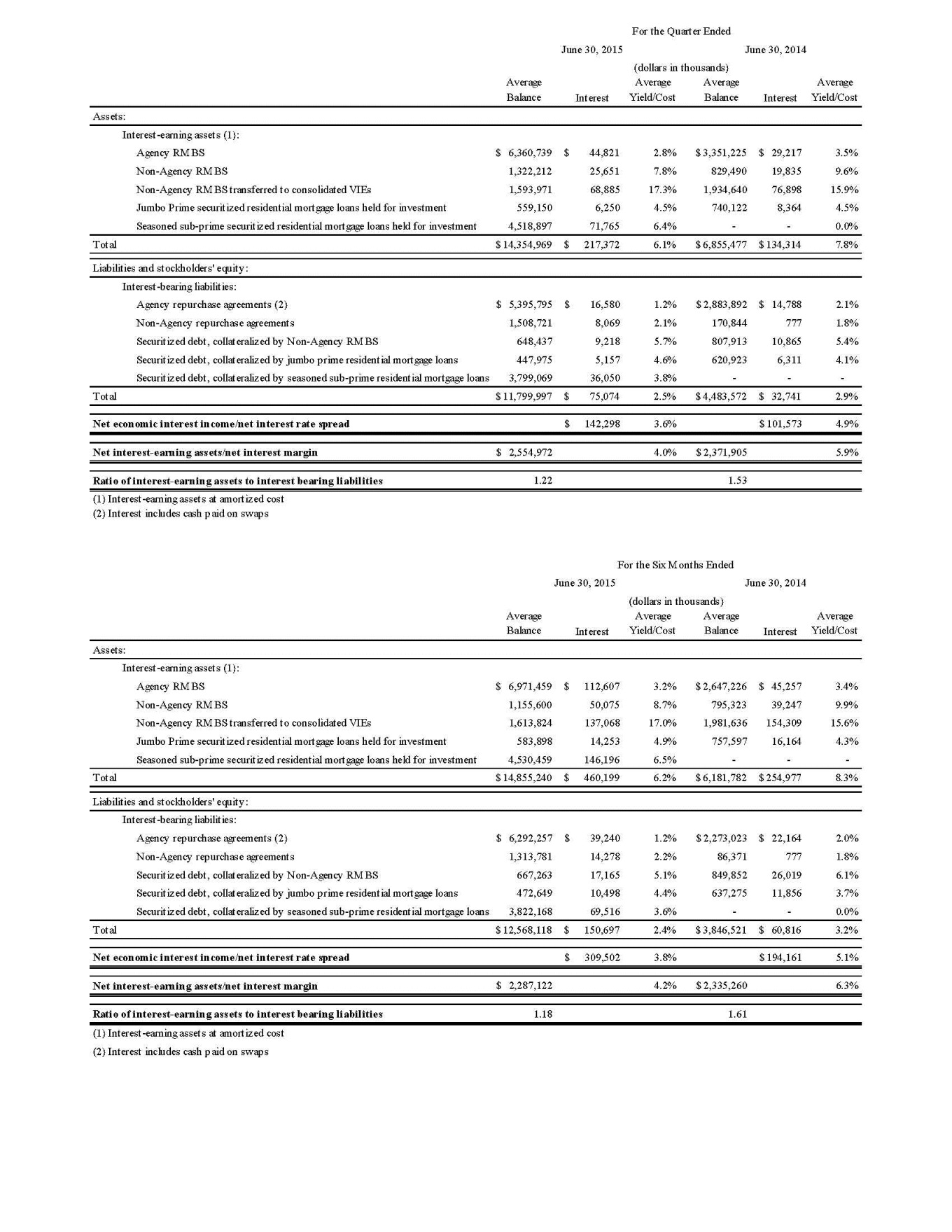

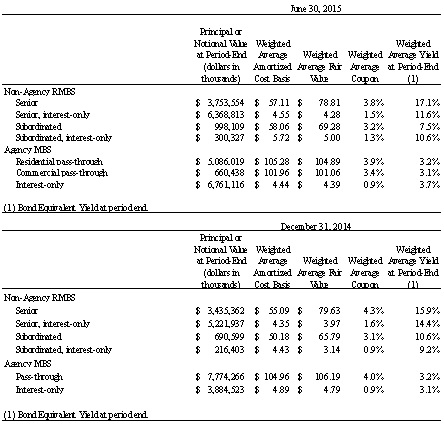

The following table summarizes certain characteristics of our portfolio at June 30, 2015 and December 31, 2014.

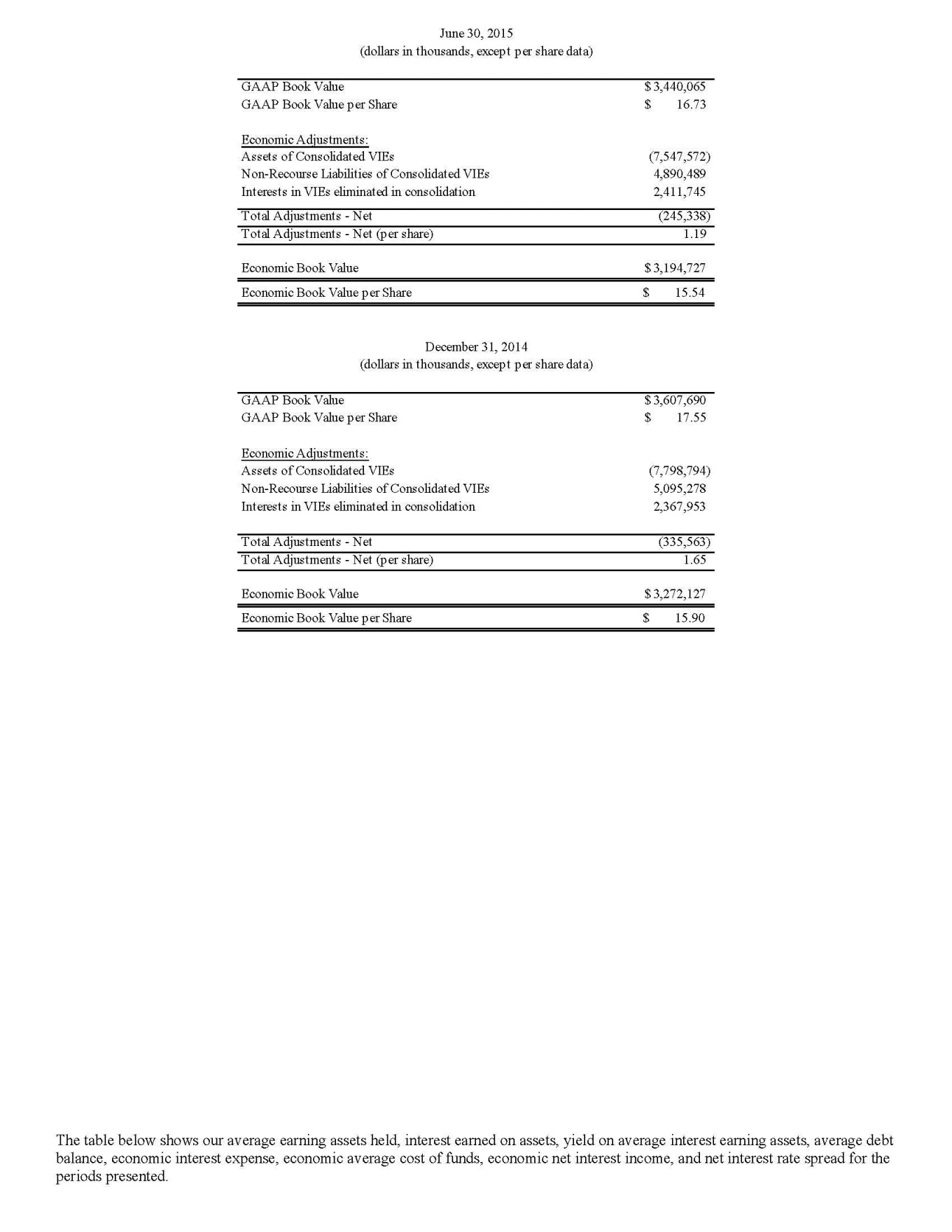

The tables below present the adjustments to GAAP book value that we believe are necessary to adequately reflect our calculation of estimated economic book value as of June 30, 2015 and December 31, 2014.