EXHIBIT 99.2

Published on May 11, 2015

Exhibit 99.2

Q1 2015 Supplemental Financial Information May 11, 2015 www.chimerareit.com

Disclaimer This material is not intended to be exhaustive, is preliminary in nature and may be subject to change. In addition, much of the information contained herein is based on various assumptions (some of which are beyond the control of Chimera Investment Corporation, the “Company”) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” “would,” “projected,” “will” or similar expressions, or variations on those terms or the negative of those terms. The Company’s forward-looking statements are subject to numerous risks, uncertainties and other factors. Furthermore, none of the financial information contained in this material has been audited or approved by the Company’s independent registered public accounting firm. Information is unaudited, estimated and subject to change. 1

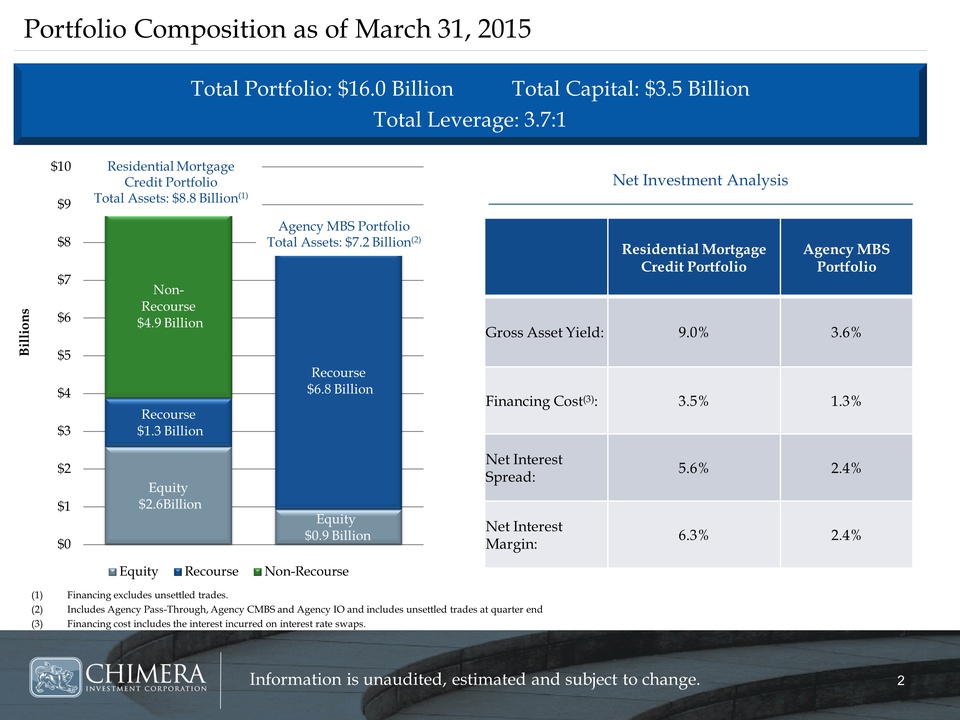

Equity $2.6Billion Equity $0.9 Billion Recourse $1.3 Billion Recourse $6.8 Billion Non- Recourse $4.9 Billion $0 $1 $2 $3 $4 $5 $6 $7 $8 $9 $10 Billions Equity Recourse Non-Recourse Portfolio Composition as of March 31, 2015 Residential Mortgage Credit Portfolio Agency MBS Portfolio Gross Asset Yield: 9.0% 3.6% Financing Cost(2): 3.5% 1.3% Net Interest Spread: 5.6% 2.4% Net Interest Margin: 6.3% 2.4% (1) Financing excludes unsettled trades. (2) Includes Agency Pass-Through, Agency CMBS and Agency IO and includes unssettled trades at quarter end (3) Financing cost includes the interest incurred on interest rate swaps. Information is unaudited, estimated and subject to change. 2 Total Portfolio: $16.0 Billion Total Capital: $3.5 Billion Total Leverage: 3.7:1 Net Investment Analysis Agency MBS Portfolio Total Assets: $7.2 Billion(1) Residential Mortgage Credit Portfolio Total Assets: $8.8 Billion(1)(2) (3)

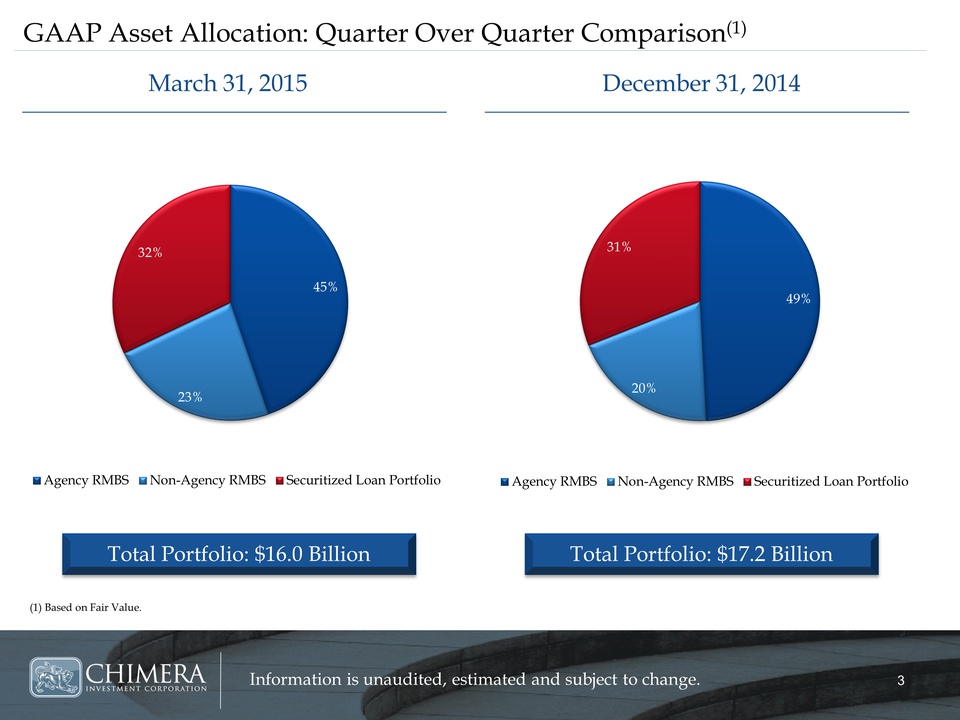

45% 23% 32% Agency RMBS Non-Agency RMBS Securitized Loan Portfolio 49% 20% 31% Agency RMBS Non-Agency RMBS Securitized Loan Portfolio March 31, 2015 December 31, 2014 GAAP Asset Allocation: Quarter Over Quarter Comparison(1) Total Portfolio: $16.0 Billion Total Portfolio: $17.2 Billion (1) Based on Fair Value. Information is unaudited, estimated and subject to change. 3

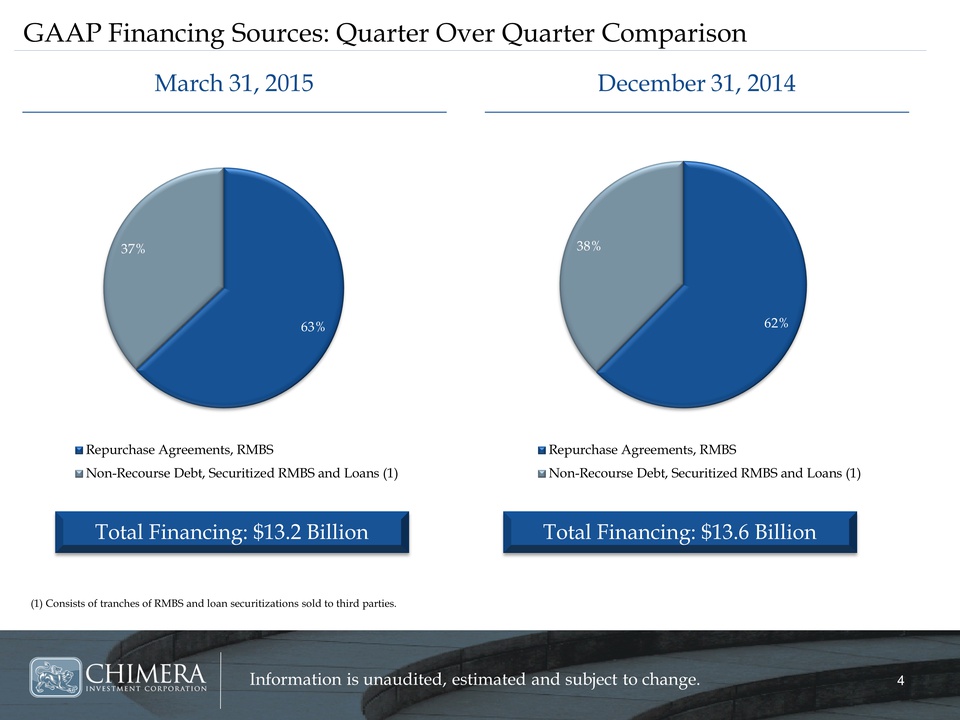

62% 38% Repurchase Agreements, RMBS Non-Recourse Debt, Securitized RMBS and Loans (1) 63% 37% Repurchase Agreements, RMBS Non-Recourse Debt, Securitized RMBS and Loans (1) (1) Consists of tranches of RMBS and loan securitizations sold to third parties. March 31, 2015 December 31, 2014 GAAP Financing Sources: Quarter Over Quarter Comparison Total Financing: $13.2 Billion Total Financing: $13.6 Billion Information is unaudited, estimated and subject to change. 4

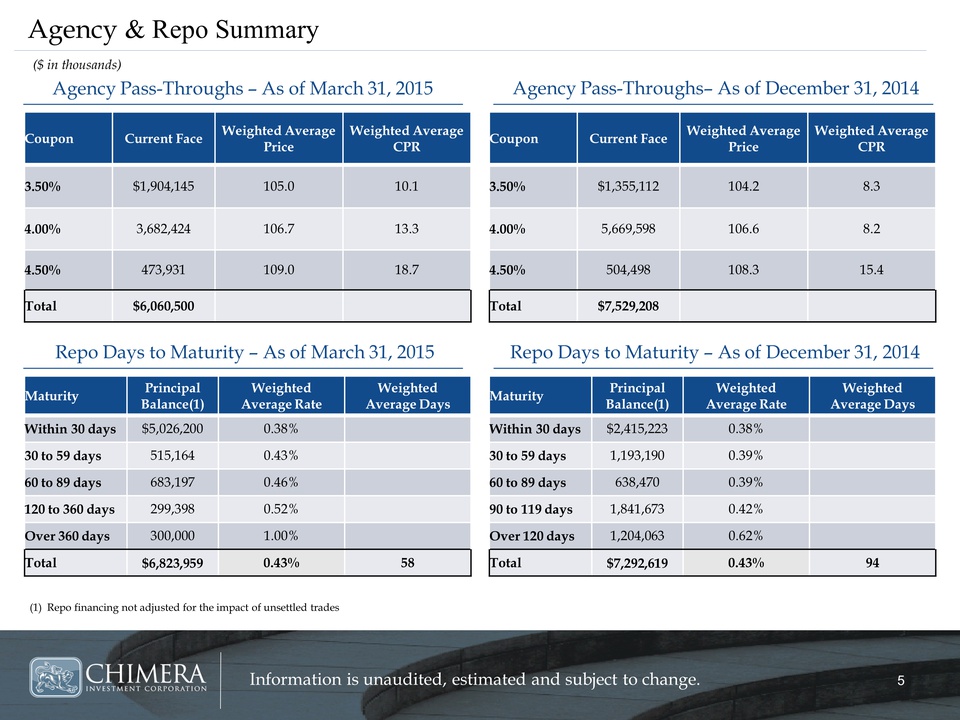

Agency & Repo Summary Agency Pass-Throughs – As of March 31, 2015 Repo Days to Maturity – As of March 31, 2015 Agency Pass-Throughs– As of December 31, 2014 Repo Days to Maturity – As of December 31, 2014 ($ in thousands) Coupon Current Face Weighted Average Price Weighted Average CPR 3.50% $1,355,112 104.2 8.3 4.00% 5,669,598 106.6 8.2 4.50% 504,498 108.3 15.4 Total $7,529,208 Maturity Principal Balance(1) Weighted Average Rate Weighted Average Days Within 30 days $2,415,223 0.38% 30 to 59 days 1,193,190 0.39% 60 to 89 days 638,470 0.39% 90 to 119 days 1,841,673 0.42% Over 120 days 1,204,063 0.62% Total $7,292,619 0.43% 94 Coupon Current Face Weighted Average Price Weighted Average CPR 3.50% $1,904,145 105.0 10.1 4.00% 3,682,424 106.7 13.3 4.50% 473,931 109.0 18.7 Total $6,060,500 Maturity Principal Balance(1) Weighted Average Rate Weighted Average Days Within 30 days $5,026,200 0.38% 30 to 59 days 515,164 0.43% 60 to 89 days 683,197 0.46% 120 to 360 days 299,398 0.52% Over 360 days 300,000 1.00% Total $6,823,959 0.43% 58 (1) Repo financing not adjusted for the impact of unsettled trades Information is unaudited, estimated and subject to change. 5

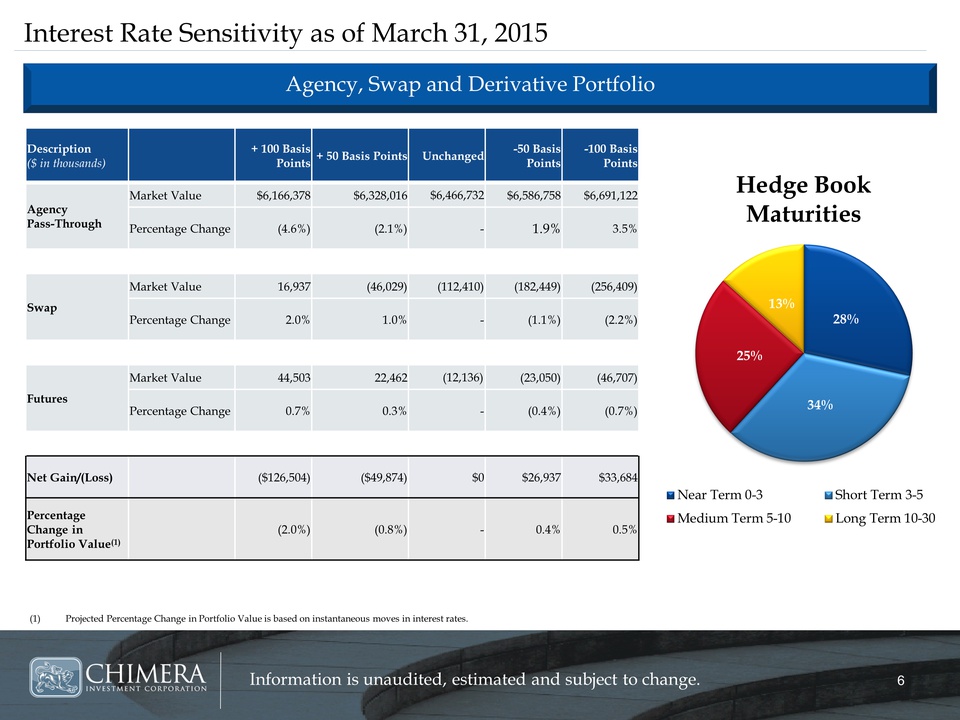

Interest Rate Sensitivity as of March 31, 2015 Agency, Swap and Derivative Portfolio Description ($ in thousands) + 100 Basis Points + 50 Basis Points Unchanged -50 Basis Points -100 Basis Points Agency Pass-Through Market Value $6,166,378 $6,328,016 $6,466,732 $6,586,758 $6,691,122 Percentage Change (4.6%) (2.1%) - 1.9% 3.5% Swap Market Value 16,937 (46,029) (112,410) (182,449) (256,409) Percentage Change 2.0% 1.0% - (1.1%) (2.2%) Futures Market Value 44,503 22,462 (12,136) (23,050) (46,707) Percentage Change 0.7% 0.3% - (0.4%) (0.7%) Net Gain/(Loss) ($126,504) ($49,874) $0 $26,937 $33,684 Percentage Change in Portfolio Value(1) (2.0%) (0.8%) - 0.4% 0.5% (1) Projected Percentage Change in Portfolio Value is based on instantaneous moves in interest rates. 28% 34% 25% 13% Hedge Book Maturities Near Term 0-3 Short Term 3-5 Medium Term 5-10 Long Term 10-30 Information is unaudited, estimated and subject to change. 6

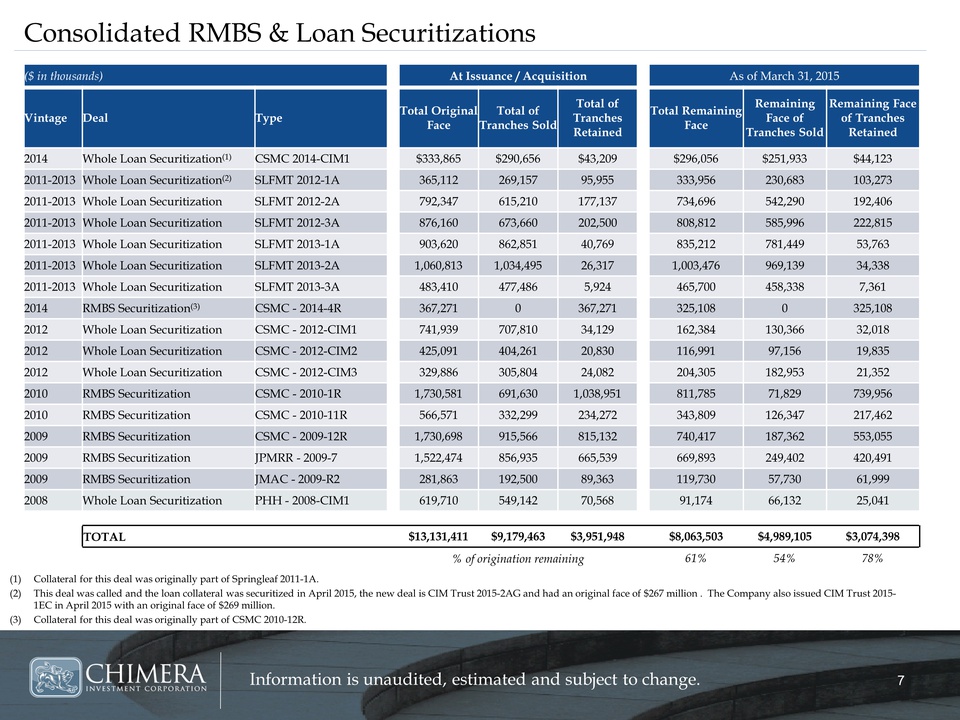

Information is unaudited, estimated and subject to change. 7 Consolidated RMBS & Loan Securitizations ($ in thousands) At Issuance / Acquisition As of March 31, 2015 Vintage Deal Type Total Original Face Total of Tranches Sold Total of Tranches Retained Total Remaining Face Remaining Face of Tranches Sold Remaining Face of Tranches Retained 2014 Whole Loan Securitization(1) CSMC 2014-CIM1 $333,865 $290,656 $43,209 $296,056 $251,933 $44,123 2011-2013 Whole Loan Securitization(2) SLFMT 2012-1A 365,112 269,157 95,955 333,956 230,683 103,273 2011-2013 Whole Loan Securitization SLFMT 2012-2A 792,347 615,210 177,137 734,696 542,290 192,406 2011-2013 Whole Loan Securitization SLFMT 2012-3A 876,160 673,660 202,500 808,812 585,996 222,815 2011-2013 Whole Loan Securitization SLFMT 2013-1A 903,620 862,851 40,769 835,212 781,449 53,763 2011-2013 Whole Loan Securitization SLFMT 2013-2A 1,060,813 1,034,495 26,317 1,003,476 969,139 34,338 2011-2013 Whole Loan Securitization SLFMT 2013-3A 483,410 477,486 5,924 465,700 458,338 7,361 2014 RMBS Securitization(3) CSMC - 2014-4R 367,271 0 367,271 325,108 0 325,108 2012 Whole Loan Securitization CSMC - 2012-CIM1 741,939 707,810 34,129 162,384 130,366 32,018 2012 Whole Loan Securitization CSMC - 2012-CIM2 425,091 404,261 20,830 116,991 97,156 19,835 2012 Whole Loan Securitization CSMC - 2012-CIM3 329,886 305,804 24,082 204,305 182,953 21,352 2010 RMBS Securitization CSMC - 2010-1R 1,730,581 691,630 1,038,951 811,785 71,829 739,956 2010 RMBS Securitization CSMC - 2010-11R 566,571 332,299 234,272 343,809 126,347 217,462 2009 RMBS Securitization CSMC - 2009-12R 1,730,698 915,566 815,132 740,417 187,362 553,055 2009 RMBS Securitization JPMRR - 2009-7 1,522,474 856,935 665,539 669,893 249,402 420,491 2009 RMBS Securitization JMAC - 2009-R2 281,863 192,500 89,363 119,730 57,730 61,999 2008 Whole Loan Securitization PHH - 2008-CIM1 619,710 549,142 70,568 91,174 66,132 25,041 TOTAL $13,131,411 $9,179,463 $3,951,948 $8,063,503 $4,989,105 $3,074,398 % of origination remaining 61% 54% 78% (1) Collateral for this deal was originally part of Springleaf 2011-1A. (2) This deal was called and the loan collateral was securitized in April 2015, the new deal is CIM Trust 2015-2AG and had an original face of $267 million . The Company also issued CIM Trust 2015- 1EC in April 2015 with an original face of $269 million. (3) Collateral for this deal was originally part of CSMC 2010-12R.

Q1 2015 Supplemental Financial Information www.chimerareit.com