EXHIBIT 99.2

Published on February 17, 2016

Exhibit 99.2

CONFERENCEN AM EGOESHERE0

0Informationisun aud it ed, estimated and subject to change.

WWW.ANNALY.C OMWWW.CHIMERAREIT.COM Q4 2015 Supplemental Financial

Information February 17, 2016

CONFERENCEN AM EGOESHERE1

1Information isun audit ed, estimated and subject to change. Disclaimer

This material is not intended to be exhaustive, is preliminary in nature

and may be subject to change. In addition, much of the information

contained herein is based on various assumptions (some of which are

beyond the control of Chimera Investment Corporation, the “Company”) and

may be identified by reference to a future period or periods or by the

use of forward-looking terminology, such as “believe,” “expect,”

“anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,”

“would,” “projected,” “will” or similar expressions, or variations on

those terms or the negative of those terms. The Company’s

forward-looking statements are subject to numerous risks, uncertainties

and other factors. Furthermore, none of the financial information

contained in this material has been audited or approved by the Company’s

independent registered public accounting firm.1

CIOnNfFoErmREaNtCioEn N

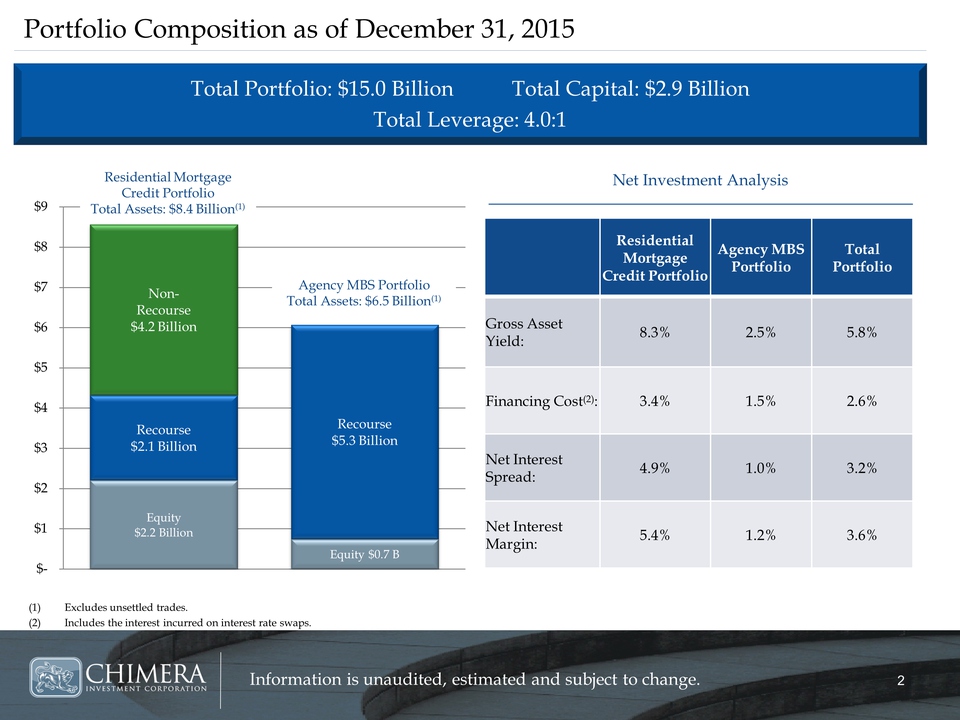

iAsM uEn GaOuEdSit HeEdR, Eestimated and subject to change. 22 Portfolio

Composition as of December 31, 2015 Residential Mortgage Credit

Portfolio Agency MBS Portfolio Total Portfolio Gross Asset Yield: 8.3%

2.5% 5.8% Financing Cost(2): 3.4% 1.5% 2.6% Net Interest Spread: 4.9%

1.0% 3.2% Net Interest Margin: 5.4% 1.2% 3.6% (1) Excludes unsettled

trades. (2) Includes the interest incurred on interest rate swaps. Total

Portfolio: $15.0 Billion Total Capital: $2.9 Billion Total Leverage:

4.0:1 Net Investment Analysis Equity $2.2 Billion Equity $0.7 B Recourse

$2.1 Billion Recourse $5.3 Billion Non-Recourse $4.2 Billion $- $1 $2 $3

$4 $5 $6 $7 $8 $9 Residential Mortgage Credit Portfolio Total Assets:

$8.4 Billion(1) Agency MBS Portfolio Total Assets: $6.5 Billion(1)2

CIOnNfFoErmREaNtCioEn N

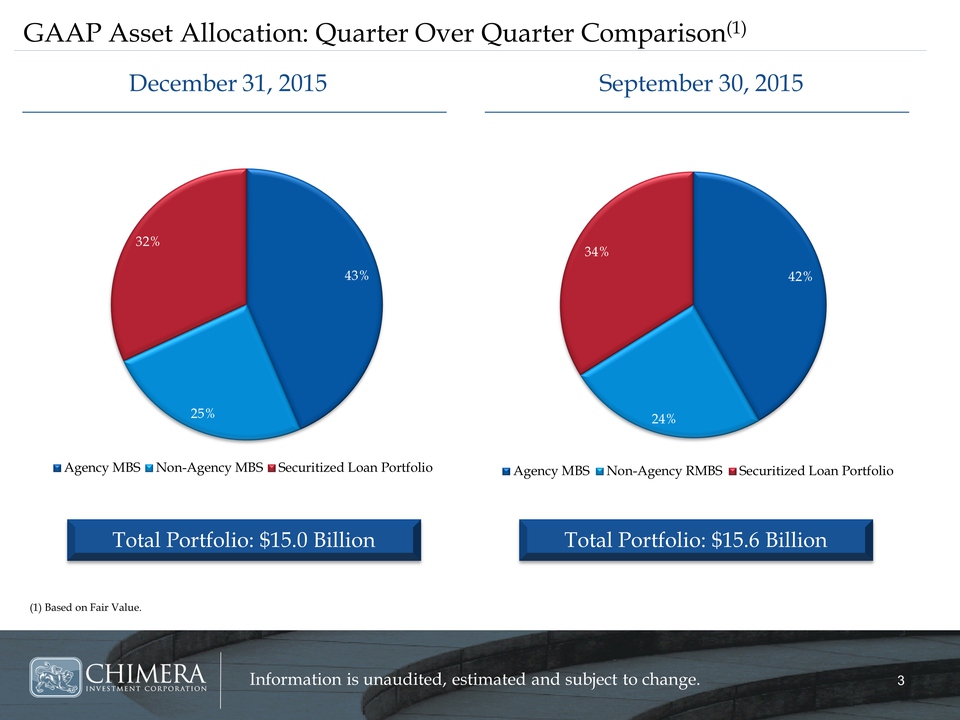

iAsM uEn GaOuEdSit HeEdR, Eestimated and subject to change. 33 December

31, 2015 September 30, 2015 GAAP Asset Allocation: Quarter Over Quarter

Comparison(1) (1) Based on Fair Value. 42% 24% 34% Agency MBS Non-Agency

RMBS Securitized Loan Portfolio Total Portfolio: $15.6 Billion 43% 25%

32% Agency MBS Non-Agency MBS Securitized Loan Portfolio Total

Portfolio: $15.0 Billion3

CIOnNfFoErmREaNtCioEn N

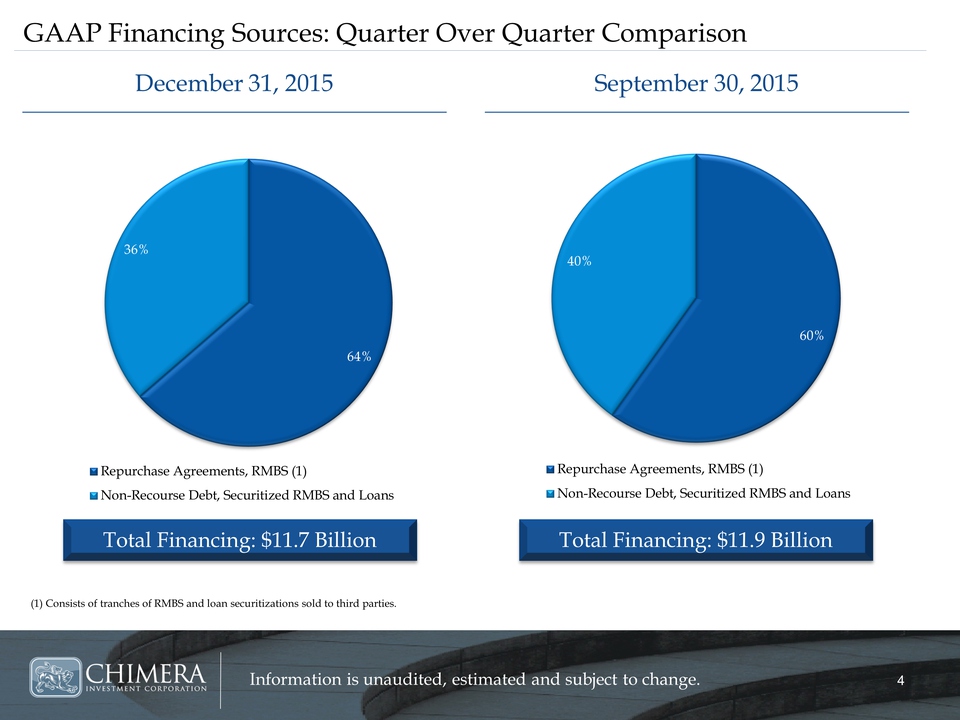

iAsM uEn GaOuEdSit HeEdR, Eestimated and subject to change. 44 (1)

Consists of tranches of RMBS and loan securitizations sold to third

parties. December 31, 2015 September 30, 2015 GAAP Financing Sources:

Quarter Over Quarter Comparison Total Financing: $11.7 Billion 60% 40%

Repurchase Agreements, RMBS (1) Non-Recourse Debt, Securitized RMBS and

Loans Total Financing: $11.9 Billion 64% 36% Repurchase Agreements, RMBS

(1) Non-Recourse Debt, Securitized RMBS and Loans4

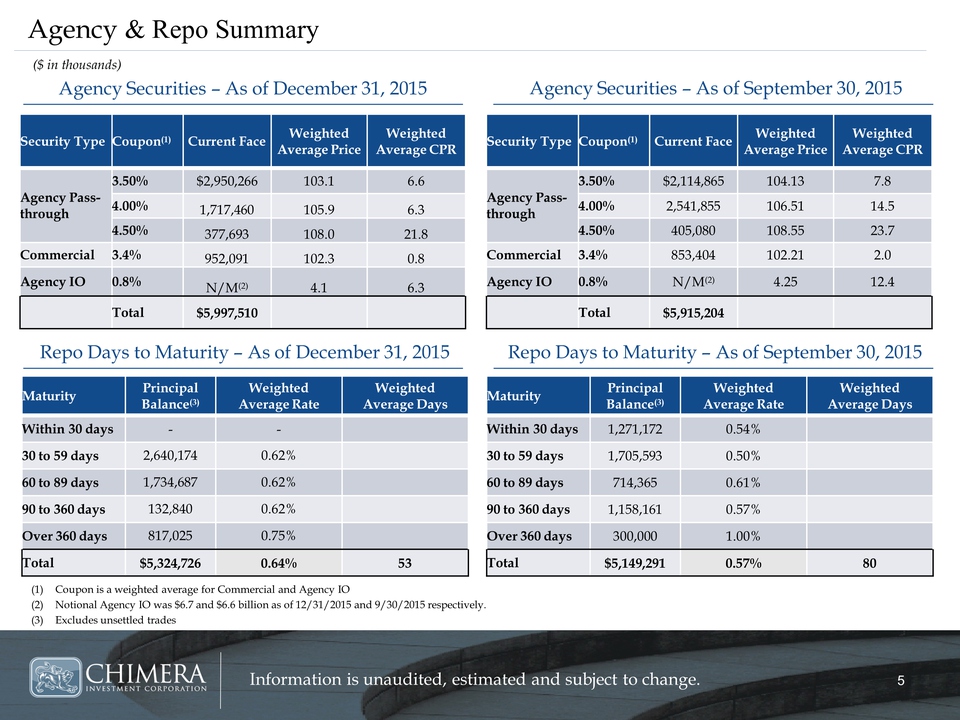

CIOnNfFoErmREaNtCioEn N

iAsM uEn GaOuEdSit HeEdR, Eestimated and subject to change. 55 Agency &

Repo Summary Agency Securities – As of December 31, 2015 Repo Days to

Maturity – As of December 31, 2015 Agency Securities – As of September

30, 2015 Repo Days to Maturity – As of September 30, 2015 ($ in

thousands) Maturity Principal Balance(3) Weighted Average Rate Weighted

Average Days Within 30 days 1,271,172 0.54% 30 to 59 days 1,705,593

0.50% 60 to 89 days 714,365 0.61% 90 to 360 days 1,158,161 0.57% Over

360 days 300,000 1.00% Total $5,149,291 0.57% 80 (1) Coupon is a

weighted average for Commercial and Agency IO (2) Notional Agency IO was

$6.7 and $6.6 billion as of 12/31/2015 and 9/30/2015 respectively. (3)

Excludes unsettled trades Security Type Coupon(1) Current Face Weighted

Average Price Weighted Average CPR Agency Pass-through 3.50% $2,950,266

103.1 6.6 4.00% 1,717,460 105.9 6.3 4.50% 377,693 108.0 21.8 Commercial

3.4% 952,091 102.3 0.8 Agency IO 0.8% N/M(2) 4.1 6.3 Total $5,997,510

Maturity Principal Balance(3) Weighted Average Rate Weighted Average

Days Within 30 days - - 30 to 59 days 2,640,174 0.62% 60 to 89 days

1,734,687 0.62% 90 to 360 days 132,840 0.62% Over 360 days 817,025 0.75%

Total $5,324,726 0.64% 53 Security Type Coupon(1) Current Face Weighted

Average Price Weighted Average CPR Agency Pass-through 3.50% $2,114,865

104.13 7.8 4.00% 2,541,855 106.51 14.5 4.50% 405,080 108.55 23.7

Commercial 3.4% 853,404 102.21 2.0 Agency IO 0.8% N/M(2) 4.25 12.4 Total

$5,915,204 5

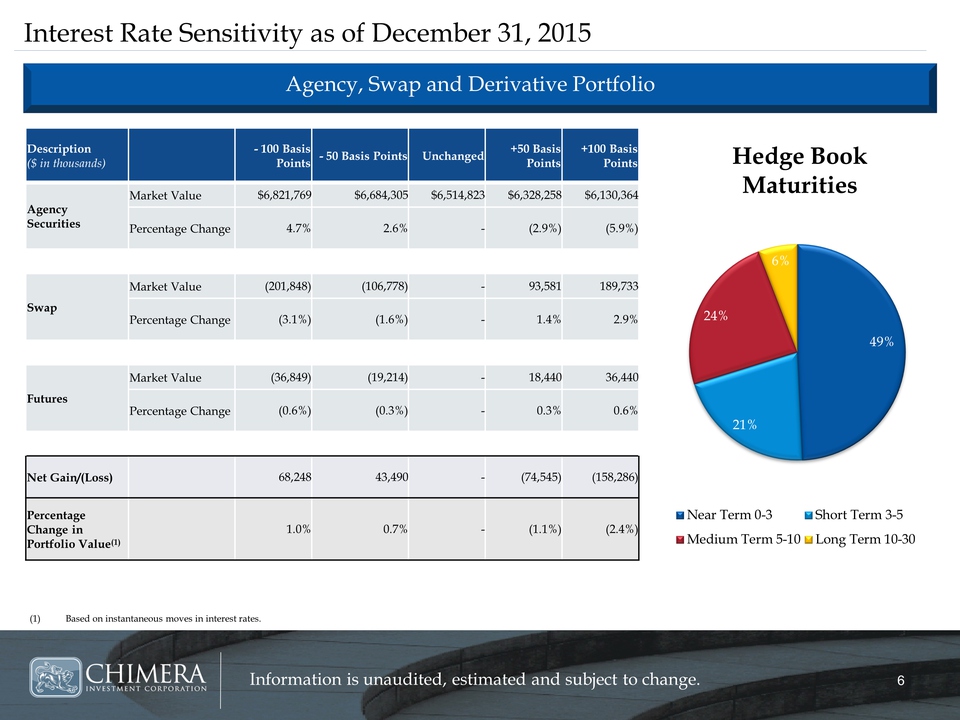

CIOnNfFoErmREaNtCioEn N

iAsM uEn GaOuEdSit HeEdR, Eestimated and subject to change. 66 Interest

Rate Sensitivity as of December 31, 2015 Agency, Swap and Derivative

Portfolio Description ($ in thousands) - 100 Basis Points - 50 Basis

Points Unchanged +50 Basis Points +100 Basis Points Agency Securities

Market Value $6,821,769 $6,684,305 $6,514,823 $6,328,258 $6,130,364

Percentage Change 4.7% 2.6% - (2.9%) (5.9%) Swap Market Value (201,848)

(106,778) - 93,581 189,733 Percentage Change (3.1%) (1.6%) - 1.4% 2.9%

Futures Market Value (36,849) (19,214) - 18,440 36,440 Percentage Change

(0.6%) (0.3%) - 0.3% 0.6% Net Gain/(Loss) 68,248 43,490 - (74,545)

(158,286) Percentage Change in Portfolio Value(1) 1.0% 0.7% - (1.1%)

(2.4%) (1) Based on instantaneous moves in interest rates. 49% 21% 24%

6% Hedge Book Maturities Near Term 0-3 Short Term 3-5 Medium Term 5-10

Long Term 10-30 6

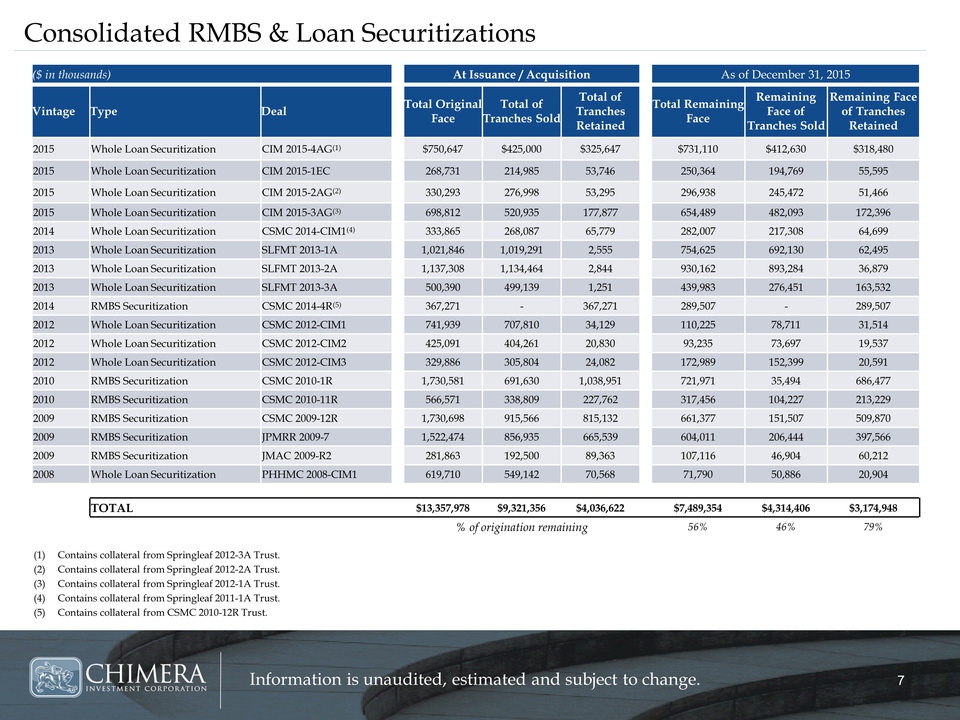

CIOnNfFoErmREaNtCioEn N

iAsM uEn GaOuEdSit HeEdR, Eestimated and subject to change. 77

Consolidated RMBS & Loan Securitizations ($ in thousands) At Issuance /

Acquisition As of December 31, 2015 Vintage Type Deal Total Original

Face Total of Tranches Sold Total of Tranches Retained Total Remaining

Face Remaining Face of Tranches Sold Remaining Face of Tranches Retained

2015 Whole Loan Securitization CIM 2015-4AG(1) $750,647 $425,000

$325,647 $731,110 $412,630 $318,480 2015 Whole Loan Securitization CIM

2015-1EC 268,731 214,985 53,746 250,364 194,769 55,595 2015 Whole Loan

Securitization CIM 2015-2AG(2) 330,293 276,998 53,295 296,938 245,472

51,466 2015 Whole Loan Securitization CIM 2015-3AG(3) 698,812 520,935

177,877 654,489 482,093 172,396 2014 Whole Loan Securitization CSMC

2014-CIM1(4) 333,865 268,087 65,779 282,007 217,308 64,699 2013 Whole

Loan Securitization SLFMT 2013-1A 1,021,846 1,019,291 2,555 754,625

692,130 62,495 2013 Whole Loan Securitization SLFMT 2013-2A 1,137,308

1,134,464 2,844 930,162 893,284 36,879 2013 Whole Loan Securitization

SLFMT 2013-3A 500,390 499,139 1,251 439,983 276,451 163,532 2014 RMBS

Securitization CSMC 2014-4R(5) 367,271 - 367,271 289,507 - 289,507 2012

Whole Loan Securitization CSMC 2012-CIM1 741,939 707,810 34,129 110,225

78,711 31,514 2012 Whole Loan Securitization CSMC 2012-CIM2 425,091

404,261 20,830 93,235 73,697 19,537 2012 Whole Loan Securitization CSMC

2012-CIM3 329,886 305,804 24,082 172,989 152,399 20,591 2010 RMBS

Securitization CSMC 2010-1R 1,730,581 691,630 1,038,951 721,971 35,494

686,477 2010 RMBS Securitization CSMC 2010-11R 566,571 338,809 227,762

317,456 104,227 213,229 2009 RMBS Securitization CSMC 2009-12R 1,730,698

915,566 815,132 661,377 151,507 509,870 2009 RMBS Securitization JPMRR

2009-7 1,522,474 856,935 665,539 604,011 206,444 397,566 2009 RMBS

Securitization JMAC 2009-R2 281,863 192,500 89,363 107,116 46,904 60,212

2008 Whole Loan Securitization PHHMC 2008-CIM1 619,710 549,142 70,568

71,790 50,886 20,904 TOTAL $13,357,978 $9,321,356 $4,036,622 $7,489,354

$4,314,406 $3,174,948 % of origination remaining 56% 46% 79% (1)

Contains collateral from Springleaf 2012-3A Trust. (2) Contains

collateral from Springleaf 2012-2A Trust. (3) Contains collateral from

Springleaf 2012-1A Trust. (4) Contains collateral from Springleaf

2011-1A Trust. (5) Contains collateral from CSMC 2010-12R Trust.7

WWCWWIOnWNWfFo..ACErNmRHNEIaMANtLCEiYoRE.nAC N ROiAsEMM IuTE.n CGaOOuMEd Sit HeEdR, Eestimated and subject to change. 88 Q4 2015 Supplemental Financial Information