EXHIBIT 99.1

Published on May 31, 2016

Exhibit 99.1

INVESTOR PRESENTATION NYSE: CIM June 1, 2016 Information is unaudited, estimated and subject to change.

DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our Annual Report on Form 10-K for the year ended December 31, 2015, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the credit risk in our underlying assets; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; our ability to borrow to finance our assets and the associated costs; changes in the competitive landscape within our industry; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire residential mortgage loans and successfully securitize the residential mortgage loans we acquire; our ability to oversee our third party sub-servicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940.Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above.This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept.Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. chimerareit.com Information is unaudited, estimated and subject to change.

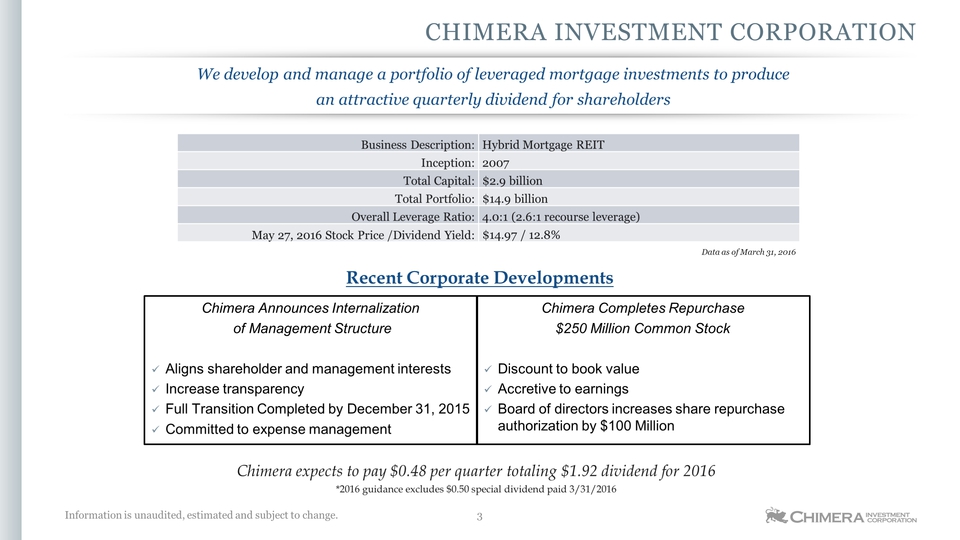

Chimera Investment Corporation Information is unaudited, estimated and subject to change. We develop and manage a portfolio of leveraged mortgage investments to produce an attractive quarterly dividend for shareholders Recent Corporate Developments Chimera Announces Internalization of Management StructureAligns shareholder and management interestsIncrease transparencyFull Transition Completed by December 31, 2015Committed to expense management Chimera Completes Repurchase$250 Million Common StockDiscount to book valueAccretive to earningsBoard of directors increases share repurchase authorization by $100 Million Chimera expects to pay $0.48 per quarter totaling $1.92 dividend for 2016*2016 guidance excludes $0.50 special dividend paid 3/31/2016 Business Description: Hybrid Mortgage REIT Inception: 2007 Total Capital: $2.9 billion Total Portfolio: $14.9 billion Overall Leverage Ratio: 4.0:1 (2.6:1 recourse leverage) May 27, 2016 Stock Price /Dividend Yield: $14.97 / 12.8% Data as of March 31, 2016 3

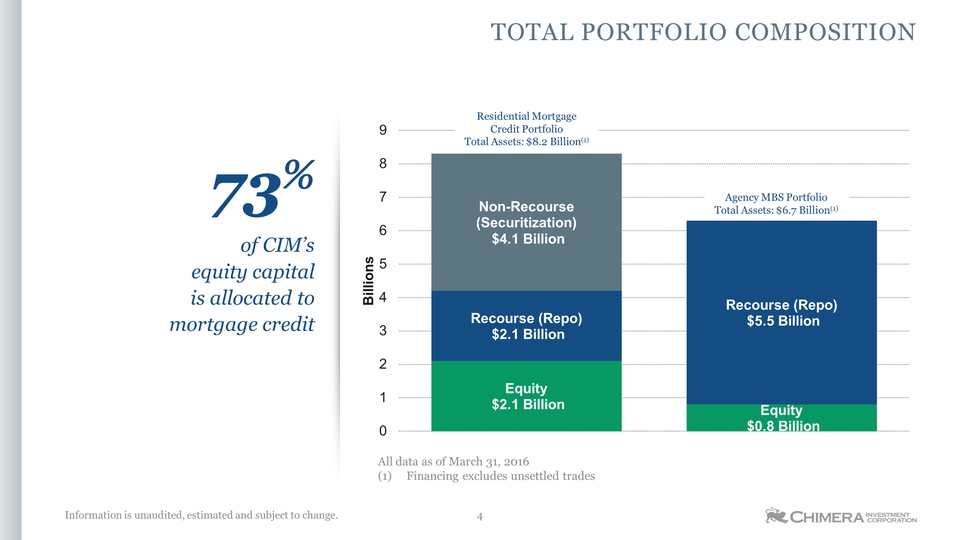

Total portfolio composition Information is unaudited, estimated and subject to change. 73% of CIM’s equity capital is allocated to mortgage credit All data as of March 31, 2016 Financing excludes unsettled trades Residential Mortgage Credit PortfolioTotal Assets: $8.2 Billion(1) Agency MBS PortfolioTotal Assets: $6.7 Billion(1) 4

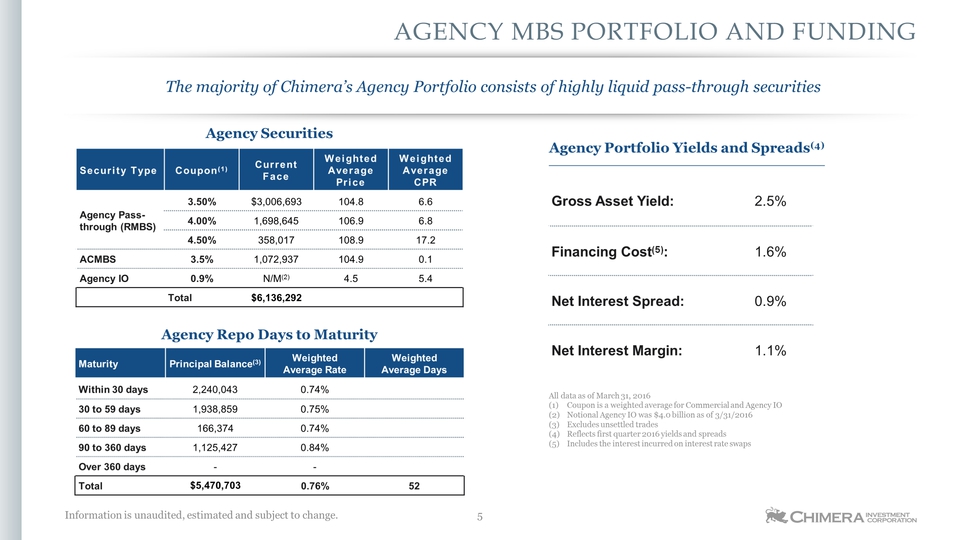

Agency MBS Portfolio and Funding Information is unaudited, estimated and subject to change. The majority of Chimera’s Agency Portfolio consists of highly liquid pass-through securities All data as of March 31, 2016Coupon is a weighted average for Commercial and Agency IONotional Agency IO was $4.0 billion as of 3/31/2016Excludes unsettled tradesReflects first quarter 2016 yields and spreadsIncludes the interest incurred on interest rate swaps Agency Securities Agency Repo Days to Maturity Agency Portfolio Yields and Spreads(4) Gross Asset Yield: 2.5% Financing Cost(5): 1.6% Net Interest Spread: 0.9% Net Interest Margin: 1.1% Security Type Coupon(1) Current Face Weighted Average Price Weighted Average CPR Agency Pass-through (RMBS) 3.50% $3,006,693 104.8 6.6 4.00% 1,698,645 106.9 6.8 4.50% 358,017 108.9 17.2 ACMBS 3.5% 1,072,937 104.9 0.1 Agency IO 0.9% N/M(2) 4.5 5.4 Total $6,136,292 Maturity Principal Balance(3) Weighted Average Rate Weighted Average Days Within 30 days 2,240,043 0.74% 30 to 59 days 1,938,859 0.75% 60 to 89 days 166,374 0.74% 90 to 360 days 1,125,427 0.84% Over 360 days - - Total $5,470,703 0.76% 52 5

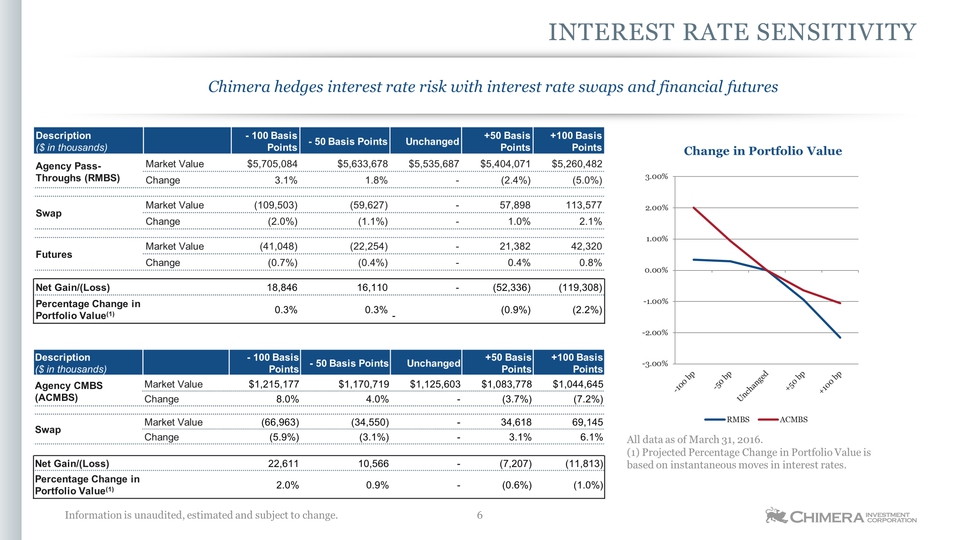

Interest Rate Sensitivity Information is unaudited, estimated and subject to change. Chimera hedges interest rate risk with interest rate swaps and financial futures All data as of March 31, 2016. (1) Projected Percentage Change in Portfolio Value is based on instantaneous moves in interest rates. Description($ in thousands) - 100 Basis Points - 50 Basis Points Unchanged +50 Basis Points +100 Basis Points Agency Pass-Throughs (RMBS) Market Value $5,705,084 $5,633,678 $5,535,687 $5,404,071 $5,260,482 Change 3.1% 1.8% - (2.4%) (5.0%) Swap Market Value (109,503) (59,627) - 57,898 113,577 Change (2.0%) (1.1%) - 1.0% 2.1% Futures Market Value (41,048) (22,254) - 21,382 42,320 Change (0.7%) (0.4%) - 0.4% 0.8% Net Gain/(Loss) 18,846 16,110 - (52,336) (119,308) Percentage Change in Portfolio Value(1) 0.3% 0.3% - (0.9%) (2.2%) Description($ in thousands) - 100 Basis Points - 50 Basis Points Unchanged +50 Basis Points +100 Basis Points Agency CMBS(ACMBS) Market Value $1,215,177 $1,170,719 $1,125,603 $1,083,778 $1,044,645 Change 8.0% 4.0% - (3.7%) (7.2%) Swap Market Value (66,963) (34,550) - 34,618 69,145 Change (5.9%) (3.1%) - 3.1% 6.1% Net Gain/(Loss) 22,611 10,566 - (7,207) (11,813) Percentage Change in Portfolio Value(1) 2.0% 0.9% - (0.6%) (1.0%) 6

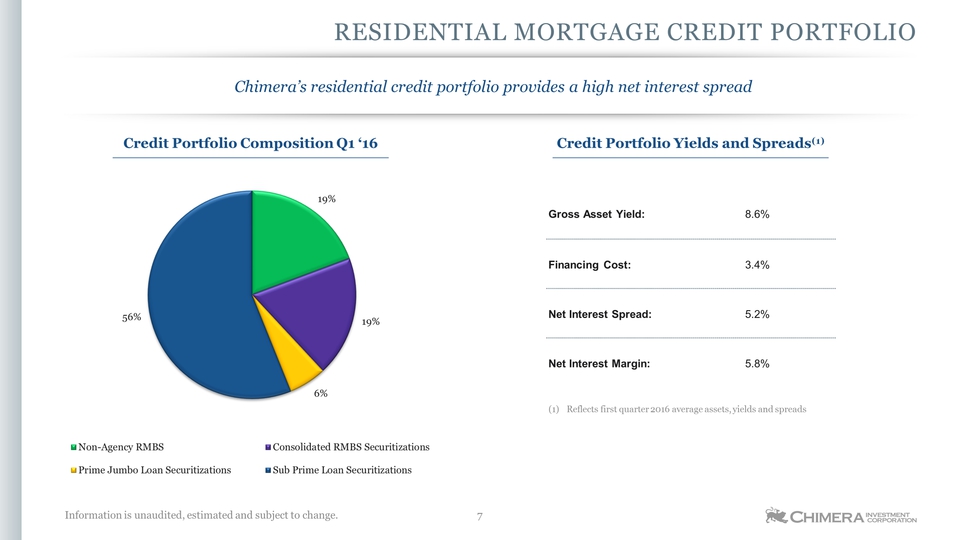

Residential Mortgage Credit Portfolio Information is unaudited, estimated and subject to change. Chimera’s residential credit portfolio provides a high net interest spread Gross Asset Yield: 8.6% Financing Cost: 3.4% Net Interest Spread: 5.2% Net Interest Margin: 5.8% Credit Portfolio Composition Q1 ‘16 Reflects first quarter 2016 average assets, yields and spreads Credit Portfolio Yields and Spreads(1) 7

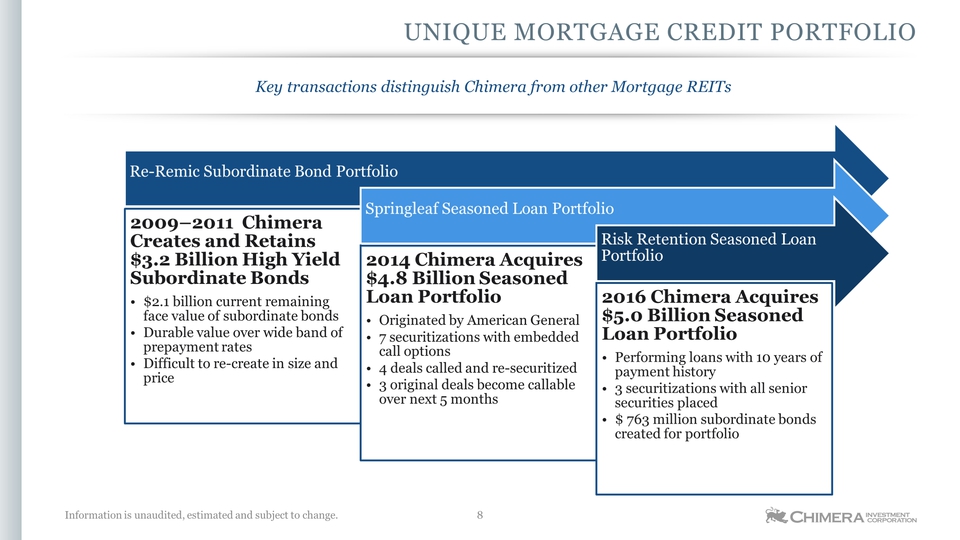

Unique Mortgage Credit Portfolio Information is unaudited, estimated and subject to change. Key transactions distinguish Chimera from other Mortgage REITs 8

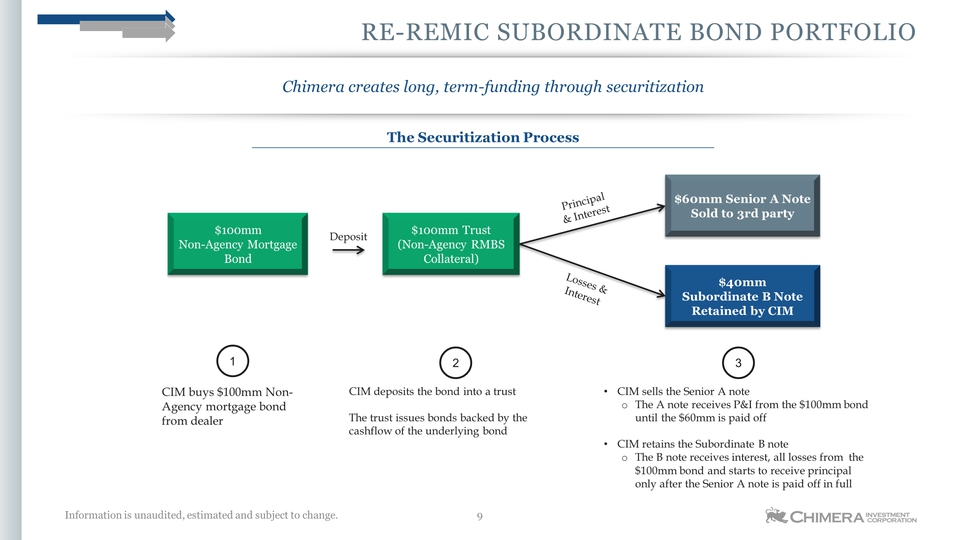

Re-Remic Subordinate Bond Portfolio Information is unaudited, estimated and subject to change. Chimera creates long, term-funding through securitization The Securitization Process $100mm Non-Agency Mortgage Bond $100mm Trust(Non-Agency RMBS Collateral) $60mm Senior A Note Sold to 3rd party Deposit Losses & Interest Principal& Interest $40mm Subordinate B Note Retained by CIM CIM buys $100mm Non-Agency mortgage bond from dealer CIM deposits the bond into a trust The trust issues bonds backed by the cashflow of the underlying bond CIM sells the Senior A noteThe A note receives P&I from the $100mm bond until the $60mm is paid offCIM retains the Subordinate B noteThe B note receives interest, all losses from the $100mm bond and starts to receive principal only after the Senior A note is paid off in full 1 2 3 9

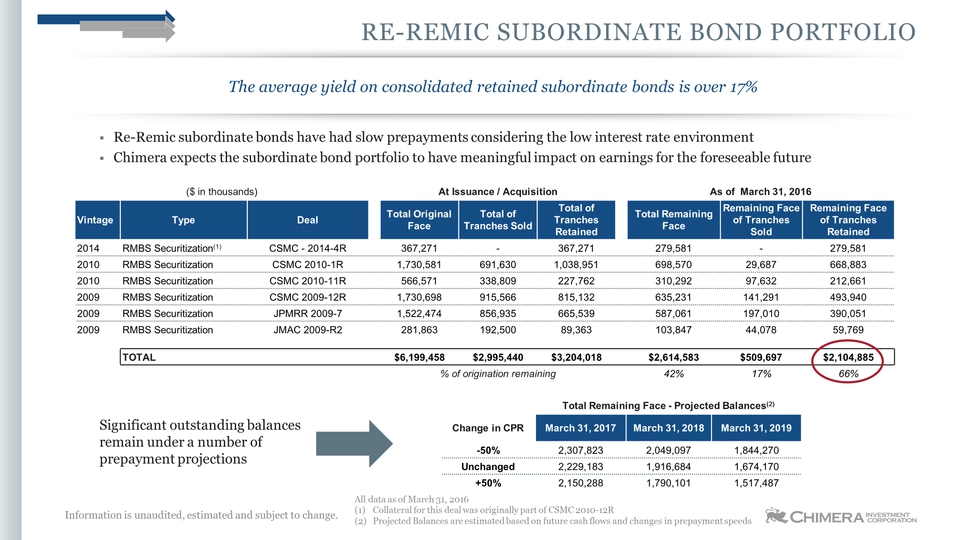

Re-Remic Subordinate Bond Portfolio Information is unaudited, estimated and subject to change. The average yield on consolidated retained subordinate bonds is over 17% Re-Remic subordinate bonds have had slow prepayments considering the low interest rate environmentChimera expects the subordinate bond portfolio to have meaningful impact on earnings for the foreseeable future ($ in thousands) At Issuance / Acquisition As of March 31, 2016 Vintage Type Deal Total Original Face Total of Tranches Sold Total of Tranches Retained Total Remaining Face Remaining Face of Tranches Sold Remaining Face of Tranches Retained 2014 RMBS Securitization(1) CSMC - 2014-4R 367,271 - 367,271 279,581 - 279,581 2010 RMBS Securitization CSMC 2010-1R 1,730,581 691,630 1,038,951 698,570 29,687 668,883 2010 RMBS Securitization CSMC 2010-11R 566,571 338,809 227,762 310,292 97,632 212,661 2009 RMBS Securitization CSMC 2009-12R 1,730,698 915,566 815,132 635,231 141,291 493,940 2009 RMBS Securitization JPMRR 2009-7 1,522,474 856,935 665,539 587,061 197,010 390,051 2009 RMBS Securitization JMAC 2009-R2 281,863 192,500 89,363 103,847 44,078 59,769 TOTAL $6,199,458 $2,995,440 $3,204,018 $2,614,583 $509,697 $2,104,885 % of origination remaining 42% 17% 66% Total Remaining Face - Projected Balances(2) Change in CPR March 31, 2017 March 31, 2018 March 31, 2019 -50% 2,307,823 2,049,097 1,844,270 Unchanged 2,229,183 1,916,684 1,674,170 +50% 2,150,288 1,790,101 1,517,487 Significant outstanding balances remain under a number of prepayment projections All data as of March 31, 2016Collateral for this deal was originally part of CSMC 2010-12RProjected Balances are estimated based on future cash flows and changes in prepayment speeds

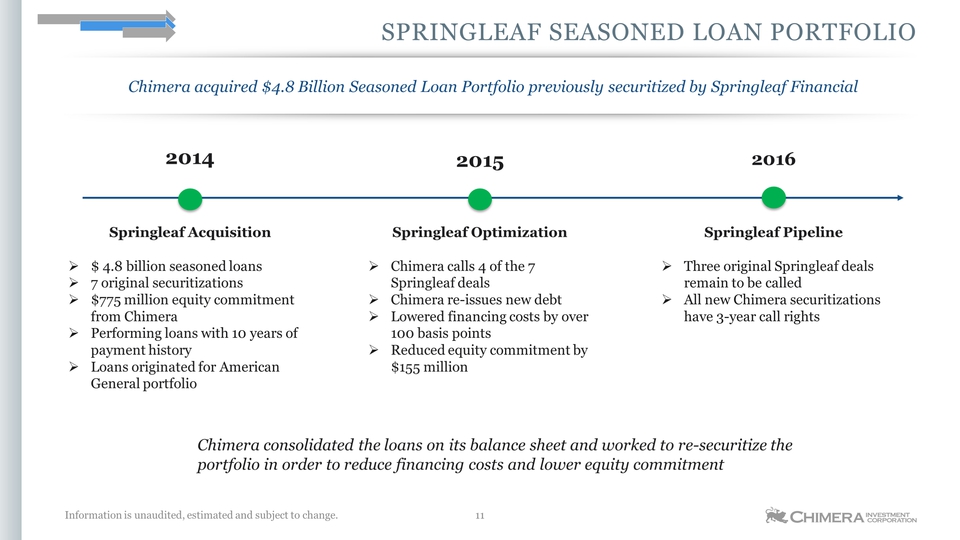

Springleaf Seasoned Loan Portfolio Information is unaudited, estimated and subject to change. Chimera acquired $4.8 Billion Seasoned Loan Portfolio previously securitized by Springleaf Financial Springleaf Acquisition$ 4.8 billion seasoned loans7 original securitizations $775 million equity commitment from ChimeraPerforming loans with 10 years of payment historyLoans originated for American General portfolio Springleaf PipelineThree original Springleaf deals remain to be calledAll new Chimera securitizations have 3-year call rights Springleaf OptimizationChimera calls 4 of the 7 Springleaf dealsChimera re-issues new debt Lowered financing costs by over 100 basis pointsReduced equity commitment by $155 million 2014 2016 2015 Chimera consolidated the loans on its balance sheet and worked to re-securitize the portfolio in order to reduce financing costs and lower equity commitment 11

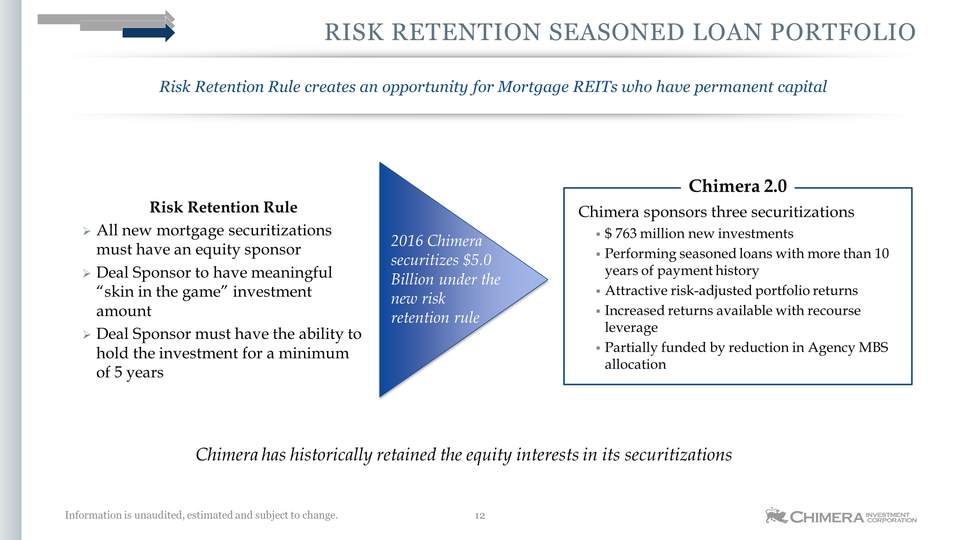

Risk Retention Seasoned Loan Portfolio Information is unaudited, estimated and subject to change. Risk Retention Rule creates an opportunity for Mortgage REITs who have permanent capital Risk Retention RuleAll new mortgage securitizations must have an equity sponsorDeal Sponsor to have meaningful “skin in the game” investment amountDeal Sponsor must have the ability to hold the investment for a minimum of 5 years Chimera sponsors three securitizations$ 763 million new investmentsPerforming seasoned loans with more than 10 years of payment historyAttractive risk-adjusted portfolio returnsIncreased returns available with recourse leveragePartially funded by reduction in Agency MBS allocation Chimera 2.0 Chimera has historically retained the equity interests in its securitizations 2016 Chimera securitizes $5.0 Billion under the new risk retention rule 12

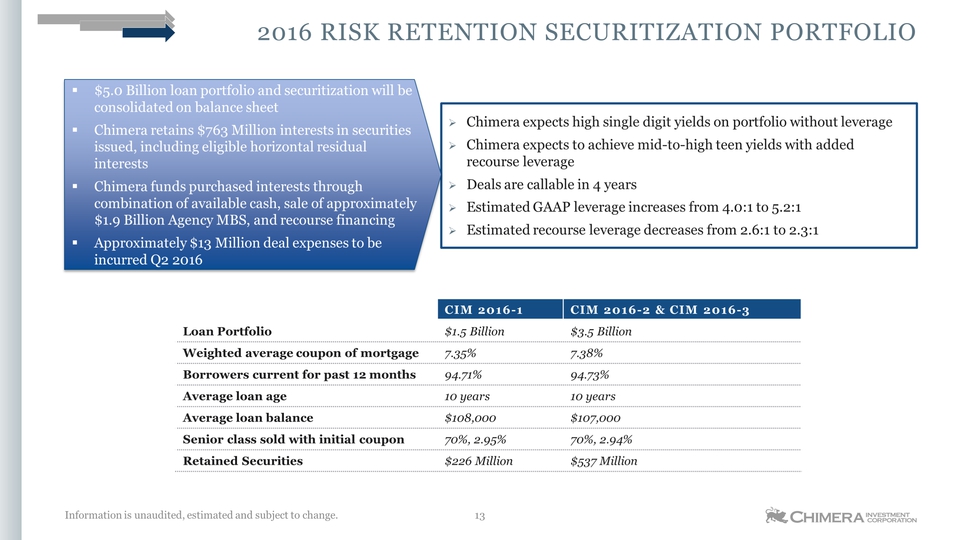

2016 Risk Retention Securitization Portfolio Information is unaudited, estimated and subject to change. Chimera expects high single digit yields on portfolio without leverageChimera expects to achieve mid-to-high teen yields with added recourse leverageDeals are callable in 4 years Estimated GAAP leverage increases from 4.0:1 to 5.2:1Estimated recourse leverage decreases from 2.6:1 to 2.3:1 $5.0 Billion loan portfolio and securitization will be consolidated on balance sheetChimera retains $763 Million interests in securities issued, including eligible horizontal residual interestsChimera funds purchased interests through combination of available cash, sale of approximately $1.9 Billion Agency MBS, and recourse financingApproximately $13 Million deal expenses to be incurred Q2 2016 CIM 2016-1 CIM 2016-2 & CIM 2016-3 Loan Portfolio $1.5 Billion $3.5 Billion Weighted average coupon of mortgage 7.35% 7.38% Borrowers current for past 12 months 94.71% 94.73% Average loan age 10 years 10 years Average loan balance $108,000 $107,000 Senior class sold with initial coupon 70%, 2.95% 70%, 2.94% Retained Securities $226 Million $537 Million 13

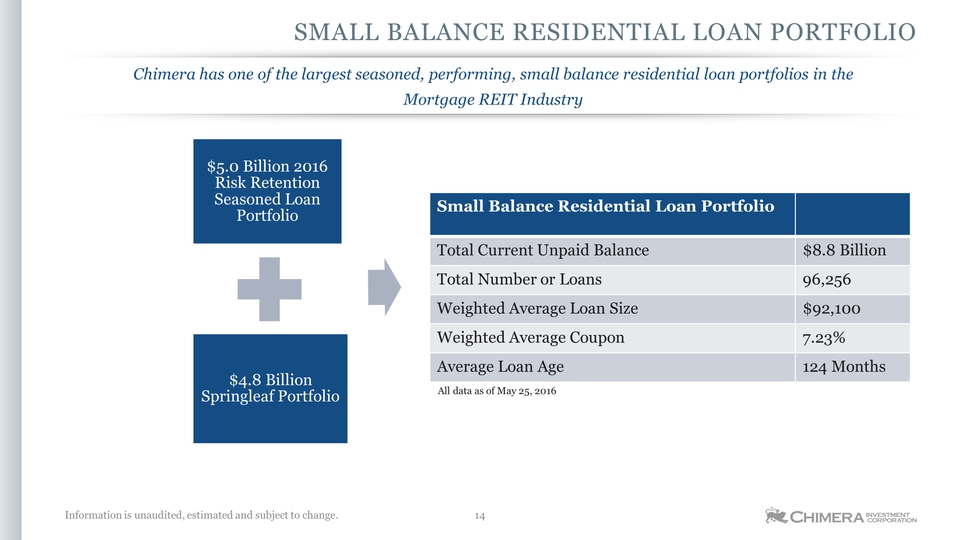

Small Balance Residential Loan Portfolio Information is unaudited, estimated and subject to change. Chimera has one of the largest seasoned, performing, small balance residential loan portfolios in the Mortgage REIT Industry Small Balance Residential Loan Portfolio Total Current Unpaid Balance $8.8 Billion Total Number or Loans 96,256 Weighted Average Loan Size $92,100 Weighted Average Coupon 7.23% Average Loan Age 124 Months All data as of May 25, 2016 14

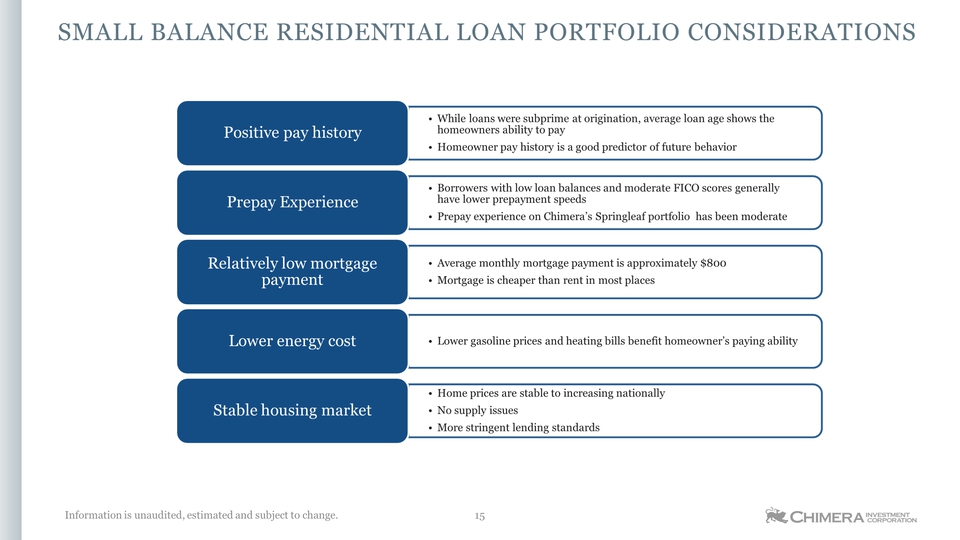

Small Balance Residential Loan Portfolio Considerations Information is unaudited, estimated and subject to change. 15

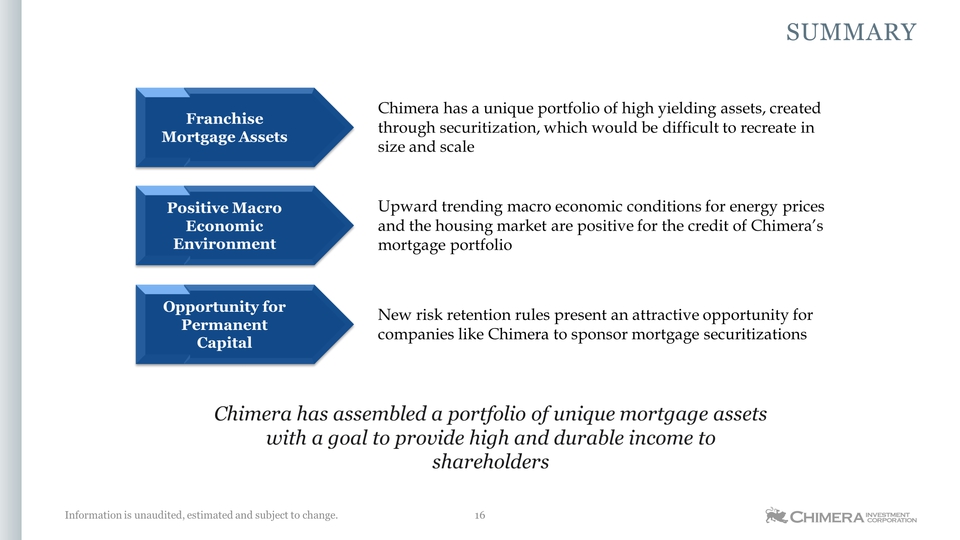

Summary Information is unaudited, estimated and subject to change. Franchise Mortgage Assets Positive Macro Economic Environment Opportunity for Permanent Capital Chimera has a unique portfolio of high yielding assets, created through securitization, which would be difficult to recreate in size and scale Upward trending macro economic conditions for energy prices and the housing market are positive for the credit of Chimera’s mortgage portfolio New risk retention rules present an attractive opportunity for companies like Chimera to sponsor mortgage securitizations Chimera has assembled a portfolio of unique mortgage assets with a goal to provide high and durable income to shareholders 16

chimerareit.com