INVESTOR PRESENTATION

Published on October 17, 2024

Exhibit 99.2

Information is unaudited, estimated and subject to change. Chimera Investment Corporation to Acquire Palisades Group October 17th, 2024

Information is unaudited, estimated and subject to change. DISCLAIMER 2 This presentation includes “forward - looking statements” within the meaning of the safe harbor provisions of the United States Pr ivate Securities Litigation Reform Act of 1995, including as related to the expected timing of the closing of Chimera’s acquisition of the Palisades Group and the expected impact (including as related to Chimer a’s future earnings) of the transaction. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward - looking statements as predictions of futur e events. Words such as “goals,” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “ con tinue,” and similar expressions are intended to identify such forward - looking statements. These forward - looking statements involve significant risks and uncertainties that could cause actual results to differ materiall y from expected results, including, among other things, those described in our most recent Annual Report on Form 10 - K, and any subsequent Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: delays and/or unforeseen events that could cause the proposed acquisition of the Palisades Group to be delaye d o r not consummated; the potential that Chimera may not fully realize the expected benefits of the acquisition of the Palisades Group, including the potential financial impact; our business and investment str ate gy; our ability to accurately forecast the payment of future dividends on our common and preferred stock, and the amount of such dividends; our ability to determine accurately the fair market value of our assets; a vai lability of investment opportunities in real estate - related and other securities, including our valuation of potential opportunities that may arise as a result of current and future market dislocations; our expected inves tme nts; changes in the value of our investments, including negative changes resulting in margin calls related to the financing of our assets; changes in inflation, interest rates and mortgage prepayment rates; prep aym ents of the mortgage and other loans underlying our mortgage - backed securities, or MBS, or other asset - backed securities, or ABS; rates of default, forbearance, deferred payments, delinquencies or decreased recovery rates on our investments; general volatility of the securities markets in which we invest; our ability to maintain existing financing arrangements and our ability to obtain future financing arrangements; our abi lity to effect our strategy to securitize residential mortgage loans; interest rate mismatches between our investments and our borrowings used to finance such purchases; effects of interest rate caps on our adjustable - rate investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the impact of and changes to various government programs ; the impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; market trends in our industry, interest rates, the debt securities markets or the general economy; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; our ability to find and retain qualified personnel; our ability to maintain our classification as a REIT for U.S. federal inc ome tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended; our expectations regarding materiality or significance; and the effectiveness of our disclos ure controls and procedures. Readers are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Chi mera does not undertake or accept any obligation to release publicly any updates or revisions to any forward - looking statement to reflect any change in its expectations or any change in events, conditions or circ umstances on which any such statement is based. Additional information concerning these, and other risk factors, is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC ). All subsequent written and oral forward - looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionar y s tatements above. Readers are advised that any financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by Chi mera’s independent auditors. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third par tie s and industry publications. We have not independently verified any such market and industry data from third - party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, n or shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. We use our website (www.chimerareit.com) as a channel of distribution of company information. The information we post on our web site may be deemed material. Accordingly, investors should monitor our website, in addition to following our press releases, SEC filings and public conference calls and webcasts. In addition, you may autom ati cally receive email alerts and other information about Chimera when you enroll your email address by visiting our website, then clicking on “News and Events" and selecting "Email Alerts" to complete the email not ification form. Our website and any alerts are not incorporated into this document.

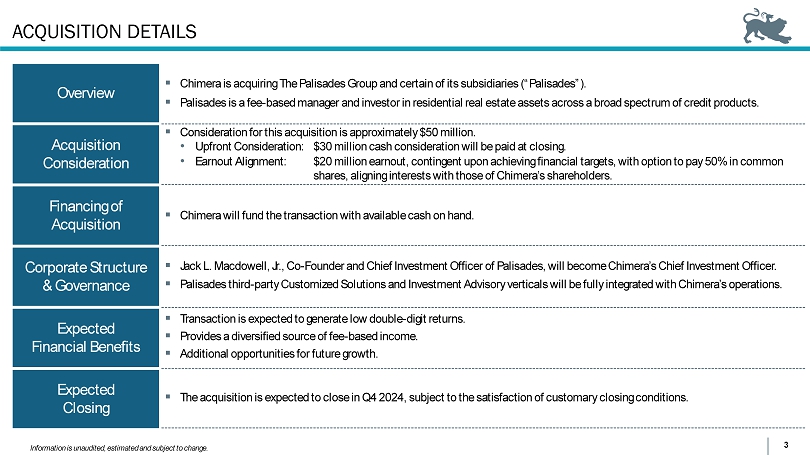

Information is unaudited, estimated and subject to change. ACQUISITION DETAILS 3 Overview Acquisition Consideration Corporate Structure & Governance Financing of Acquisition Expected Financial Benefits Expected Closing ▪ Chimera is acquiring The Palisades Group and certain of its subsidiaries (“Palisades”). ▪ Palisades is a fee - based manager and investor in residential real estate assets across a broad spectrum of credit products. ▪ Consideration for this acquisition is approximately $50 million. • Upfront Consideration: $30 million cash consideration will be paid at closing. • Earnout Alignment: $20 million earnout, contingent upon achieving financial targets, with option to pay 50% in common shares, aligning interests with those of Chimera’s shareholders. ▪ Jack L. Macdowell, Jr., Co - Founder and Chief Investment Officer of Palisades, will become Chimera’s Chief Investment Officer. ▪ Palisades third - party Customized Solutions and Investment Advisory verticals will be fully integrated with Chimera’s operations. ▪ Chimera will fund the transaction with available cash on hand. ▪ Transaction is expected to generate low double - digit returns. ▪ Provides a diversified source of fee - based income. ▪ Additional opportunities for future growth. ▪ The acquisition is expected to close in Q4 2024, subject to the satisfaction of customary closing conditions.

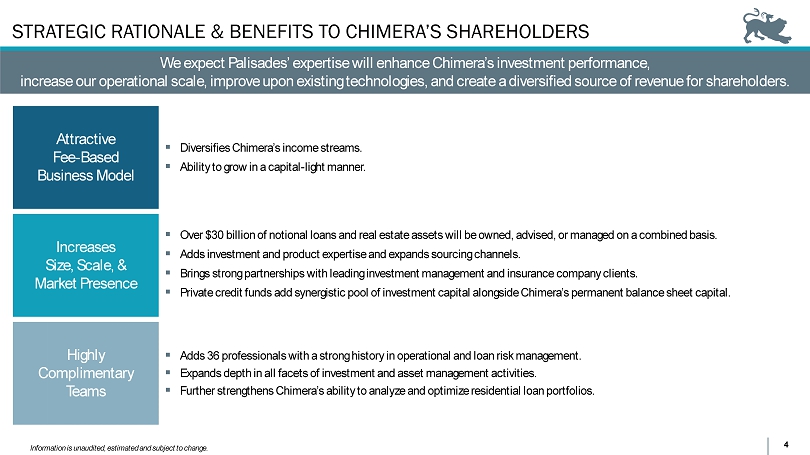

Information is unaudited, estimated and subject to change. STRATEGIC RATIONALE & BENEFITS TO CHIMERA’S SHAREHOLDERS 4 We expect Palisades’ expertise will enhance Chimera’s investment performance, increase our operational scale, improve upon existing technologies, and create a diversified source of revenue for shareholde rs. Attractive Fee - Based Business Model Increases Size, Scale, & Market Presence Highly Complimentary Teams ▪ Diversifies Chimera’s income streams. ▪ Ability to grow in a capital - light manner. ▪ Over $30 billion of notional loans and real estate assets will be owned, advised, or managed on a combined basis. ▪ Adds investment and product expertise and expands sourcing channels. ▪ Brings strong partnerships with leading investment management and insurance company clients. ▪ Private credit funds add synergistic pool of investment capital alongside Chimera’s permanent balance sheet capital. ▪ Adds 36 professionals with a strong history in operational and loan risk management. ▪ Expands depth in all facets of investment and asset management activities. ▪ Further strengthens Chimera’s ability to analyze and optimize residential loan portfolios.

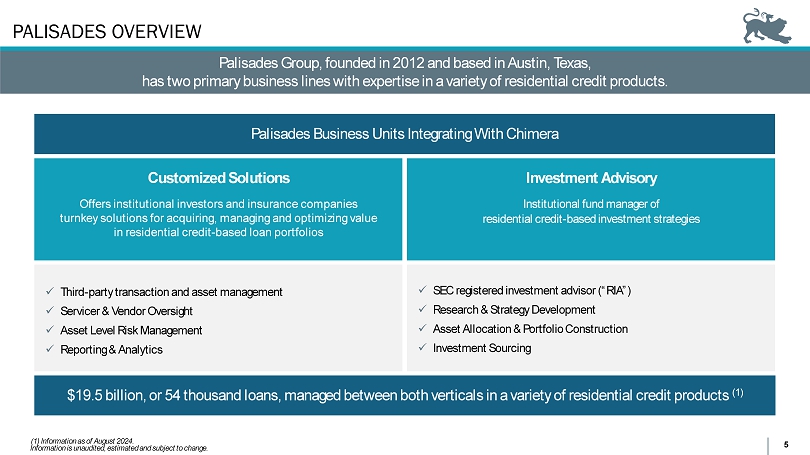

Information is unaudited, estimated and subject to change. PALISADES OVERVIEW 5 Palisades Business Units Integrating With Chimera Customized Solutions Offers institutional investors and insurance companies turnkey solutions for acquiring, managing and optimizing value in residential credit - based loan portfolios Investment Advisory Institutional fund manager of residential credit - based investment strategies x Third - party transaction and asset management x Servicer & Vendor Oversight x Asset Level Risk Management x Reporting & Analytics x SEC registered investment advisor (“RIA”) x Research & Strategy Development x Asset Allocation & Portfolio Construction x Investment Sourcing (1) Information as of August 2024. Palisades Group, founded in 2012 and based in Austin, Texas, has two primary business lines with expertise in a variety of residential credit products. $19.5 billion, or 54 thousand loans, managed between both verticals in a variety of residential credit products (1)

Information is unaudited, estimated and subject to change.