EXHIBIT 99.1

Published on August 8, 2019

INVESTOR PRESENTATION NYSE: CIM 2nd Quarter 2019

DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the credit risk in our underlying assets; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; our ability to borrow to finance our assets and the associated costs; changes in the competitive landscape within our industry; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire residential mortgage loans and successfully securitize the residential mortgage loans we acquire; our ability to oversee our third party sub-servicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. Information is unaudited, estimated and subject to change.

CHIMERA IS A HYBRID MORTGAGE REIT Chimera develops and manages a portfolio of leveraged residential mortgage investments to produce an attractive quarterly dividend for shareholders ▪ Established in 2007 ▪ Internally managed since August 2015 ▪ Total Capital $4.0 Billion ▪ Total Portfolio $27.2 Billion ▪ Common Stock Price $18.87 / Dividend Yield 10.60% ▪ Total preferred stock $930 Million ▪ Overall leverage ratio 5.7:1 / Recourse leverage ratio 3.7:1 All data as of June 30, 2019 Information is unaudited, estimated and subject to change. 2

TOTAL RETURN Chimera has outperformed mortgage REITs and the S&P 500 since internalization of management Cumulative Total Return* 118% 110% 90% 70% 51% 50% 45% 30% 10% -10% -30% 15 15 16 16 16 16 16 17 17 17 17 17 18 18 18 18 19 19 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 20 5/ 2/ 2/ 1/ 0/ 7/ 3/ 4/ 4/ 4/ 0/ 8/ 0/ 7/ 4/ 2/ 4/ 4/ 8/ /2 /1 4/ /2 9/ /2 /1 5/ /2 /1 /2 /2 6/ /2 /1 2/ /2 10 1 6 11 2 7 10 12 3 8 11 4 6/30/2019 CIM REM* SPY* *Assuming reinvestment of dividends SPY: The SPDR® S&P 500® ETF Trust seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index . REM: The iShares Mortgage Real Estate ETF seeks to track the investment results of an index composed of U.S. REITs that hold U.S. residential and commercial mortgages. All data as of June 30, 2019 Source: Bloomberg Information is unaudited, estimated and subject to change. 3

DIVIDENDS Chimera has declared $4.6 billion in dividends since inception 700 6,000 600 5,000 500 4,000 ) ) s 400 s n n o o i i l l l l i 3,000 i M M ( ( $ 300 $ 2,000 200 1,000 100 0 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 YTD Period Ending Common Dividends Preferred Dividends Special Dividends Cumulative Dividends Paid All data as of June 30, 2019 Information is unaudited, estimated and subject to change. 4

DYNAMIC INVESTMENT STRATEGY Chimera focuses on acquiring Residential Mortgage Loans, Non-Agency RMBS, Agency RMBS and Agency CMBS Residential Chimera acquires residential mortgage loans. Chimera utilizes leverage through a combination of securitization, repo and warehouse facilities to manage risk and increase returns on the portfolio. Chimera's loan portfolio has Mortgage Loans historically generated higher returns with less price volatility and interest rate risk than comparable Agency RMBS. Non-Agency Chimera invests in both investment grade and non-investment grade RMBS. This portfolio provides high risk-adjusted returns RMBS while providing increased liquidity. Non-Agency RMBS securities typically carry higher yields than Agency RMBS. Agency mortgage-backed securities that are backed by residential loans provide spread income for the portfolio with the Agency added benefit of liquidity. Chimera utilizes repo and various hedging techniques to increase returns on the portfolio while RMBS managing interest rate risk. Agency mortgage backed securities are amongst the most liquid securities available in the fixed income market. Agency Chimera acquires Agency CMBS primarily in the form of Ginnie Mae Construction Loan and Ginnie Mae Permanent Loan Certificates. These assets typically have prepayment protection. This prepayment protection generally makes these assets CMBS longer duration and thus more efficient to hedge interest rate risk compared to Agency RMBS. Information is unaudited, estimated and subject to change. 5

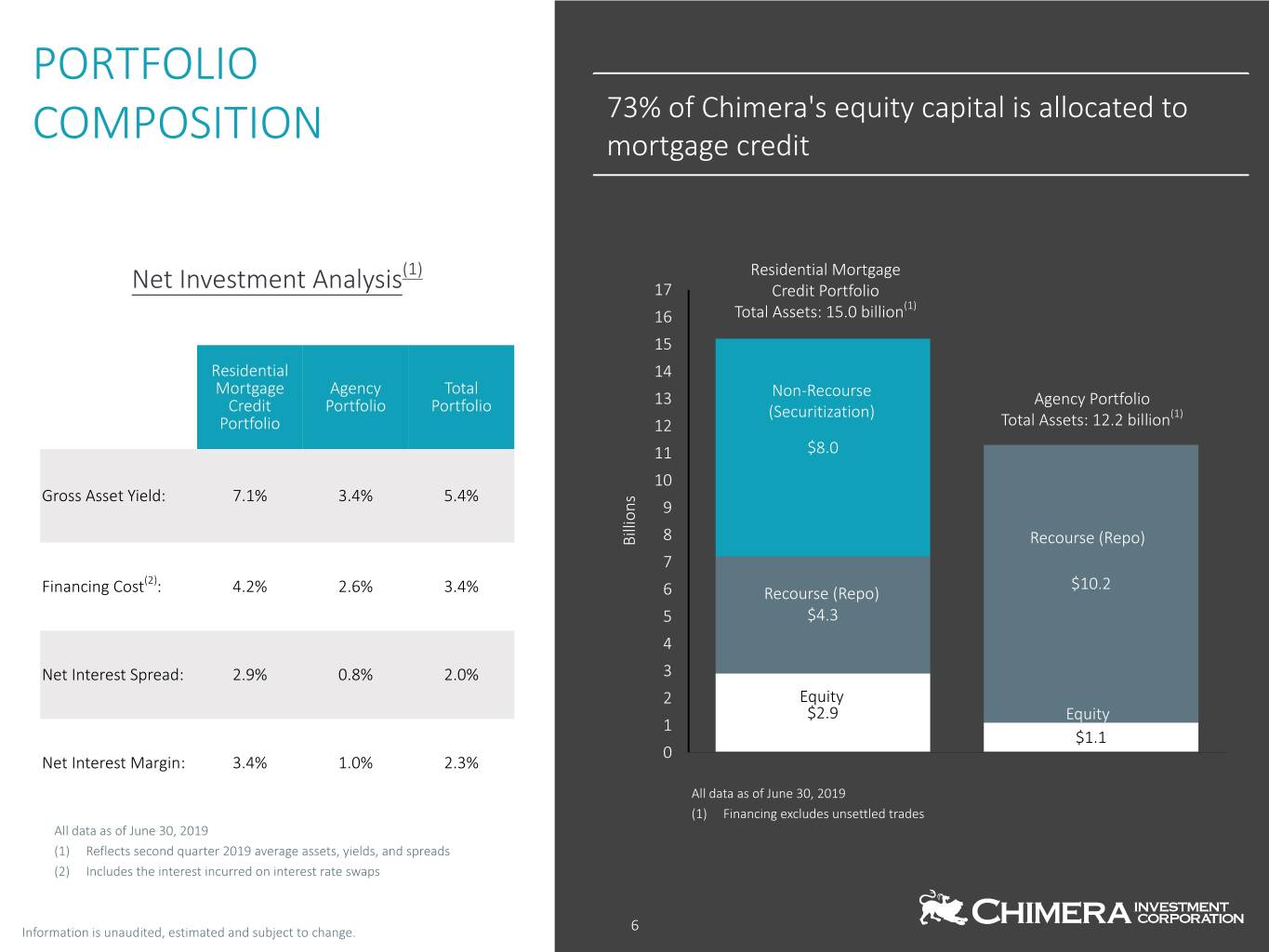

PORTFOLIO 73% of Chimera's equity capital is allocated to COMPOSITION mortgage credit (1) Residential Mortgage Net Investment Analysis 17 Credit Portfolio (1) 16 Total Assets: 15.0 billion 15 Residential 14 Mortgage Agency Total 13 Non-Recourse Agency Portfolio Credit Portfolio Portfolio (Securitization) (1) Portfolio 12 Total Assets: 12.2 billion 11 $8.0 10 Gross Asset Yield: 7.1% 3.4% 5.4% s n 9 o i l l i 8 B Recourse (Repo) 7 (2) $10.2 Financing Cost : 4.2% 2.6% 3.4% 6 Recourse (Repo) 5 $4.3 4 Net Interest Spread: 2.9% 0.8% 2.0% 3 2 Equity $2.9 Equity 1 $1.1 0 Net Interest Margin: 3.4% 1.0% 2.3% All data as of June 30, 2019 (1) Financing excludes unsettled trades All data as of June 30, 2019 (1) Reflects second quarter 2019 average assets, yields, and spreads (2) Includes the interest incurred on interest rate swaps Information is unaudited, estimated and subject to change. 6

LOAN PORTFOLIO COMPOSITION Chimera has acquired a unique portfolio of residential mortgage loans comprising 45% of the total portfolio Portfolio Fair Value 10% Seasoned Low Loan Balance Mortgage Portfolio Total Current Unpaid Balance $11.6 Billion 45% Total Number of Loans 133,529 33% Weighted Average Loan Size $87,095 Weighted Average Coupon 6.82% 12% Average Loan Age 161 Months All data as of June 30, 2019 Securitized Loan Portfolio Agency CMBS Agency RMBS Non-Agency RMBS Information is unaudited, estimated and subject to change. 7

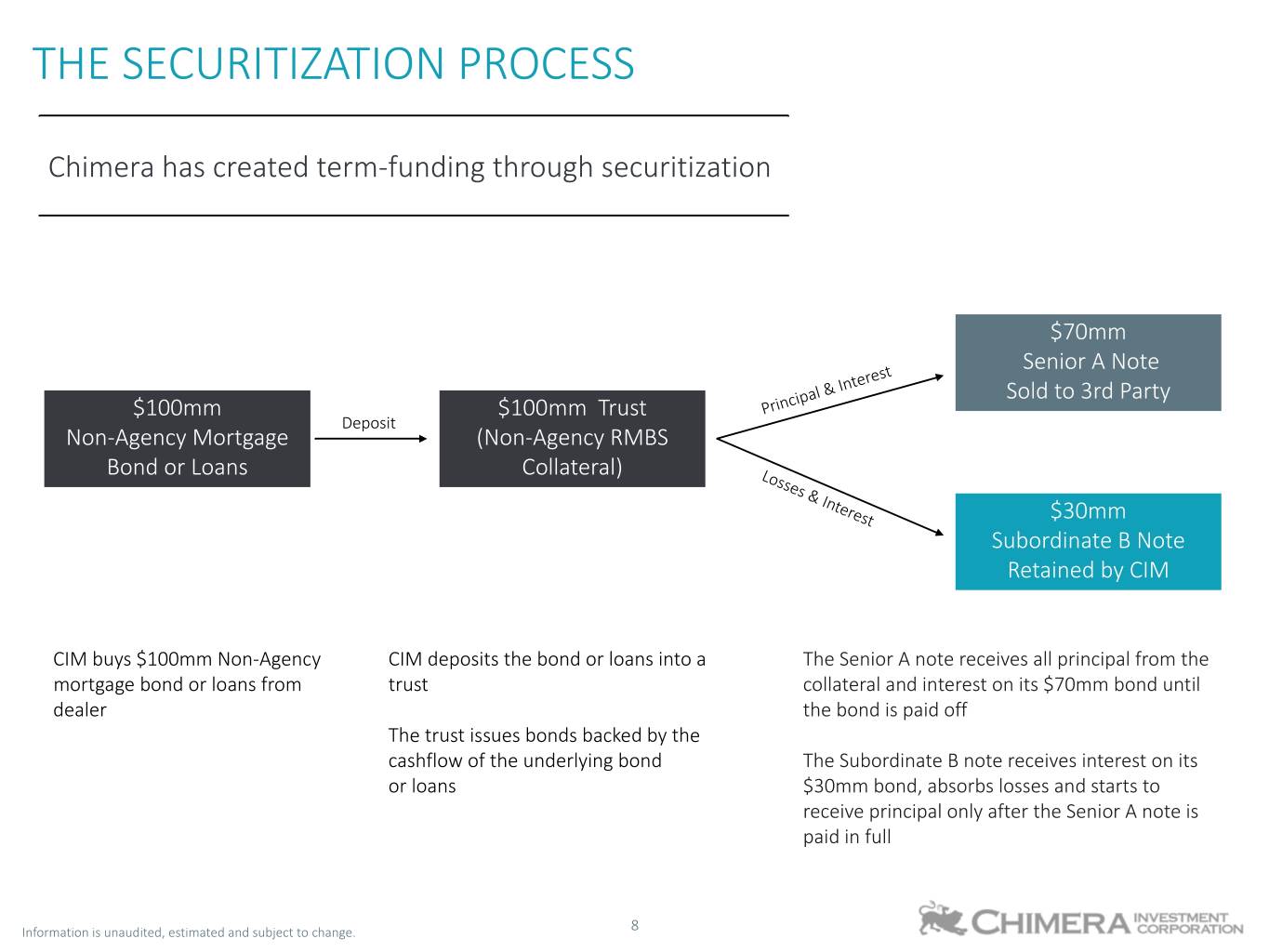

1 THE SECURITIZATION PROCESS Chimera has created term-funding through securitization 2 3 $70mm Senior A Note Sold to 3rd Party $100mm $100mm Trust Principal & Interest Deposit Non-Agency Mortgage (Non-Agency RMBS Bond or Loans Collateral) Losses & Interest $30mm Subordinate B Note Retained by CIM CIM buys $100mm Non-Agency CIM deposits the bond or loans into a The Senior A note receives all principal from the mortgage bond or loans from trust collateral and interest on its $70mm bond until dealer the bond is paid off The trust issues bonds backed by the cashflow of the underlying bond The Subordinate B note receives interest on its or loans $30mm bond, absorbs losses and starts to receive principal only after the Senior A note is paid in full Information is unaudited, estimated and subject to change. 8

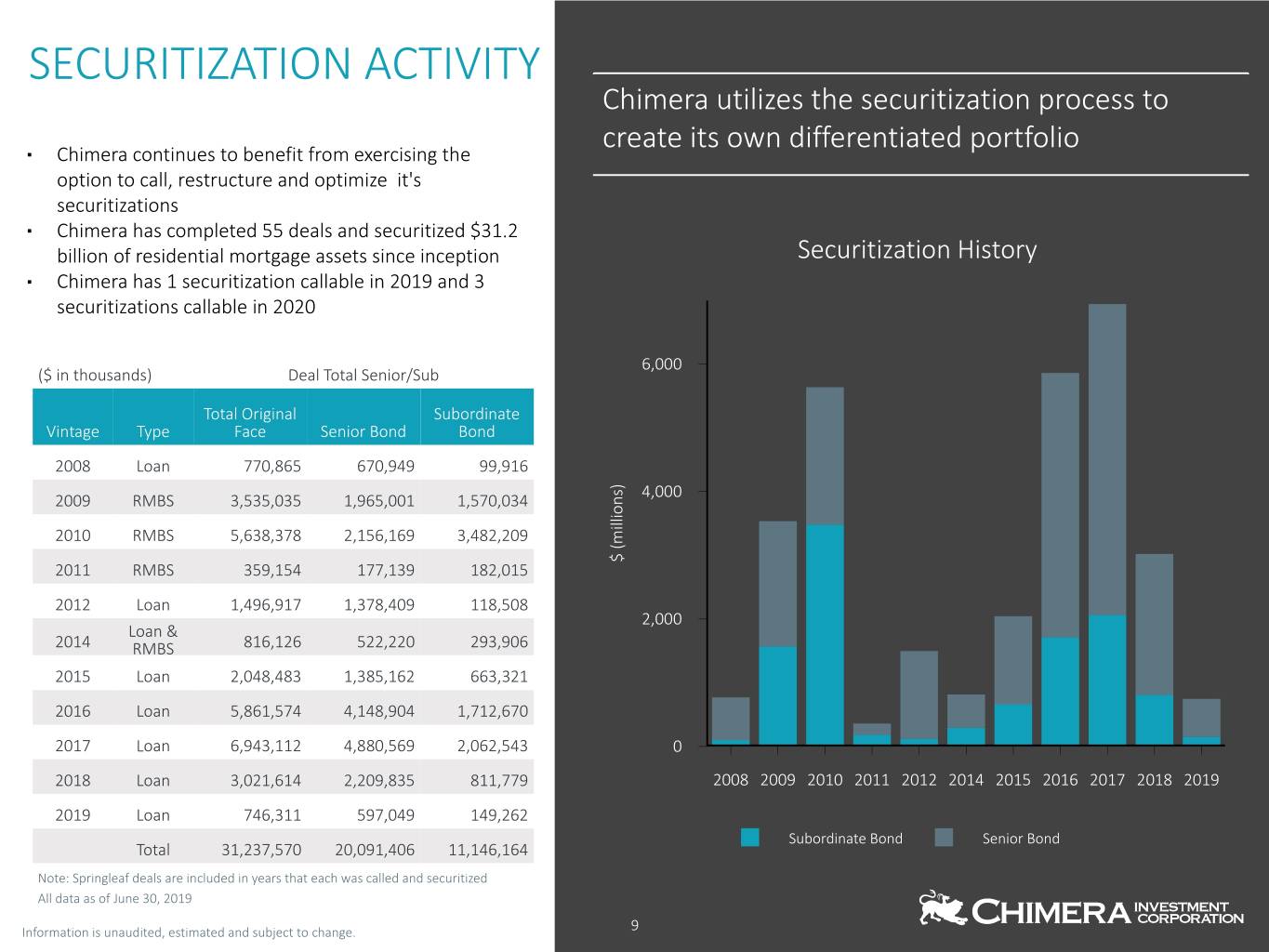

SECURITIZATION ACTIVITY Chimera utilizes the securitization process to create its own differentiated portfolio ▪ Chimera continues to benefit from exercising the option to call, restructure and optimize it's securitizations ▪ Chimera has completed 55 deals and securitized $31.2 billion of residential mortgage assets since inception Securitization History ▪ Chimera has 1 securitization callable in 2019 and 3 securitizations callable in 2020 6,000 ($ in thousands) Deal Total Senior/Sub Total Original Subordinate Vintage Type Face Senior Bond Bond 2008 Loan 770,865 670,949 99,916 ) s 4,000 2009 RMBS 3,535,035 1,965,001 1,570,034 n o i l l i 2010 RMBS 5,638,378 2,156,169 3,482,209 m ( $ 2011 RMBS 359,154 177,139 182,015 2012 Loan 1,496,917 1,378,409 118,508 2,000 Loan & 2014 RMBS 816,126 522,220 293,906 2015 Loan 2,048,483 1,385,162 663,321 2016 Loan 5,861,574 4,148,904 1,712,670 2017 Loan 6,943,112 4,880,569 2,062,543 0 2018 Loan 3,021,614 2,209,835 811,779 2008 2009 2010 2011 2012 2014 2015 2016 2017 2018 2019 2019 Loan 746,311 597,049 149,262 Subordinate Bond Senior Bond Total 31,237,570 20,091,406 11,146,164 Note: Springleaf deals are included in years that each was called and securitized All data as of June 30, 2019 Information is unaudited, estimated and subject to change. 9

AGENCY PORTFOLIO Liquidity in Agency Securities enables Chimera to vary it's investments based upon relative value and residential mortgage credit opportunities available in the market 14 12 2.9 3.1 3.3 10 ) 2.5 s 8 n o i l l i b ( $ 6 0.9 1.0 1.1 2.3 9.2 9.0 8.9 4 8.3 1.3 1.3 6.9 1.3 1.4 1.8 1.9 2.1 6.8 6.0 1.4 5.3 5.3 5.4 4.6 2 3.0 2.9 2.7 2.6 2.5 2.4 2.3 2.3 0 4Q14 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 1Q18 2Q18 3Q18 4Q18 1Q19 2Q19 Period Ending *excludes Agency IO Agency Passthrough Agency Commercial All data as of June 30, 2019 Information is unaudited, estimated and subject to change. 10

CAPITAL MANAGEMENT Chimera continues to add shareholder value while diversifying its capital structure ▪ Board of Directors expects to declare $2.00 dividends per common share in 2019 5,800,000 Shares 13,000,000 Shares ▪ Chimera has raised $930 million in 8.00% Fixed Series A 8.00% Variable Series B preferred stock, representing 23% of Cumulative Redeemable Cumulative Redeemable total capital Preferred Stock Preferred Stock Issued October 2016 Issued February 2017 ▪ Board of Directors authorization for $85 million share repurchase 10,400,000 Shares 8,000,000 Shares 7.75% Variable Series C 8.00% Variable Series D Cumulative Redeemable Cumulative Redeemable Preferred Stock Preferred Stock Issued September 2018 Issued January 2019 All data as of June 30, 2019 Information is unaudited, estimated and subject to change.

SUMMARY Chimera has assembled a unique portfolio of mortgage assets with a goal to provide high and durable income to shareholders Dynamic Investment Chimera has developed a diversified portfolio of mortgage backed securities to maximize risk-adjusted returns. Chimera's total return has outperformed the Mortgage REIT Index and the S&P 500 since internalization of Strategy management in 2015. Unique Mortgage Chimera has created a high yield mortgage portfolio through securitization activity. Chimera’s seasoned mortgage portfolio has a weighted average coupon of 6.8% with a weighted average loan size of less than Credit Portfolio ninety thousand dollars. Diversified Capital The addition of preferred stock has created a positive impact on our balance sheet, allowing us to grow our Structure investment portfolio and lower the company’s overall cost of capital. Information is unaudited, estimated and subject to change.

Appendix 13

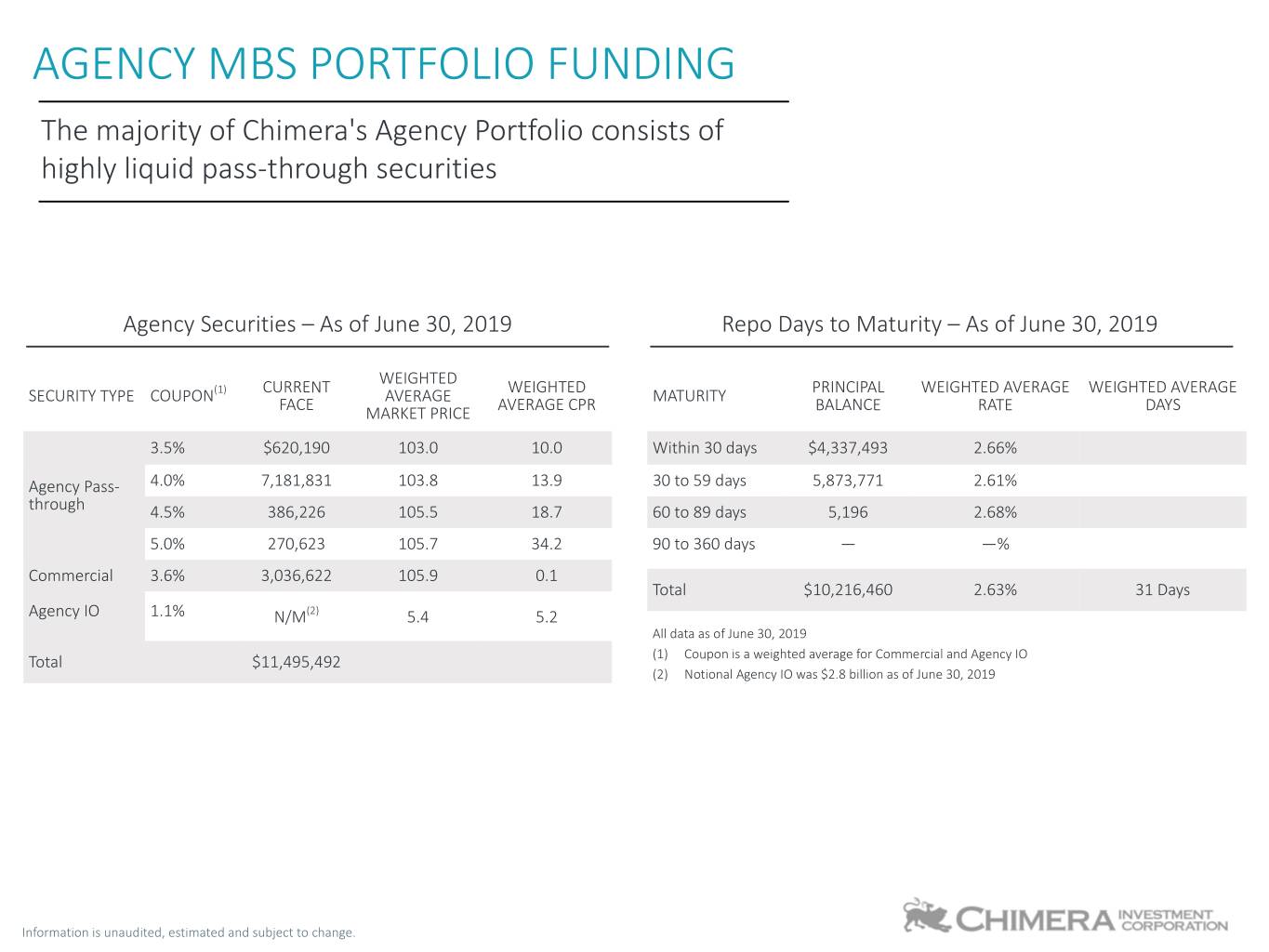

AGENCY MBS PORTFOLIO FUNDING The majority of Chimera's Agency Portfolio consists of highly liquid pass-through securities Agency Securities – As of June 30, 2019 Repo Days to Maturity – As of June 30, 2019 WEIGHTED (1) CURRENT WEIGHTED SECURITY TYPE COUPON AVERAGE MATURITY PRINCIPAL WEIGHTED AVERAGE WEIGHTED AVERAGE FACE MARKET PRICE AVERAGE CPR BALANCE RATE DAYS 3.5% $620,190 103.0 10.0 Within 30 days $4,337,493 2.66% Agency Pass- 4.0% 7,181,831 103.8 13.9 30 to 59 days 5,873,771 2.61% through 4.5% 386,226 105.5 18.7 60 to 89 days 5,196 2.68% 5.0% 270,623 105.7 34.2 90 to 360 days — —% Commercial 3.6% 3,036,622 105.9 0.1 Total $10,216,460 2.63% 31 Days Agency IO 1.1% N/M(2) 5.4 5.2 All data as of June 30, 2019 Total $11,495,492 (1) Coupon is a weighted average for Commercial and Agency IO (2) Notional Agency IO was $2.8 billion as of June 30, 2019 Information is unaudited, estimated and subject to change.

INTEREST RATE SENSITIVITY Chimera rebalanced its Agency hedge portfolio during the quarter Description - 100 Basis - 50 Basis +50 Basis +100 Basis ($ in thousands) Points Points Unchanged Points Points Hedge Book Maturities Market Value $ 12,414,897 $ 12,310,754 $ 12,154,575 $ 11,922,436 $ 11,638,675 Agency Securities 0% Percentage Change 2.1 % 1.3 % - (1.9)% (4.2)% 16% Market Value (324,172) (158,685) - 152,265 298,372 Swap Percentage Change (2.7)% (1.3)% - 1.3 % 2.5 % Market Value (35,186) (17,351) - 16,886 33,327 Futures 17% Percentage Change (0.3)% (0.1)% - 0.1 % 0.3 % Net Gain/(Loss) $ (99,036) $ (19,857) - $ (62,988) $ (184,201) 67% Percentage Change in Portfolio Value(1) (0.8)% (0.2)% - (0.5)% (1.5)% Near Term 0-3 Total Notional Balance - Derivative Instruments Short Term 3-5 June 30, 2019 March 31, 2019 Medium Term 5-10 Agency Interest Rate Swaps 4,931,700 6,733,200 Long Term 10-30 Swaptions 25,000 53,000 Futures 619,700 619,700 (1) Based on instantaneous moves in interest rates. All data as of June 30, 2019 Information is unaudited, estimated and subject to change.

chimerareit.com