EXHIBIT 99.2

Published on February 12, 2020

FINANCIAL SUPPLEMENT 4th Quarter 2019

DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to: the state of credit markets and general economic conditions; changes in interest rates and the market value of our assets; the rates of default or decreased recovery on the mortgages underlying our target assets; the occurrence, extent and timing of credit losses within our portfolio; the credit risk in our underlying assets; declines in home prices; our ability to establish, adjust and maintain appropriate hedges for the risks in our portfolio; the availability and cost of our target assets; our ability to borrow to finance our assets and the associated costs; changes in the competitive landscape within our industry; our ability to manage various operational risks and costs associated with our business; interruptions in or impairments to our communications and information technology systems; our ability to acquire residential mortgage loans and successfully securitize the residential mortgage loans we acquire; our ability to oversee our third party sub-servicers; the impact of any deficiencies in the servicing or foreclosure practices of third parties and related delays in the foreclosure process; our exposure to legal and regulatory claims; legislative and regulatory actions affecting our business; the impact of new or modified government mortgage refinance or principal reduction programs; our ability to maintain our REIT qualification; and limitations imposed on our business due to our REIT status and our exempt status under the Investment Company Act of 1940. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors. Information is unaudited, estimated and subject to change.

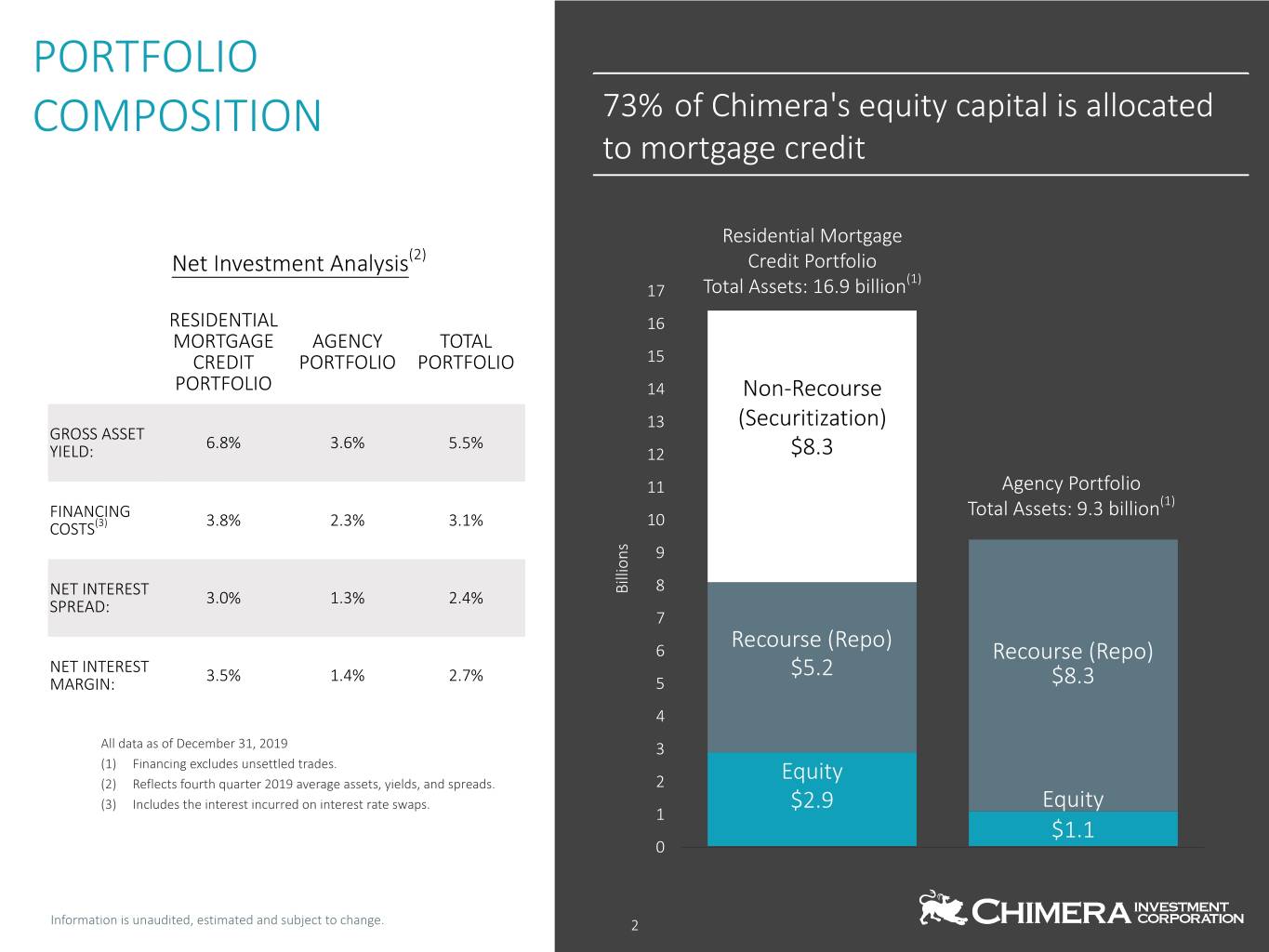

PORTFOLIO COMPOSITION 73% of Chimera's equity capital is allocated to mortgage credit Residential Mortgage Net Investment Analysis(2) Credit Portfolio (1) 17 Total Assets: 16.9 billion RESIDENTIAL 16 MORTGAGE AGENCY TOTAL CREDIT PORTFOLIO PORTFOLIO 15 PORTFOLIO 14 Non-Recourse 13 (Securitization) GROSS ASSET 6.8% 3.6% 5.5% YIELD: 12 $8.3 11 Agency Portfolio (1) FINANCING Total Assets: 9.3 billion (3) 10 COSTS 3.8% 2.3% 3.1% s n 9 o i l l i NET INTEREST B 8 SPREAD: 3.0% 1.3% 2.4% 7 Recourse (Repo) 6 Recourse (Repo) NET INTEREST $5.2 MARGIN: 3.5% 1.4% 2.7% 5 $8.3 4 All data as of December 31, 2019 3 (1) Financing excludes unsettled trades. (2) Reflects fourth quarter 2019 average assets, yields, and spreads. 2 Equity (3) Includes the interest incurred on interest rate swaps. $2.9 Equity 1 $1.1 0 Information is unaudited, estimated and subject to change. 2

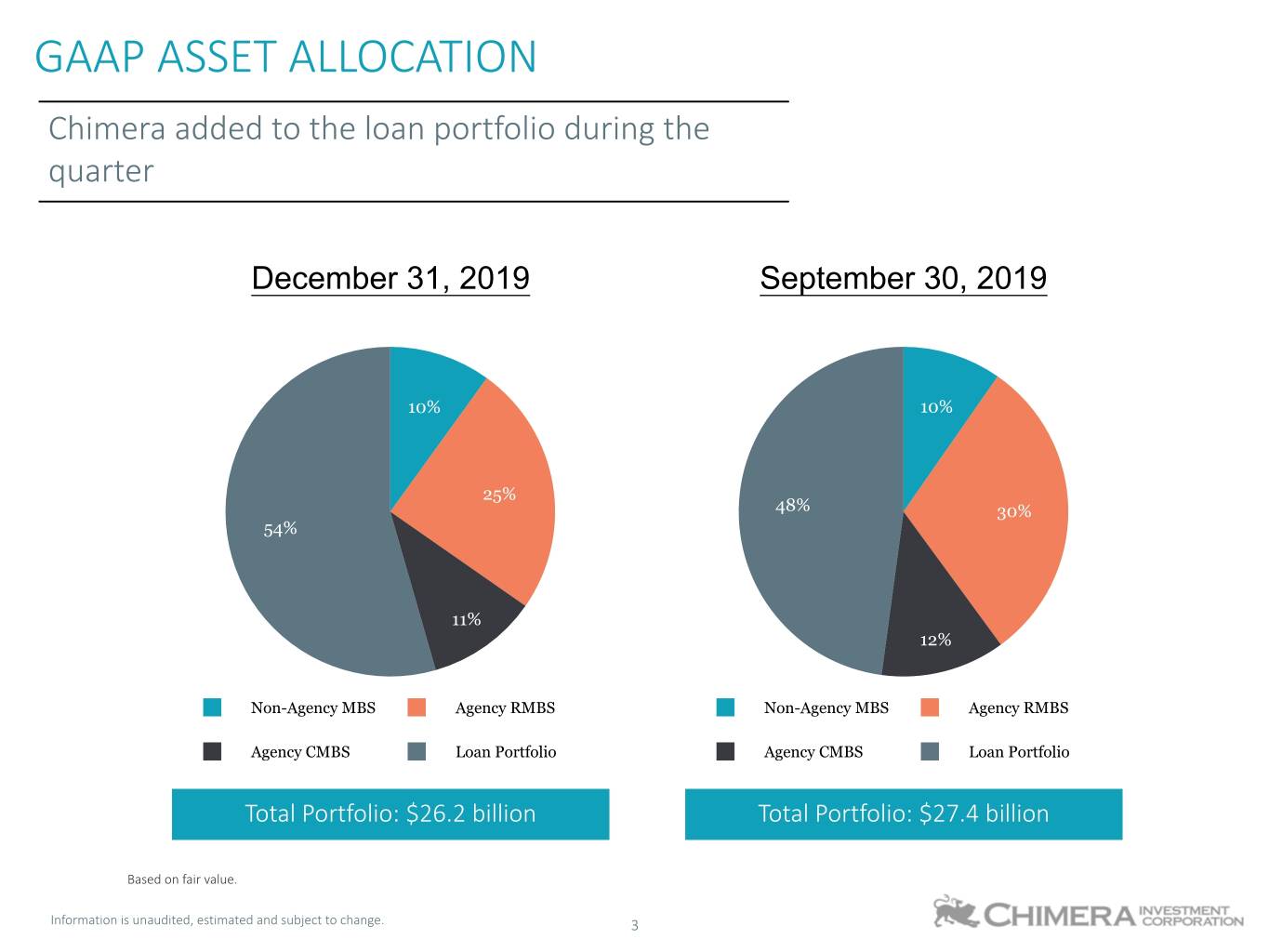

GAAP ASSET ALLOCATION Chimera added to the loan portfolio during the quarter December 31, 2019 September 30, 2019 10% 10% 25% 48% 30% 54% 11% 12% Non-Agency MBS Agency RMBS Non-Agency MBS Agency RMBS Agency CMBS Loan Portfolio Agency CMBS Loan Portfolio Total Portfolio: $26.2 billion Total Portfolio: $27.4 billion Based on fair value. Information is unaudited, estimated and subject to change. 3

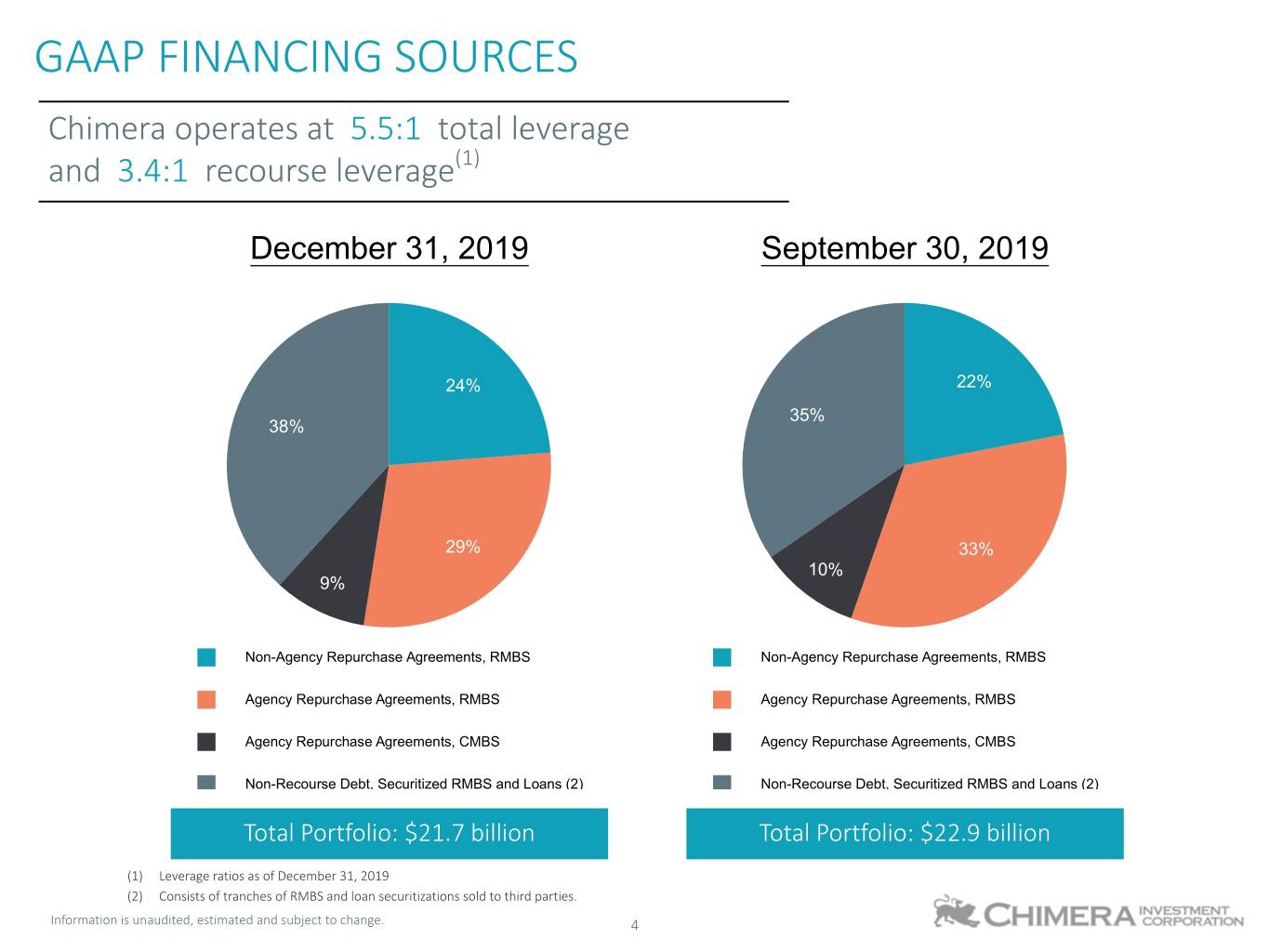

GAAP FINANCING SOURCES Chimera operates at 5.5:1 total leverage and 3.4:1 recourse leverage(1) December 31, 2019 September 30, 2019 24% 22% 35% 38% 29% 33% 10% 9% Non-Agency Repurchase Agreements, RMBS Non-Agency Repurchase Agreements, RMBS Agency Repurchase Agreements, RMBS Agency Repurchase Agreements, RMBS Agency Repurchase Agreements, CMBS Agency Repurchase Agreements, CMBS Non-Recourse Debt, Securitized RMBS and Loans (2) Non-Recourse Debt, Securitized RMBS and Loans (2) Total Portfolio: $21.7 billion Total Portfolio: $22.9 billion (1) Leverage ratios as of December 31, 2019 (2) Consists of tranches of RMBS and loan securitizations sold to third parties. Information is unaudited, estimated and subject to change. 4

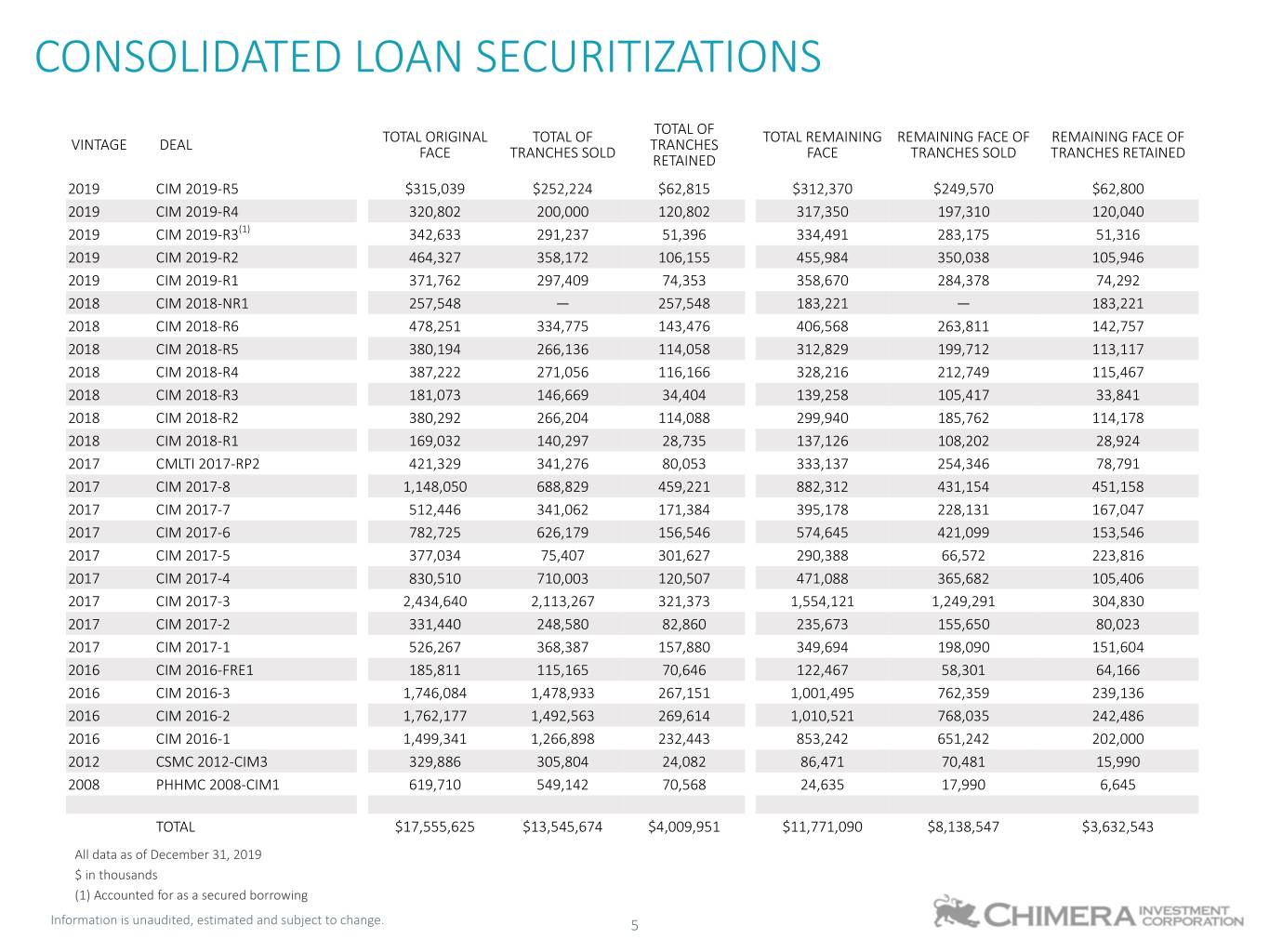

CONSOLIDATED LOAN SECURITIZATIONS TOTAL OF VINTAGE DEAL TOTAL ORIGINAL TOTAL OF TRANCHES TOTAL REMAINING REMAINING FACE OF REMAINING FACE OF FACE TRANCHES SOLD RETAINED FACE TRANCHES SOLD TRANCHES RETAINED 2019 CIM 2019-R5 $315,039 $252,224 $62,815 $312,370 $249,570 $62,800 2019 CIM 2019-R4 320,802 200,000 120,802 317,350 197,310 120,040 2019 CIM 2019-R3(1) 342,633 291,237 51,396 334,491 283,175 51,316 2019 CIM 2019-R2 464,327 358,172 106,155 455,984 350,038 105,946 2019 CIM 2019-R1 371,762 297,409 74,353 358,670 284,378 74,292 2018 CIM 2018-NR1 257,548 — 257,548 183,221 — 183,221 2018 CIM 2018-R6 478,251 334,775 143,476 406,568 263,811 142,757 2018 CIM 2018-R5 380,194 266,136 114,058 312,829 199,712 113,117 2018 CIM 2018-R4 387,222 271,056 116,166 328,216 212,749 115,467 2018 CIM 2018-R3 181,073 146,669 34,404 139,258 105,417 33,841 2018 CIM 2018-R2 380,292 266,204 114,088 299,940 185,762 114,178 2018 CIM 2018-R1 169,032 140,297 28,735 137,126 108,202 28,924 2017 CMLTI 2017-RP2 421,329 341,276 80,053 333,137 254,346 78,791 2017 CIM 2017-8 1,148,050 688,829 459,221 882,312 431,154 451,158 2017 CIM 2017-7 512,446 341,062 171,384 395,178 228,131 167,047 2017 CIM 2017-6 782,725 626,179 156,546 574,645 421,099 153,546 2017 CIM 2017-5 377,034 75,407 301,627 290,388 66,572 223,816 2017 CIM 2017-4 830,510 710,003 120,507 471,088 365,682 105,406 2017 CIM 2017-3 2,434,640 2,113,267 321,373 1,554,121 1,249,291 304,830 2017 CIM 2017-2 331,440 248,580 82,860 235,673 155,650 80,023 2017 CIM 2017-1 526,267 368,387 157,880 349,694 198,090 151,604 2016 CIM 2016-FRE1 185,811 115,165 70,646 122,467 58,301 64,166 2016 CIM 2016-3 1,746,084 1,478,933 267,151 1,001,495 762,359 239,136 2016 CIM 2016-2 1,762,177 1,492,563 269,614 1,010,521 768,035 242,486 2016 CIM 2016-1 1,499,341 1,266,898 232,443 853,242 651,242 202,000 2012 CSMC 2012-CIM3 329,886 305,804 24,082 86,471 70,481 15,990 2008 PHHMC 2008-CIM1 619,710 549,142 70,568 24,635 17,990 6,645 TOTAL $17,555,625 $13,545,674 $4,009,951 $11,771,090 $8,138,547 $3,632,543 All data as of December 31, 2019 $ in thousands (1) Accounted for as a secured borrowing Information is unaudited, estimated and subject to change. 5

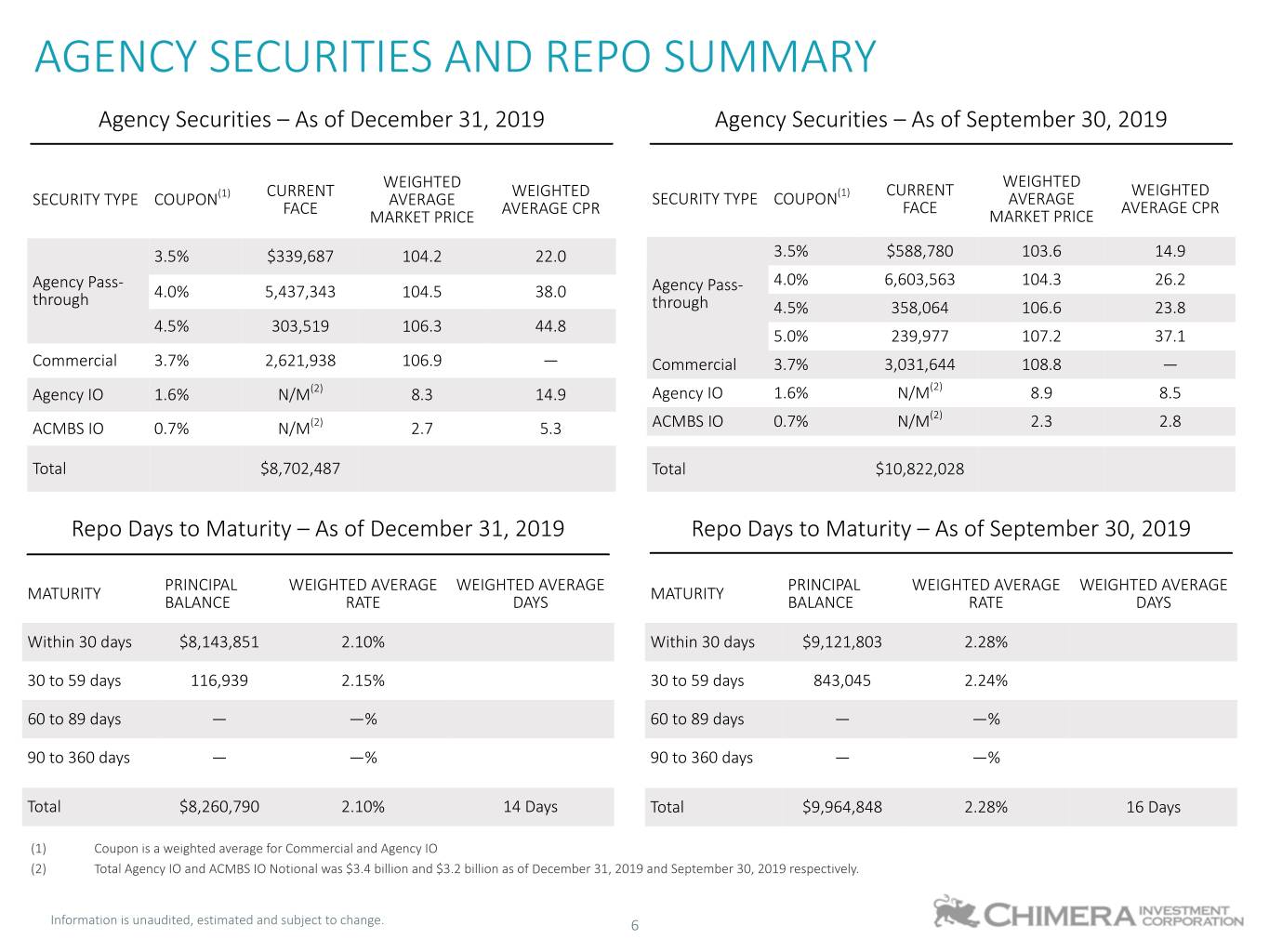

AGENCY SECURITIES AND REPO SUMMARY Agency Securities – As of December 31, 2019 Agency Securities – As of September 30, 2019 WEIGHTED WEIGHTED (1) CURRENT WEIGHTED (1) CURRENT WEIGHTED SECURITY TYPE COUPON AVERAGE SECURITY TYPE COUPON FACE AVERAGE AVERAGE CPR FACE MARKET PRICE AVERAGE CPR MARKET PRICE 3.5% $339,687 104.2 22.0 3.5% $588,780 103.6 14.9 Agency Pass- 4.0% 6,603,563 104.3 26.2 4.0% 5,437,343 104.5 38.0 Agency Pass- through through 4.5% 358,064 106.6 23.8 4.5% 303,519 106.3 44.8 5.0% 239,977 107.2 37.1 Commercial 3.7% 2,621,938 106.9 — Commercial 3.7% 3,031,644 108.8 — Agency IO 1.6% N/M(2) 8.3 14.9 Agency IO 1.6% N/M(2) 8.9 8.5 (2) ACMBS IO 0.7% N/M(2) 2.7 5.3 ACMBS IO 0.7% N/M 2.3 2.8 Total $8,702,487 Total $10,822,028 Repo Days to Maturity – As of December 31, 2019 Repo Days to Maturity – As of September 30, 2019 PRINCIPAL WEIGHTED AVERAGE WEIGHTED AVERAGE PRINCIPAL WEIGHTED AVERAGE WEIGHTED AVERAGE MATURITY BALANCE RATE DAYS MATURITY BALANCE RATE DAYS Within 30 days $8,143,851 2.10% Within 30 days $9,121,803 2.28% 30 to 59 days 116,939 2.15% 30 to 59 days 843,045 2.24% 60 to 89 days — —% 60 to 89 days — —% 90 to 360 days — —% 90 to 360 days — —% Total $8,260,790 2.10% 14 Days Total $9,964,848 2.28% 16 Days (1) Coupon is a weighted average for Commercial and Agency IO (2) Total Agency IO and ACMBS IO Notional was $3.4 billion and $3.2 billion as of December 31, 2019 and September 30, 2019 respectively. Information is unaudited, estimated and subject to change. 6

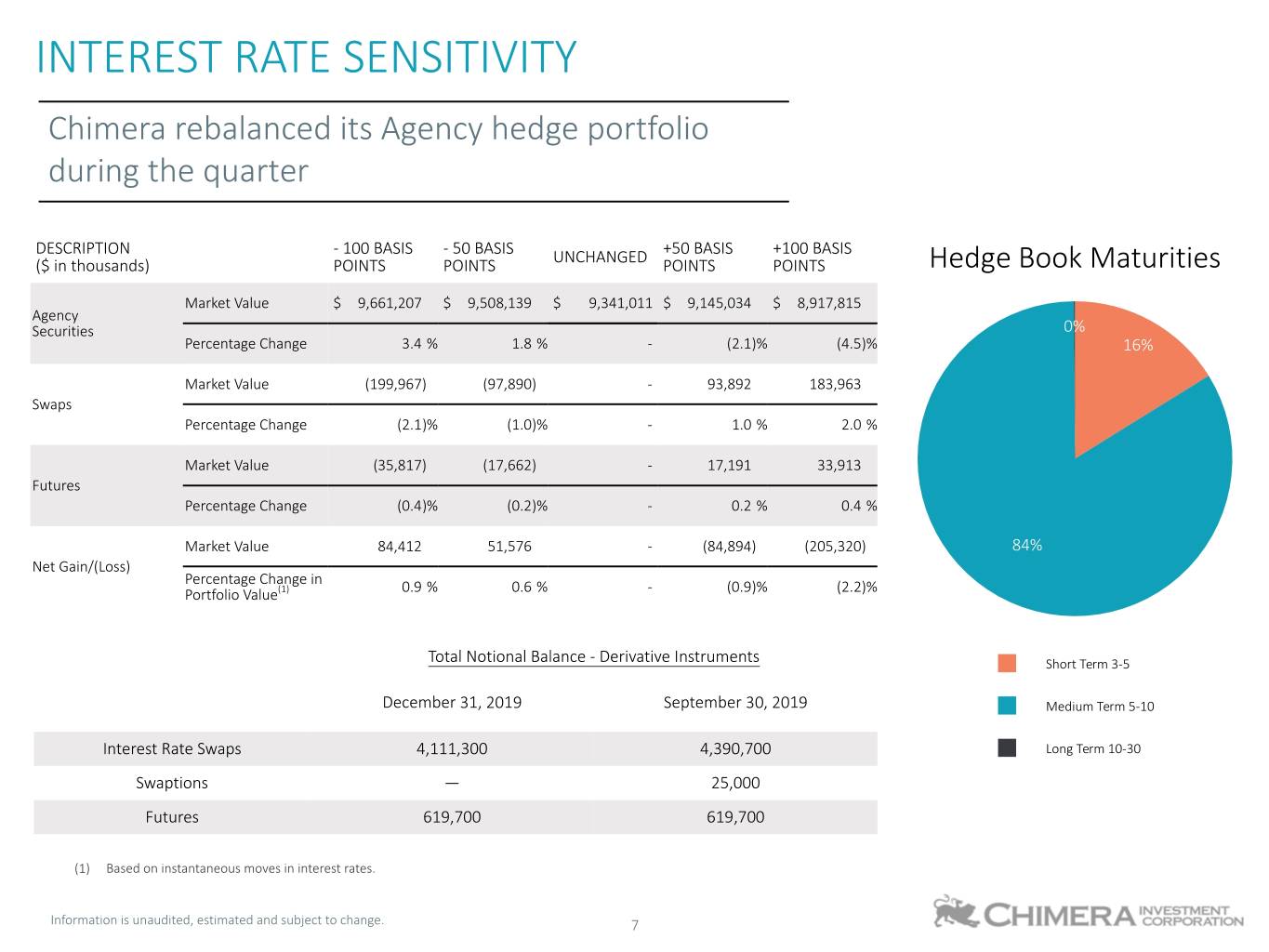

INTEREST RATE SENSITIVITY Chimera rebalanced its Agency hedge portfolio during the quarter DESCRIPTION - 100 BASIS - 50 BASIS +50 BASIS +100 BASIS ($ in thousands) POINTS POINTS UNCHANGED POINTS POINTS Hedge Book Maturities Market Value $ 9,661,207 $ 9,508,139 $ 9,341,011 $ 9,145,034 $ 8,917,815 Agency Securities 0% Percentage Change 3.4 % 1.8 % - (2.1)% (4.5)% 16% Market Value (199,967) (97,890) - 93,892 183,963 Swaps Percentage Change (2.1)% (1.0)% - 1.0 % 2.0 % Market Value (35,817) (17,662) - 17,191 33,913 Futures Percentage Change (0.4)% (0.2)% - 0.2 % 0.4 % Market Value 84,412 51,576 - (84,894) (205,320) 84% Net Gain/(Loss) Percentage Change in Portfolio Value(1) 0.9 % 0.6 % - (0.9)% (2.2)% Total Notional Balance - Derivative Instruments Short Term 3-5 December 31, 2019 September 30, 2019 Medium Term 5-10 Interest Rate Swaps 4,111,300 4,390,700 Long Term 10-30 Swaptions — 25,000 Futures 619,700 619,700 (1) Based on instantaneous moves in interest rates. Information is unaudited, estimated and subject to change. 7

chimerareit.com