EX-99.2

Published on May 5, 2021

FINANCIAL SUPPLEMENT 1st Quarter 2021

Information is unaudited, estimated and subject to change. DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Report on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to:our business and investment strategy; our ability to accurately forecast the payment of future dividends on our common and preferred stock, and the amount of such dividends; our ability to determine accurately the fair market value of our assets; availability of investment opportunities in real estate-related and other securities, including our valuation of potential opportunities that may arise as a result of current and future market dislocations; effect of the novel coronavirus (or COVID-19) pandemic on real estate market, financial markets and our Company, including the impact on the value, availability, financing and liquidity of mortgage assets; how COVID-19 may affect us, our operations and our personnel; our expected investments; changes in the value of our investments, including negative changes resulting in margin calls related to the financing of our assets; changes in interest rates and mortgage prepayment rates; prepayments of the mortgage and other loans underlying our mortgage-backed securities, or RMBS, or other asset-backed securities, or ABS; rates of default, delinquencies or decreased recovery rates on our investments; general volatility of the securities markets in which we invest; our ability to maintain existing financing arrangements and our ability to obtain future financing arrangements; our ability to effect our strategy to securitize residential mortgage loans; interest rate mismatches between our investments and our borrowings used to finance such purchases; effects of interest rate caps on our adjustable-rate investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the impact of and changes to various government programs, including in response to COVID-19; impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; market trends in our industry, interest rates, the debt securities markets or the general economy; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; availability of qualified personnel; our ability to maintain our classification as a real estate investment trust, or, REIT, for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or 1940 Act; our expectations regarding materiality or significance; and the effectiveness of our disclosure controls and procedures. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

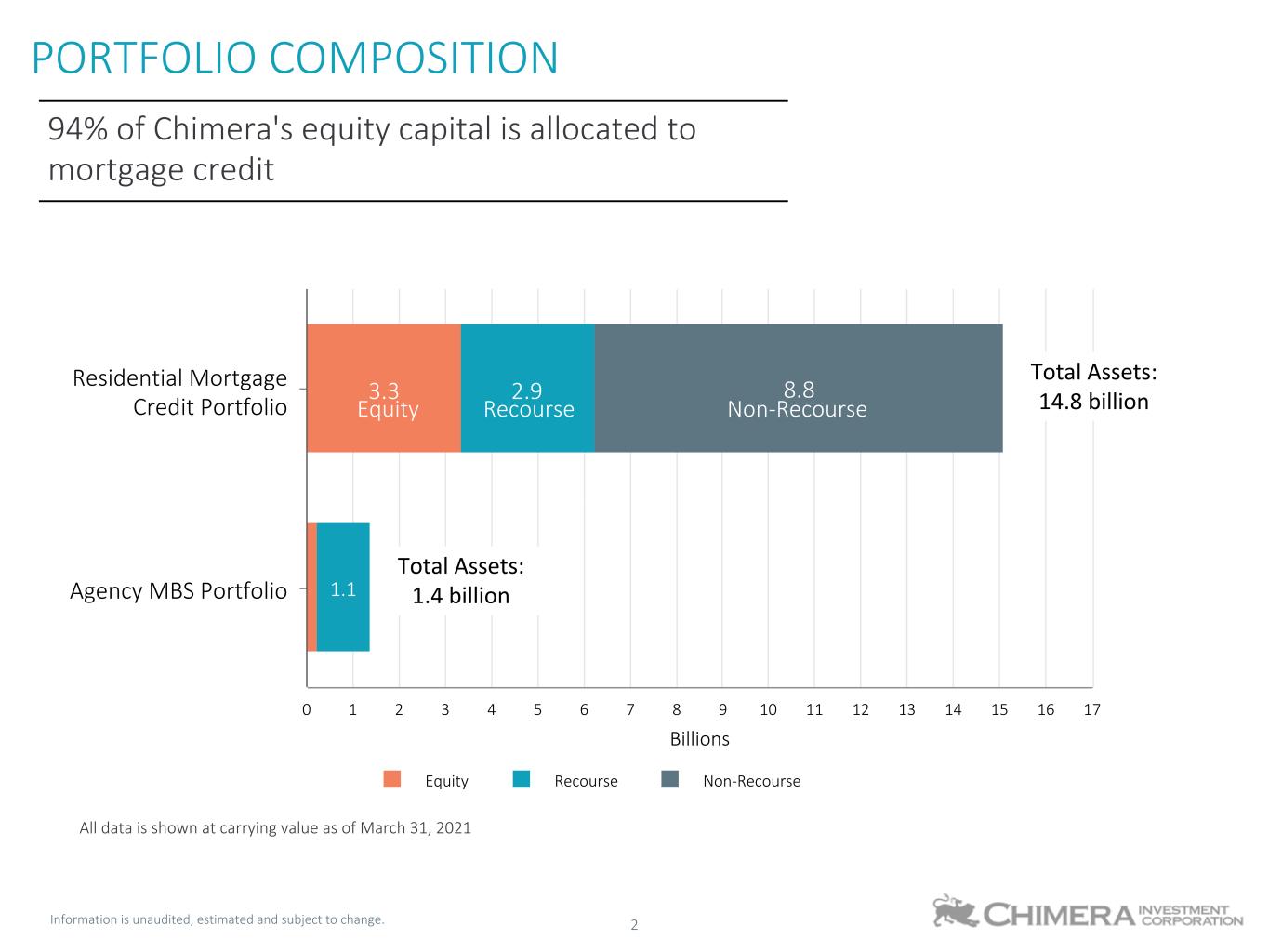

Information is unaudited, estimated and subject to change. 2 PORTFOLIO COMPOSITION 94% of Chimera's equity capital is allocated to mortgage credit Billions 3.3 2.9 1.1 8.8 Equity Recourse Non-Recourse Residential Mortgage Credit Portfolio Agency MBS Portfolio 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Total Assets: 14.8 billion Total Assets: 1.4 billion All data is shown at carrying value as of March 31, 2021 Equity Recourse Non-Recourse

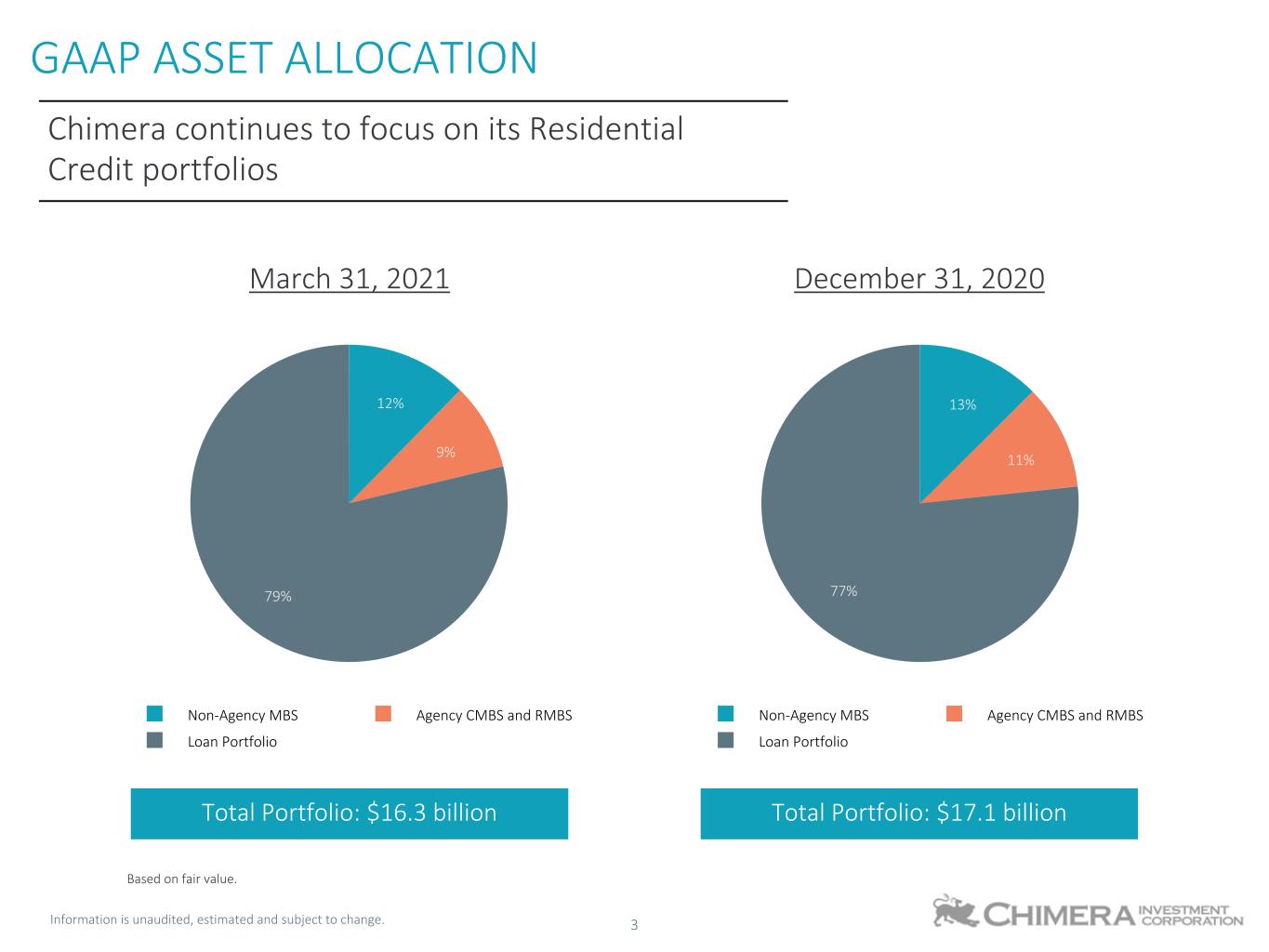

Information is unaudited, estimated and subject to change. 3 12% 9% 79% Non-Agency MBS Agency CMBS and RMBS Loan Portfolio GAAP ASSET ALLOCATION Based on fair value. 13% 11% 77% Non-Agency MBS Agency CMBS and RMBS Loan Portfolio March 31, 2021 December 31, 2020 Chimera continues to focus on its Residential Credit portfolios Total Portfolio: $16.3 billion Total Portfolio: $17.1 billion

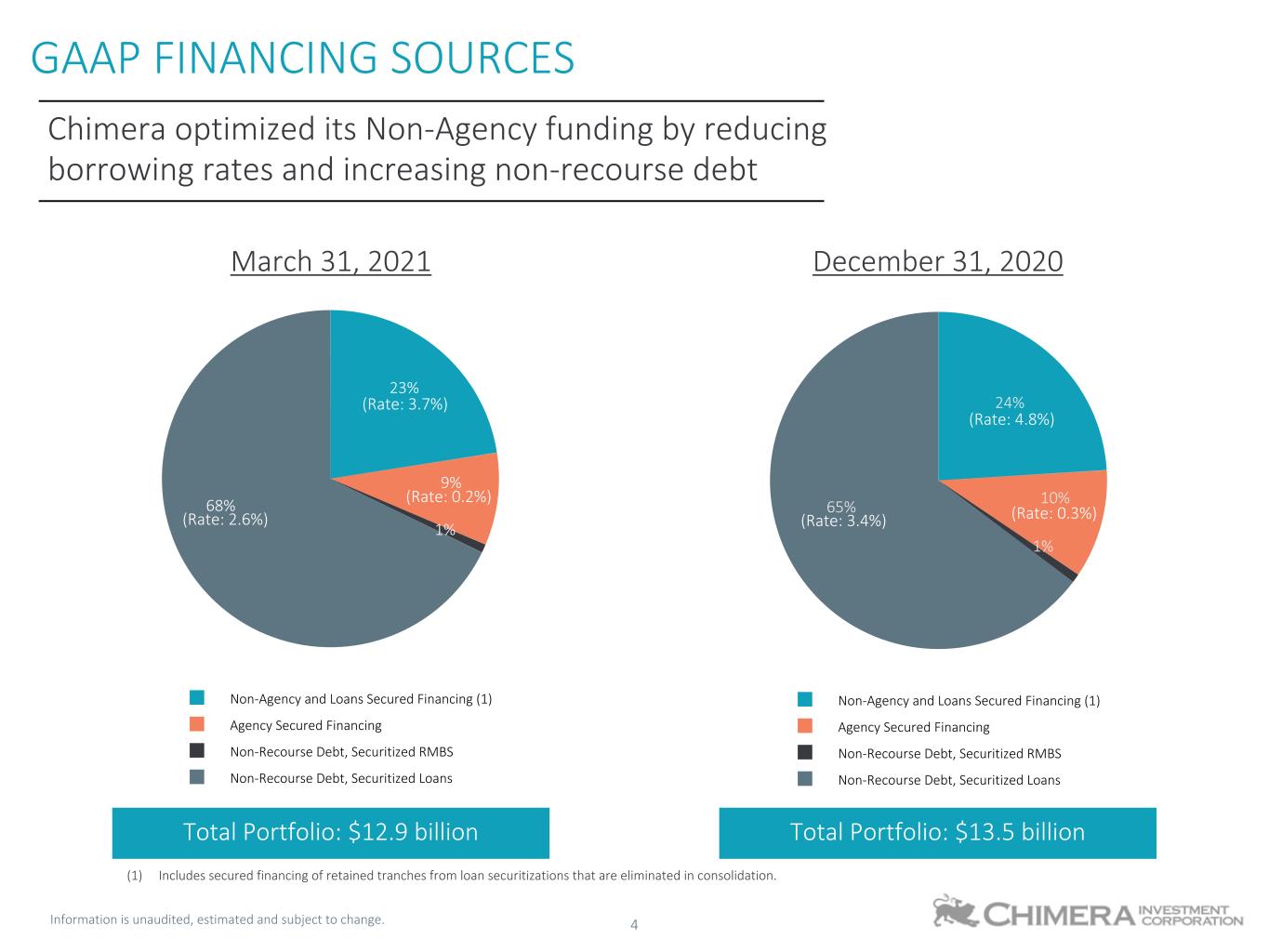

Information is unaudited, estimated and subject to change. 4 23% 9% 1% 68% Non-Agency and Loans Secured Financing (1) Agency Secured Financing Non-Recourse Debt, Securitized RMBS Non-Recourse Debt, Securitized Loans GAAP FINANCING SOURCES 24% 10% 1% 65% Non-Agency and Loans Secured Financing (1) Agency Secured Financing Non-Recourse Debt, Securitized RMBS Non-Recourse Debt, Securitized Loans (1) Includes secured financing of retained tranches from loan securitizations that are eliminated in consolidation. Chimera optimized its Non-Agency funding by reducing borrowing rates and increasing non-recourse debt March 31, 2021 December 31, 2020 Total Portfolio: $12.9 billion Total Portfolio: $13.5 billion (Rate: 2.6%) (Rate: 3.4%) (Rate: 0.2%) (Rate: 3.7%) (Rate: 0.3%) (Rate: 4.8%)

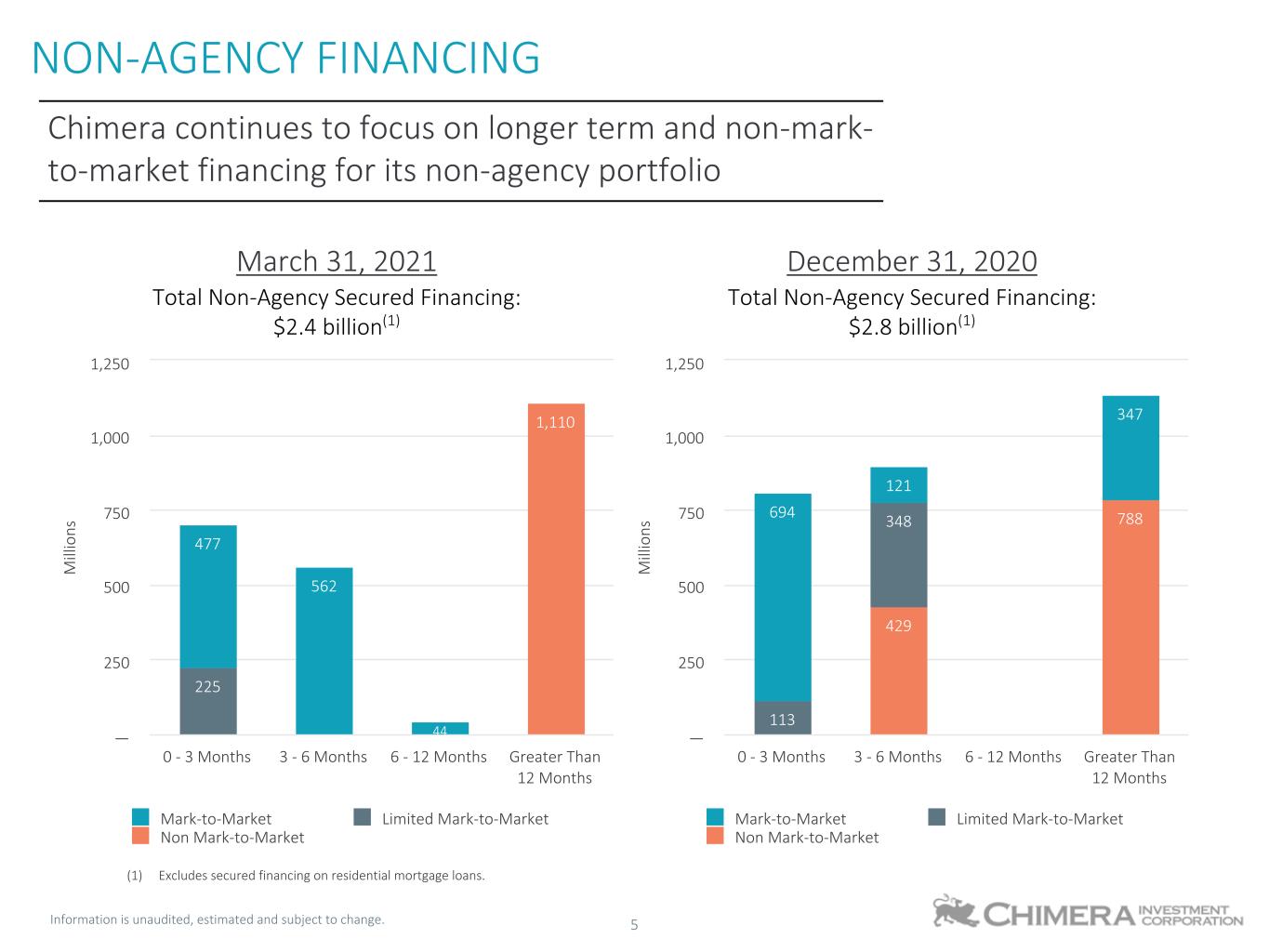

Information is unaudited, estimated and subject to change. 5 NON-AGENCY FINANCING Chimera continues to focus on longer term and non-mark- to-market financing for its non-agency portfolio M ill io ns 1,110 225 477 562 44 Mark-to-Market Limited Mark-to-Market Non Mark-to-Market 0 - 3 Months 3 - 6 Months 6 - 12 Months Greater Than 12 Months — 250 500 750 1,000 1,250 M ill io ns 429 788 113 348694 121 347 Mark-to-Market Limited Mark-to-Market Non Mark-to-Market 0 - 3 Months 3 - 6 Months 6 - 12 Months Greater Than 12 Months — 250 500 750 1,000 1,250 March 31, 2021 December 31, 2020 Total Non-Agency Secured Financing: $2.4 billion(1) Total Non-Agency Secured Financing: $2.8 billion(1) (1) Excludes secured financing on residential mortgage loans.

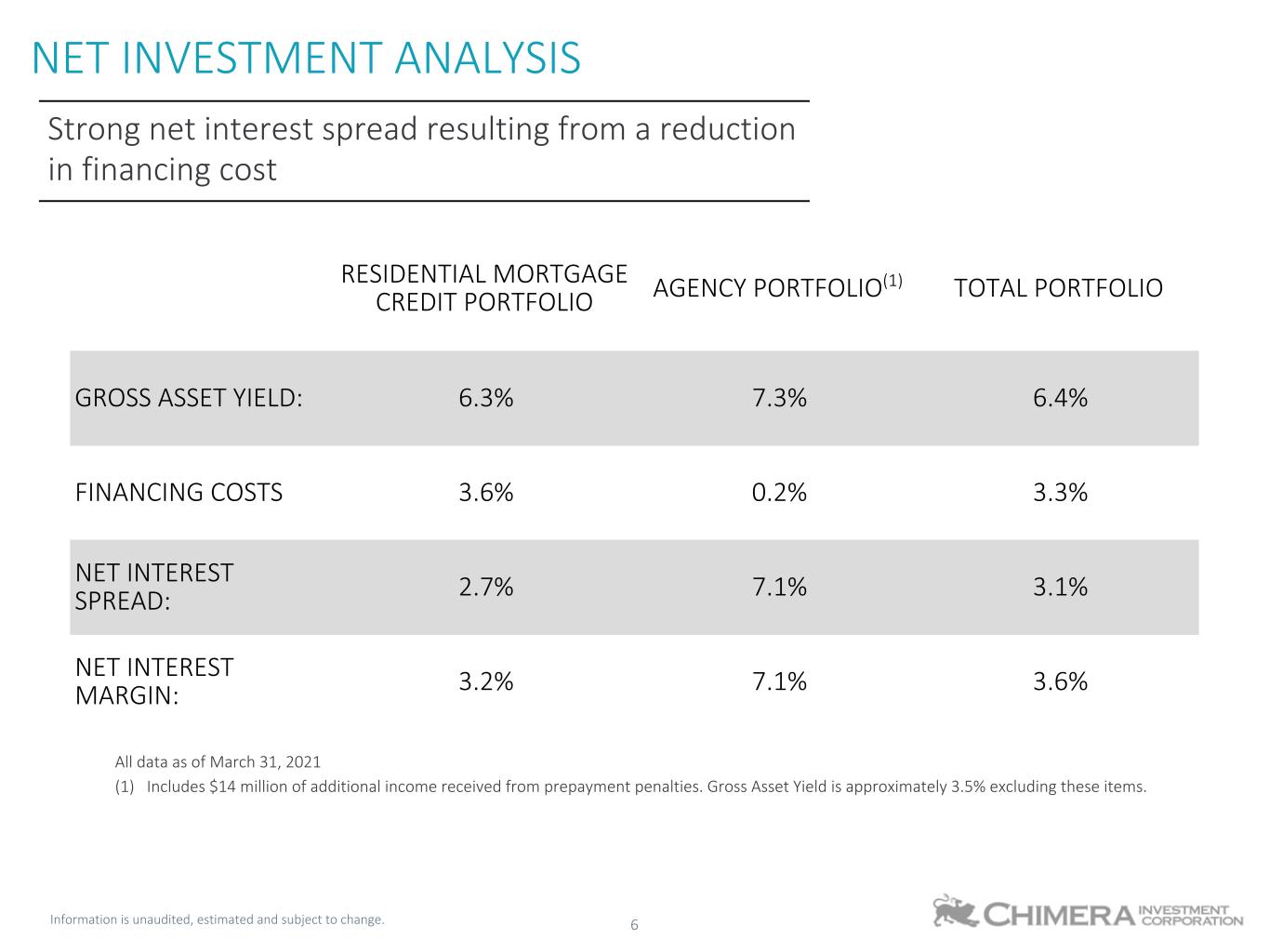

Information is unaudited, estimated and subject to change. 6 RESIDENTIAL MORTGAGE CREDIT PORTFOLIO AGENCY PORTFOLIO (1) TOTAL PORTFOLIO GROSS ASSET YIELD: 6.3% 7.3% 6.4% FINANCING COSTS 3.6% 0.2% 3.3% NET INTEREST SPREAD: 2.7% 7.1% 3.1% NET INTEREST MARGIN: 3.2% 7.1% 3.6% All data as of March 31, 2021 (1) Includes $14 million of additional income received from prepayment penalties. Gross Asset Yield is approximately 3.5% excluding these items. NET INVESTMENT ANALYSIS Strong net interest spread resulting from a reduction in financing cost

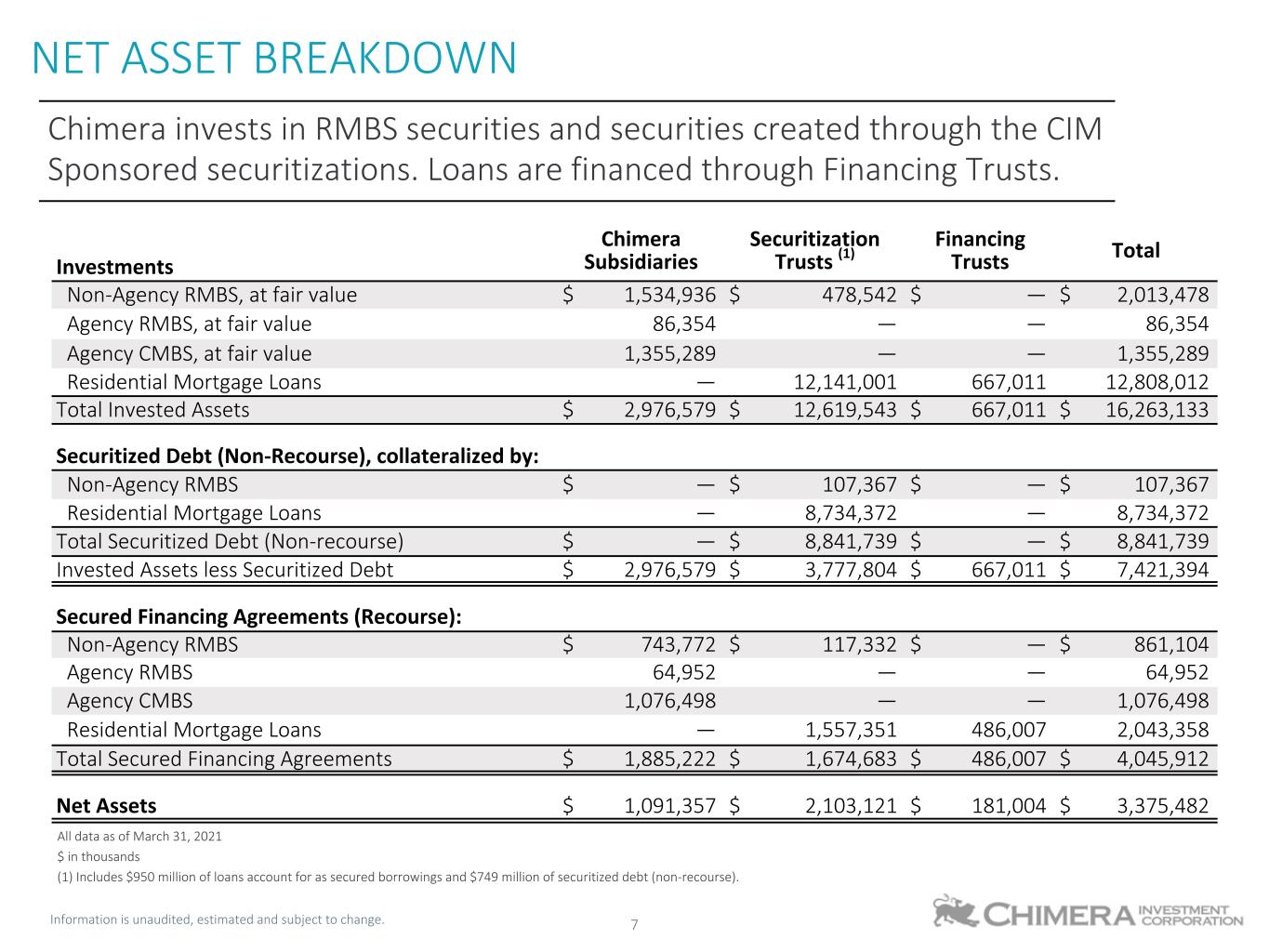

Information is unaudited, estimated and subject to change. 7 Chimera Subsidiaries Securitization Trusts (1) Financing Trusts TotalInvestments Non-Agency RMBS, at fair value $ 1,534,936 $ 478,542 $ — $ 2,013,478 Agency RMBS, at fair value 86,354 — — 86,354 Agency CMBS, at fair value 1,355,289 — — 1,355,289 Residential Mortgage Loans — 12,141,001 667,011 12,808,012 Total Invested Assets $ 2,976,579 $ 12,619,543 $ 667,011 $ 16,263,133 Securitized Debt (Non-Recourse), collateralized by: Non-Agency RMBS $ — $ 107,367 $ — $ 107,367 Residential Mortgage Loans — 8,734,372 — 8,734,372 Total Securitized Debt (Non-recourse) $ — $ 8,841,739 $ — $ 8,841,739 Invested Assets less Securitized Debt $ 2,976,579 $ 3,777,804 $ 667,011 $ 7,421,394 Secured Financing Agreements (Recourse): Non-Agency RMBS $ 743,772 $ 117,332 $ — $ 861,104 Agency RMBS 64,952 — — 64,952 Agency CMBS 1,076,498 — — 1,076,498 Residential Mortgage Loans — 1,557,351 486,007 2,043,358 Total Secured Financing Agreements $ 1,885,222 $ 1,674,683 $ 486,007 $ 4,045,912 Net Assets $ 1,091,357 $ 2,103,121 $ 181,004 $ 3,375,482 All data as of March 31, 2021 $ in thousands (1) Includes $950 million of loans account for as secured borrowings and $749 million of securitized debt (non-recourse). NET ASSET BREAKDOWN Chimera invests in RMBS securities and securities created through the CIM Sponsored securitizations. Loans are financed through Financing Trusts.

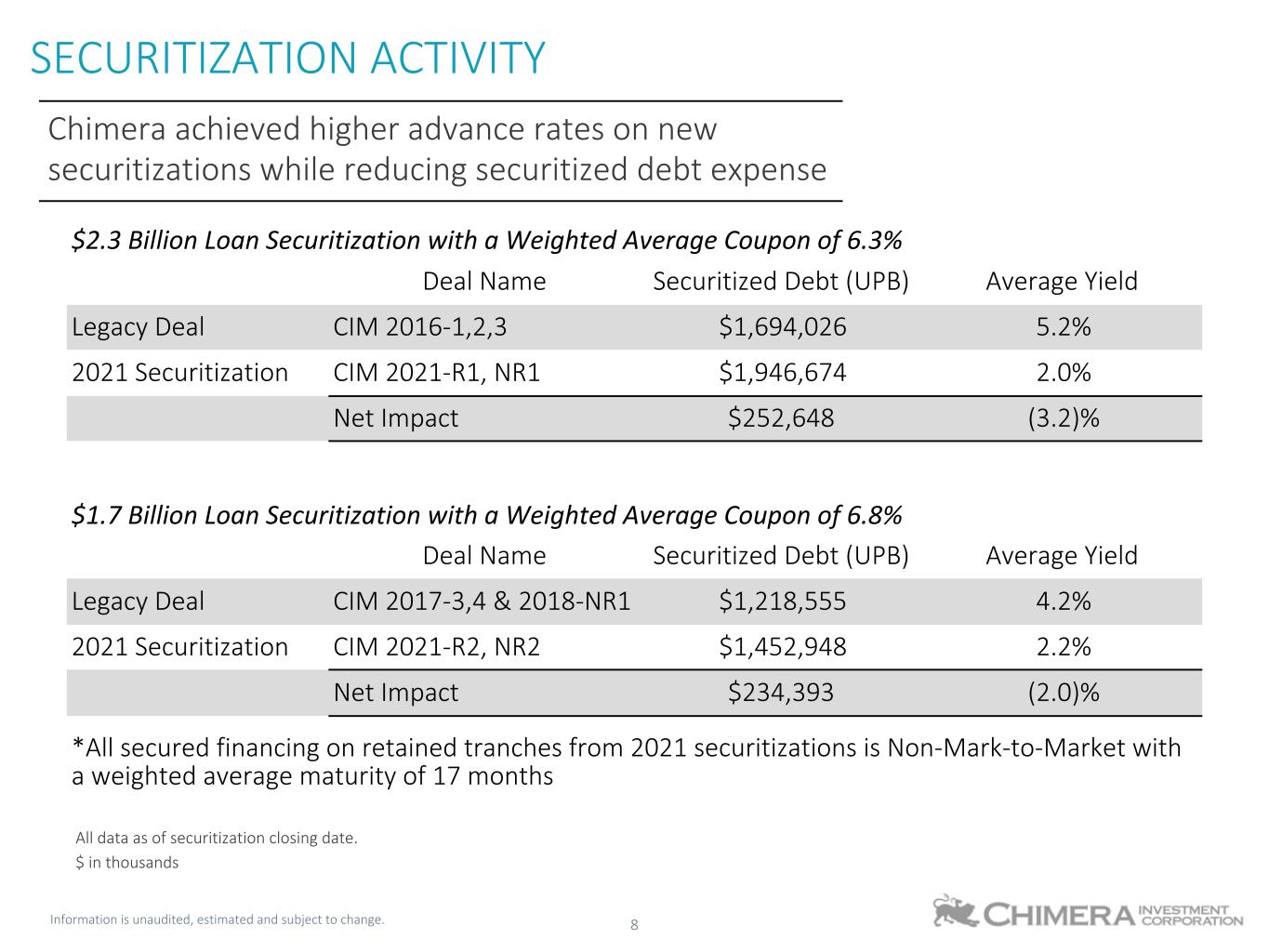

Information is unaudited, estimated and subject to change. 8 $2.3 Billion Loan Securitization with a Weighted Average Coupon of 6.3% Deal Name Securitized Debt (UPB) Average Yield Legacy Deal CIM 2016-1,2,3 $1,694,026 5.2% 2021 Securitization CIM 2021-R1, NR1 $1,946,674 2.0% Net Impact $252,648 (3.2)% $1.7 Billion Loan Securitization with a Weighted Average Coupon of 6.8% Deal Name Securitized Debt (UPB) Average Yield Legacy Deal CIM 2017-3,4 & 2018-NR1 $1,218,555 4.2% 2021 Securitization CIM 2021-R2, NR2 $1,452,948 2.2% Net Impact $234,393 (2.0)% *All secured financing on retained tranches from 2021 securitizations is Non-Mark-to-Market with a weighted average maturity of 17 months SECURITIZATION ACTIVITY Chimera achieved higher advance rates on new securitizations while reducing securitized debt expense All data as of securitization closing date. $ in thousands

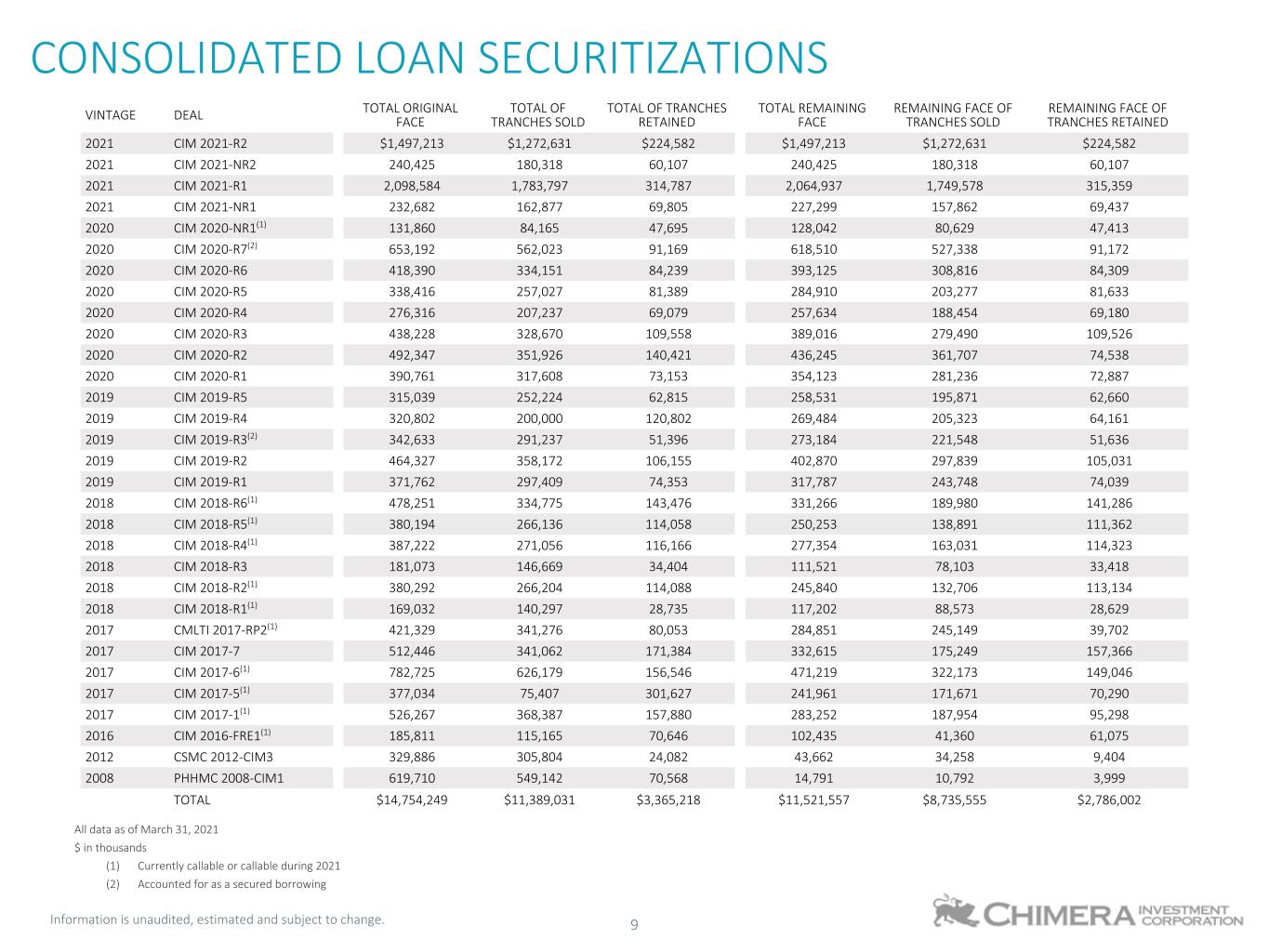

Information is unaudited, estimated and subject to change. 9 VINTAGE DEAL TOTAL ORIGINAL FACE TOTAL OF TRANCHES SOLD TOTAL OF TRANCHES RETAINED TOTAL REMAINING FACE REMAINING FACE OF TRANCHES SOLD REMAINING FACE OF TRANCHES RETAINED 2021 CIM 2021-R2 $1,497,213 $1,272,631 $224,582 $1,497,213 $1,272,631 $224,582 2021 CIM 2021-NR2 240,425 180,318 60,107 240,425 180,318 60,107 2021 CIM 2021-R1 2,098,584 1,783,797 314,787 2,064,937 1,749,578 315,359 2021 CIM 2021-NR1 232,682 162,877 69,805 227,299 157,862 69,437 2020 CIM 2020-NR1(1) 131,860 84,165 47,695 128,042 80,629 47,413 2020 CIM 2020-R7(2) 653,192 562,023 91,169 618,510 527,338 91,172 2020 CIM 2020-R6 418,390 334,151 84,239 393,125 308,816 84,309 2020 CIM 2020-R5 338,416 257,027 81,389 284,910 203,277 81,633 2020 CIM 2020-R4 276,316 207,237 69,079 257,634 188,454 69,180 2020 CIM 2020-R3 438,228 328,670 109,558 389,016 279,490 109,526 2020 CIM 2020-R2 492,347 351,926 140,421 436,245 361,707 74,538 2020 CIM 2020-R1 390,761 317,608 73,153 354,123 281,236 72,887 2019 CIM 2019-R5 315,039 252,224 62,815 258,531 195,871 62,660 2019 CIM 2019-R4 320,802 200,000 120,802 269,484 205,323 64,161 2019 CIM 2019-R3(2) 342,633 291,237 51,396 273,184 221,548 51,636 2019 CIM 2019-R2 464,327 358,172 106,155 402,870 297,839 105,031 2019 CIM 2019-R1 371,762 297,409 74,353 317,787 243,748 74,039 2018 CIM 2018-R6(1) 478,251 334,775 143,476 331,266 189,980 141,286 2018 CIM 2018-R5(1) 380,194 266,136 114,058 250,253 138,891 111,362 2018 CIM 2018-R4(1) 387,222 271,056 116,166 277,354 163,031 114,323 2018 CIM 2018-R3 181,073 146,669 34,404 111,521 78,103 33,418 2018 CIM 2018-R2(1) 380,292 266,204 114,088 245,840 132,706 113,134 2018 CIM 2018-R1(1) 169,032 140,297 28,735 117,202 88,573 28,629 2017 CMLTI 2017-RP2(1) 421,329 341,276 80,053 284,851 245,149 39,702 2017 CIM 2017-7 512,446 341,062 171,384 332,615 175,249 157,366 2017 CIM 2017-6(1) 782,725 626,179 156,546 471,219 322,173 149,046 2017 CIM 2017-5(1) 377,034 75,407 301,627 241,961 171,671 70,290 2017 CIM 2017-1(1) 526,267 368,387 157,880 283,252 187,954 95,298 2016 CIM 2016-FRE1(1) 185,811 115,165 70,646 102,435 41,360 61,075 2012 CSMC 2012-CIM3 329,886 305,804 24,082 43,662 34,258 9,404 2008 PHHMC 2008-CIM1 619,710 549,142 70,568 14,791 10,792 3,999 TOTAL $14,754,249 $11,389,031 $3,365,218 $11,521,557 $8,735,555 $2,786,002 All data as of March 31, 2021 $ in thousands (1) Currently callable or callable during 2021 (2) Accounted for as a secured borrowing CONSOLIDATED LOAN SECURITIZATIONS

chimerareit.com