EX-99.2

Published on November 3, 2021

FINANCIAL SUPPLEMENT 3rd Quarter 2021

Information is unaudited, estimated and subject to change. DISCLAIMER This presentation includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, readers should not rely on these forward-looking statements as predictions of future events. Words such as “goal” “expect,” “target,” “assume,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believe,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause actual results to differ materially from expected results, including, among other things, those described in our most recent Annual Report on Form 10-K, and any subsequent Quarterly Reports on Form 10-Q and Current Report on Form 8-K, under the caption “Risk Factors.” Factors that could cause actual results to differ include, but are not limited to:our business and investment strategy; our ability to accurately forecast the payment of future dividends on our common and preferred stock, and the amount of such dividends; our ability to determine accurately the fair market value of our assets; availability of investment opportunities in real estate-related and other securities, including our valuation of potential opportunities that may arise as a result of current and future market dislocations; effect of the novel coronavirus (or COVID-19) pandemic on real estate market, financial markets and our Company, including the impact on the value, availability, financing and liquidity of mortgage assets; how COVID-19 may affect us, our operations and our personnel; our expected investments; changes in the value of our investments, including negative changes resulting in margin calls related to the financing of our assets; changes in interest rates and mortgage prepayment rates; prepayments of the mortgage and other loans underlying our mortgage-backed securities, or RMBS, or other asset-backed securities, or ABS; rates of default, delinquencies or decreased recovery rates on our investments; general volatility of the securities markets in which we invest; our ability to maintain existing financing arrangements and our ability to obtain future financing arrangements; our ability to effect our strategy to securitize residential mortgage loans; interest rate mismatches between our investments and our borrowings used to finance such purchases; effects of interest rate caps on our adjustable-rate investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the impact of and changes to various government programs, including in response to COVID-19; impact of and changes in governmental regulations, tax law and rates, accounting guidance, and similar matters; market trends in our industry, interest rates, the debt securities markets or the general economy; estimates relating to our ability to make distributions to our stockholders in the future; our understanding of our competition; availability of qualified personnel; our ability to maintain our classification as a real estate investment trust, or, REIT, for U.S. federal income tax purposes; our ability to maintain our exemption from registration under the Investment Company Act of 1940, as amended, or 1940 Act; our expectations regarding materiality or significance; and the effectiveness of our disclosure controls and procedures. Readers are cautioned not to place undue reliance upon any forward-looking statements, which speak only as of the date made. Chimera does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Additional information concerning these and other risk factors is contained in Chimera’s most recent filings with the Securities and Exchange Commission (SEC). All subsequent written and oral forward-looking statements concerning Chimera or matters attributable to Chimera or any person acting on its behalf are expressly qualified in their entirety by the cautionary statements above. This presentation may include industry and market data obtained through research, surveys, and studies conducted by third parties and industry publications. We have not independently verified any such market and industry data from third-party sources. This presentation is provided for discussion purposes only and may not be relied upon as legal or investment advice, nor is it intended to be inclusive of all the risks and uncertainties that should be considered. This presentation does not constitute an offer to purchase or sell any securities, nor shall it be construed to be indicative of the terms of an offer that the parties or their respective affiliates would accept. Readers are advised that the financial information in this presentation is based on company data available at the time of this presentation and, in certain circumstances, may not have been audited by the company’s independent auditors.

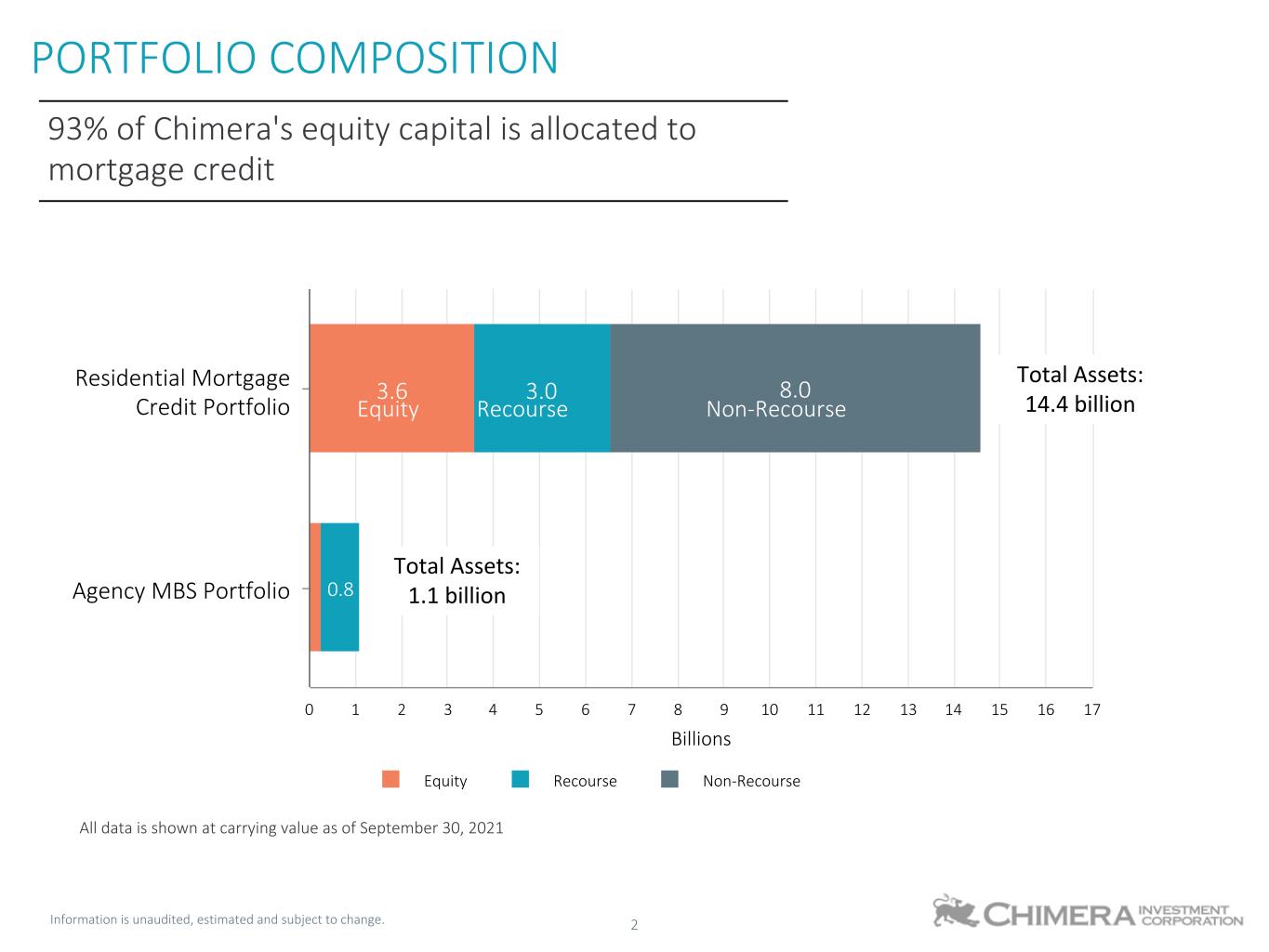

Information is unaudited, estimated and subject to change. 2 PORTFOLIO COMPOSITION 93% of Chimera's equity capital is allocated to mortgage credit Billions 3.6 3.0 0.8 8.0 Equity Recourse Non-Recourse Residential Mortgage Credit Portfolio Agency MBS Portfolio 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 Total Assets: 14.4 billion Total Assets: 1.1 billion All data is shown at carrying value as of September 30, 2021 Equity Recourse Non-Recourse

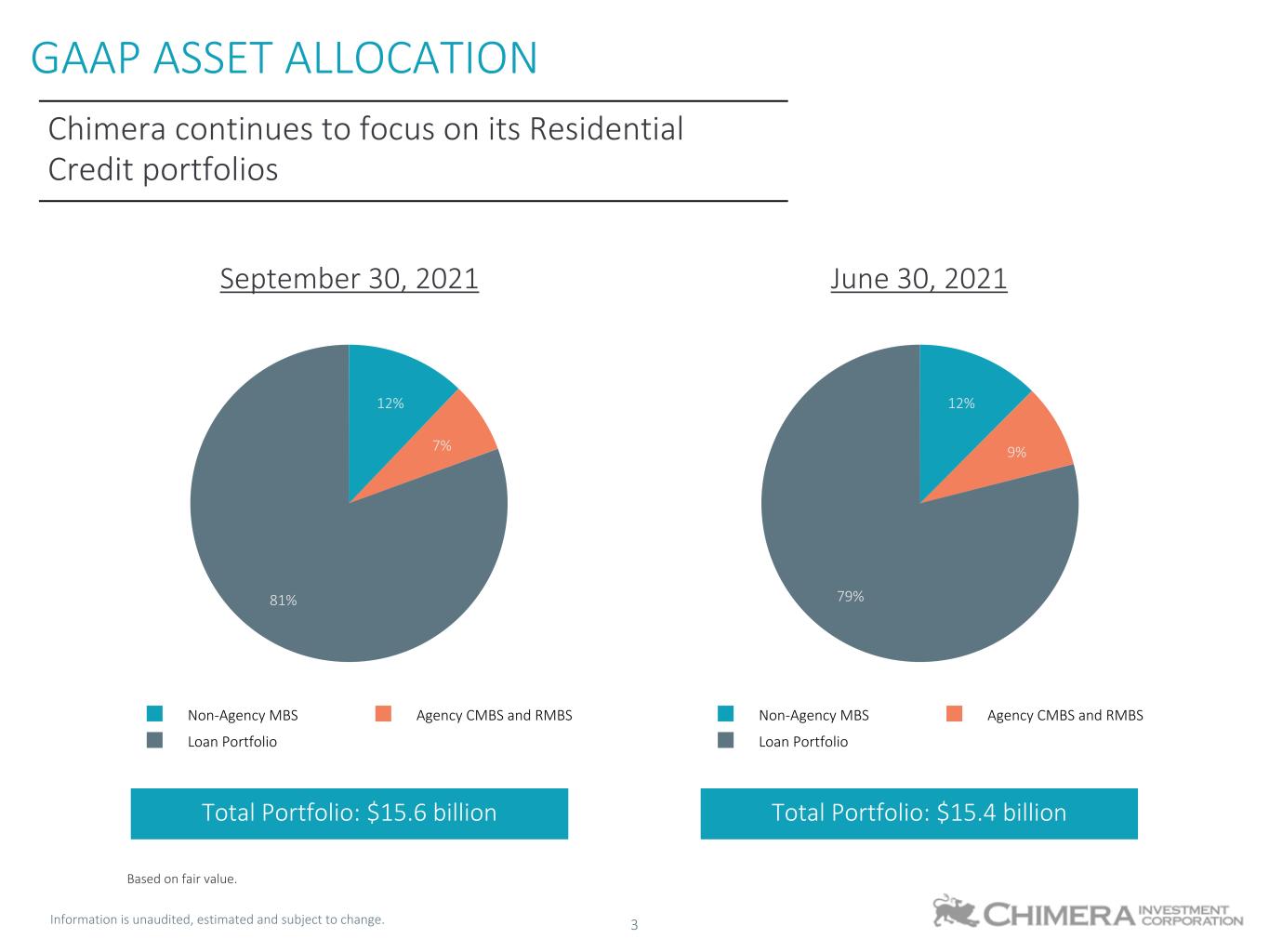

Information is unaudited, estimated and subject to change. 3 12% 7% 81% Non-Agency MBS Agency CMBS and RMBS Loan Portfolio GAAP ASSET ALLOCATION Based on fair value. 12% 9% 79% Non-Agency MBS Agency CMBS and RMBS Loan Portfolio September 30, 2021 June 30, 2021 Chimera continues to focus on its Residential Credit portfolios Total Portfolio: $15.6 billion Total Portfolio: $15.4 billion

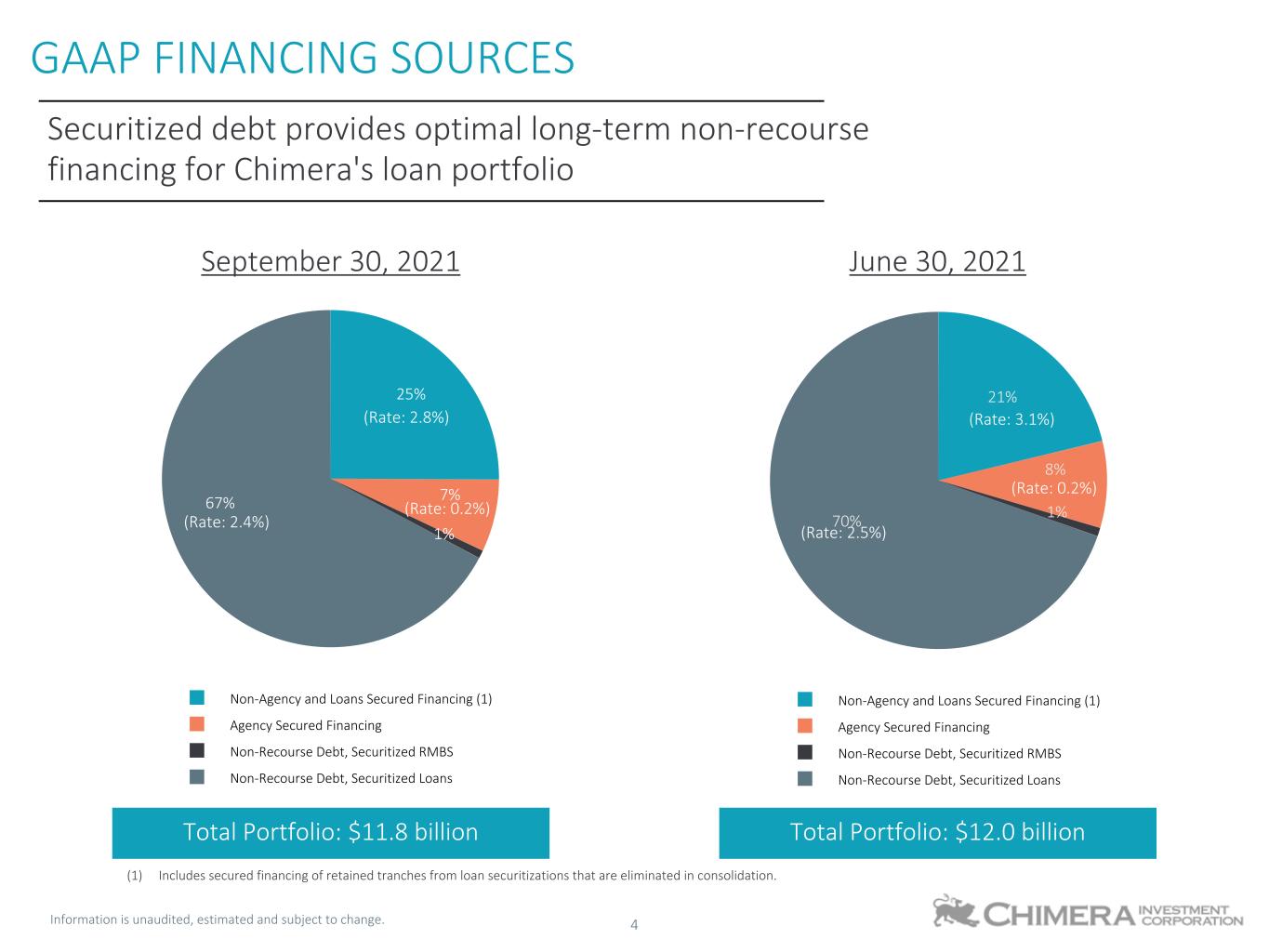

Information is unaudited, estimated and subject to change. 4 25% 7% 1% 67% Non-Agency and Loans Secured Financing (1) Agency Secured Financing Non-Recourse Debt, Securitized RMBS Non-Recourse Debt, Securitized Loans GAAP FINANCING SOURCES 21% 8% 1%70% Non-Agency and Loans Secured Financing (1) Agency Secured Financing Non-Recourse Debt, Securitized RMBS Non-Recourse Debt, Securitized Loans (1) Includes secured financing of retained tranches from loan securitizations that are eliminated in consolidation. Securitized debt provides optimal long-term non-recourse financing for Chimera's loan portfolio September 30, 2021 June 30, 2021 Total Portfolio: $11.8 billion Total Portfolio: $12.0 billion (Rate: 2.4%) (Rate: 2.5%) (Rate: 0.2%) (Rate: 2.8%) (Rate: 0.2%) (Rate: 3.1%)

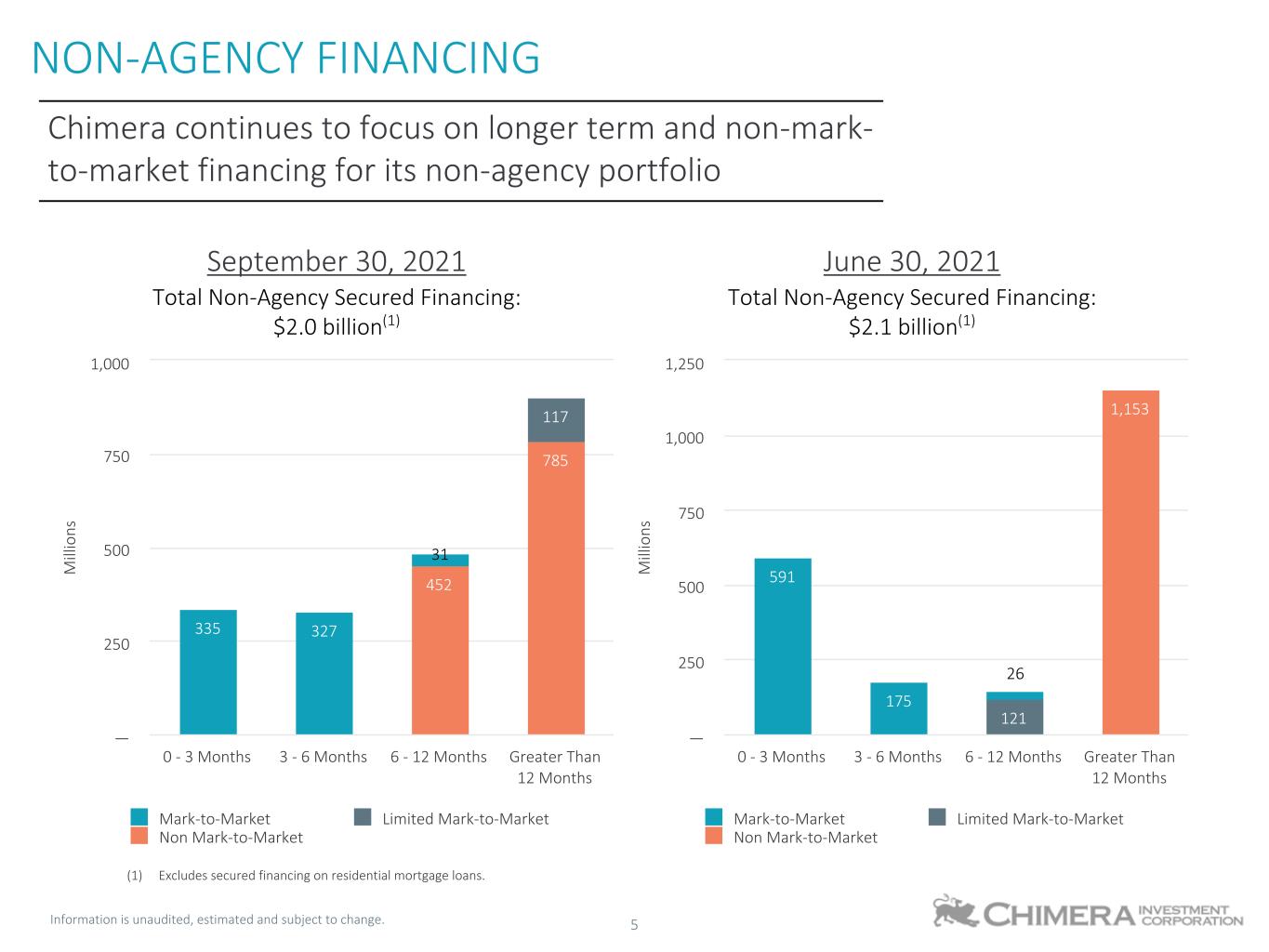

Information is unaudited, estimated and subject to change. 5 NON-AGENCY FINANCING Chimera continues to focus on longer term and non-mark- to-market financing for its non-agency portfolio M ill io ns 452 785 — — 117 335 327 31 Mark-to-Market Limited Mark-to-Market Non Mark-to-Market 0 - 3 Months 3 - 6 Months 6 - 12 Months Greater Than 12 Months — 250 500 750 1,000 M ill io ns 1,153 — 121 591 175 Mark-to-Market Limited Mark-to-Market Non Mark-to-Market 0 - 3 Months 3 - 6 Months 6 - 12 Months Greater Than 12 Months — 250 500 750 1,000 1,250 September 30, 2021 June 30, 2021 Total Non-Agency Secured Financing: $2.0 billion(1) Total Non-Agency Secured Financing: $2.1 billion(1) (1) Excludes secured financing on residential mortgage loans. 26

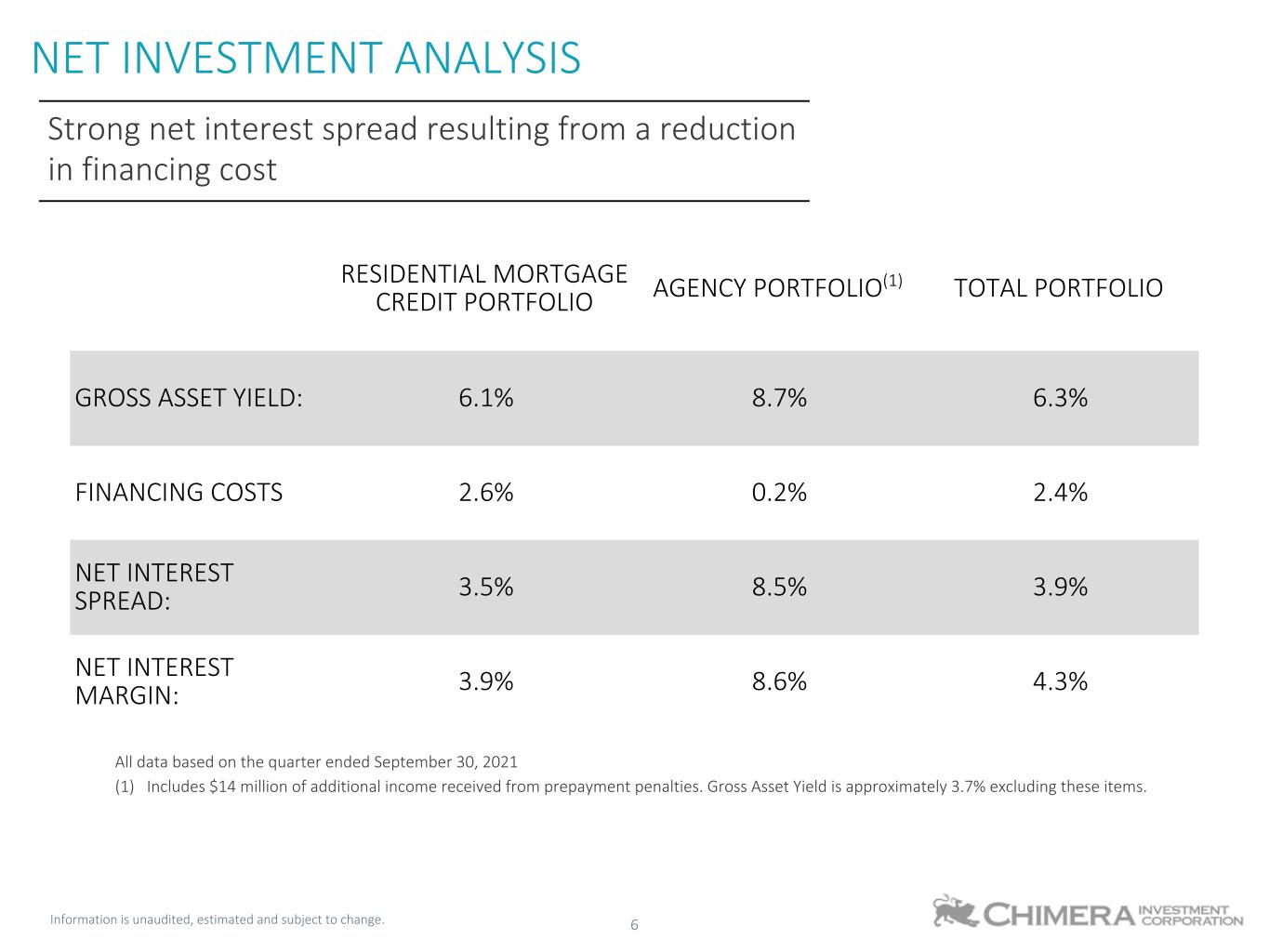

Information is unaudited, estimated and subject to change. 6 RESIDENTIAL MORTGAGE CREDIT PORTFOLIO AGENCY PORTFOLIO(1) TOTAL PORTFOLIO GROSS ASSET YIELD: 6.1% 8.7% 6.3% FINANCING COSTS 2.6% 0.2% 2.4% NET INTEREST SPREAD: 3.5% 8.5% 3.9% NET INTEREST MARGIN: 3.9% 8.6% 4.3% All data based on the quarter ended September 30, 2021 (1) Includes $14 million of additional income received from prepayment penalties. Gross Asset Yield is approximately 3.7% excluding these items. NET INVESTMENT ANALYSIS Strong net interest spread resulting from a reduction in financing cost

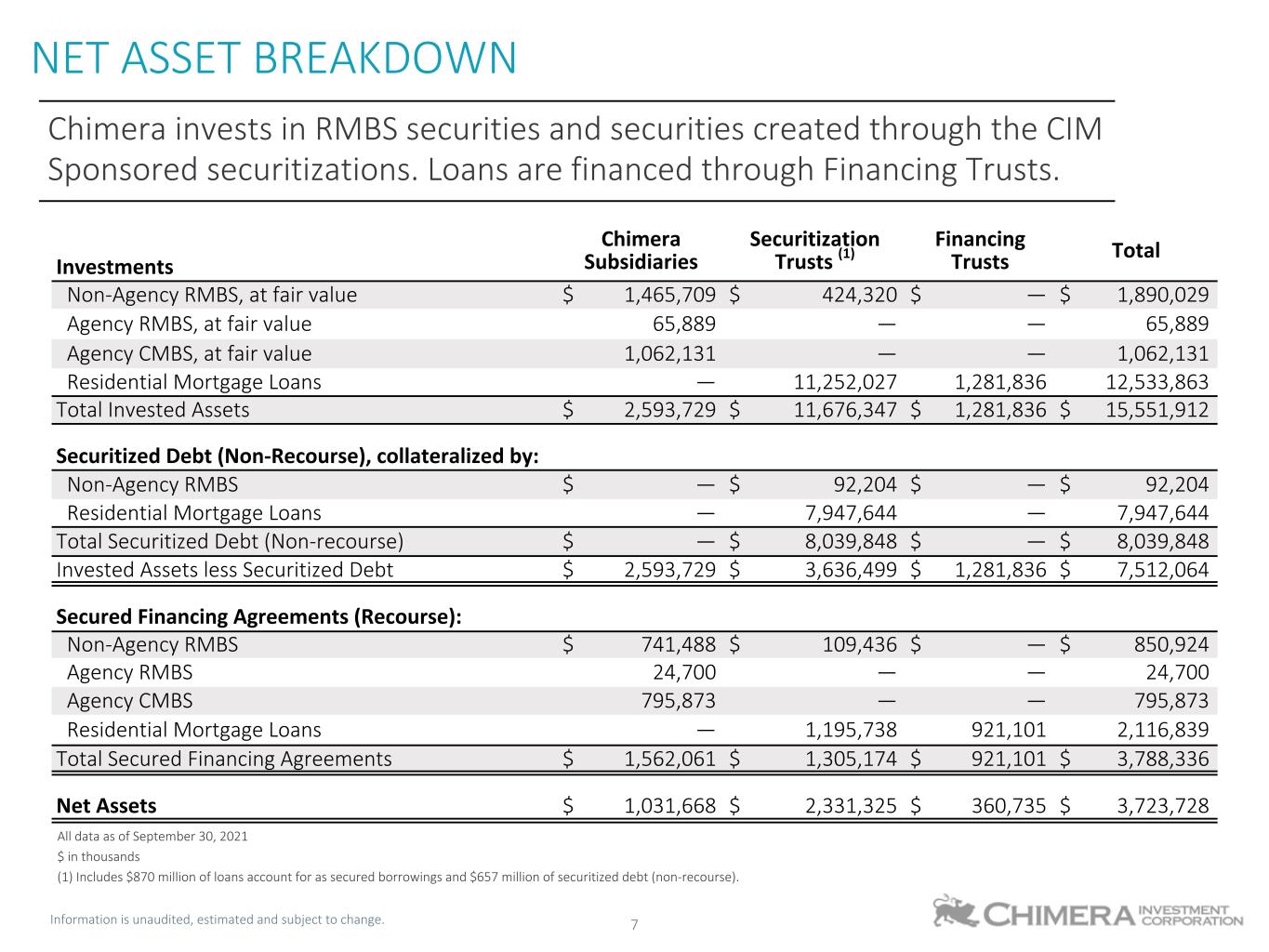

Information is unaudited, estimated and subject to change. 7 Chimera Subsidiaries Securitization Trusts (1) Financing Trusts Total Investments Non-Agency RMBS, at fair value $ 1,465,709 $ 424,320 $ — $ 1,890,029 Agency RMBS, at fair value 65,889 — — 65,889 Agency CMBS, at fair value 1,062,131 — — 1,062,131 Residential Mortgage Loans — 11,252,027 1,281,836 12,533,863 Total Invested Assets $ 2,593,729 $ 11,676,347 $ 1,281,836 $ 15,551,912 Securitized Debt (Non-Recourse), collateralized by: Non-Agency RMBS $ — $ 92,204 $ — $ 92,204 Residential Mortgage Loans — 7,947,644 — 7,947,644 Total Securitized Debt (Non-recourse) $ — $ 8,039,848 $ — $ 8,039,848 Invested Assets less Securitized Debt $ 2,593,729 $ 3,636,499 $ 1,281,836 $ 7,512,064 Secured Financing Agreements (Recourse): Non-Agency RMBS $ 741,488 $ 109,436 $ — $ 850,924 Agency RMBS 24,700 — — 24,700 Agency CMBS 795,873 — — 795,873 Residential Mortgage Loans — 1,195,738 921,101 2,116,839 Total Secured Financing Agreements $ 1,562,061 $ 1,305,174 $ 921,101 $ 3,788,336 Net Assets $ 1,031,668 $ 2,331,325 $ 360,735 $ 3,723,728 All data as of September 30, 2021 $ in thousands (1) Includes $870 million of loans account for as secured borrowings and $657 million of securitized debt (non-recourse). NET ASSET BREAKDOWN Chimera invests in RMBS securities and securities created through the CIM Sponsored securitizations. Loans are financed through Financing Trusts.

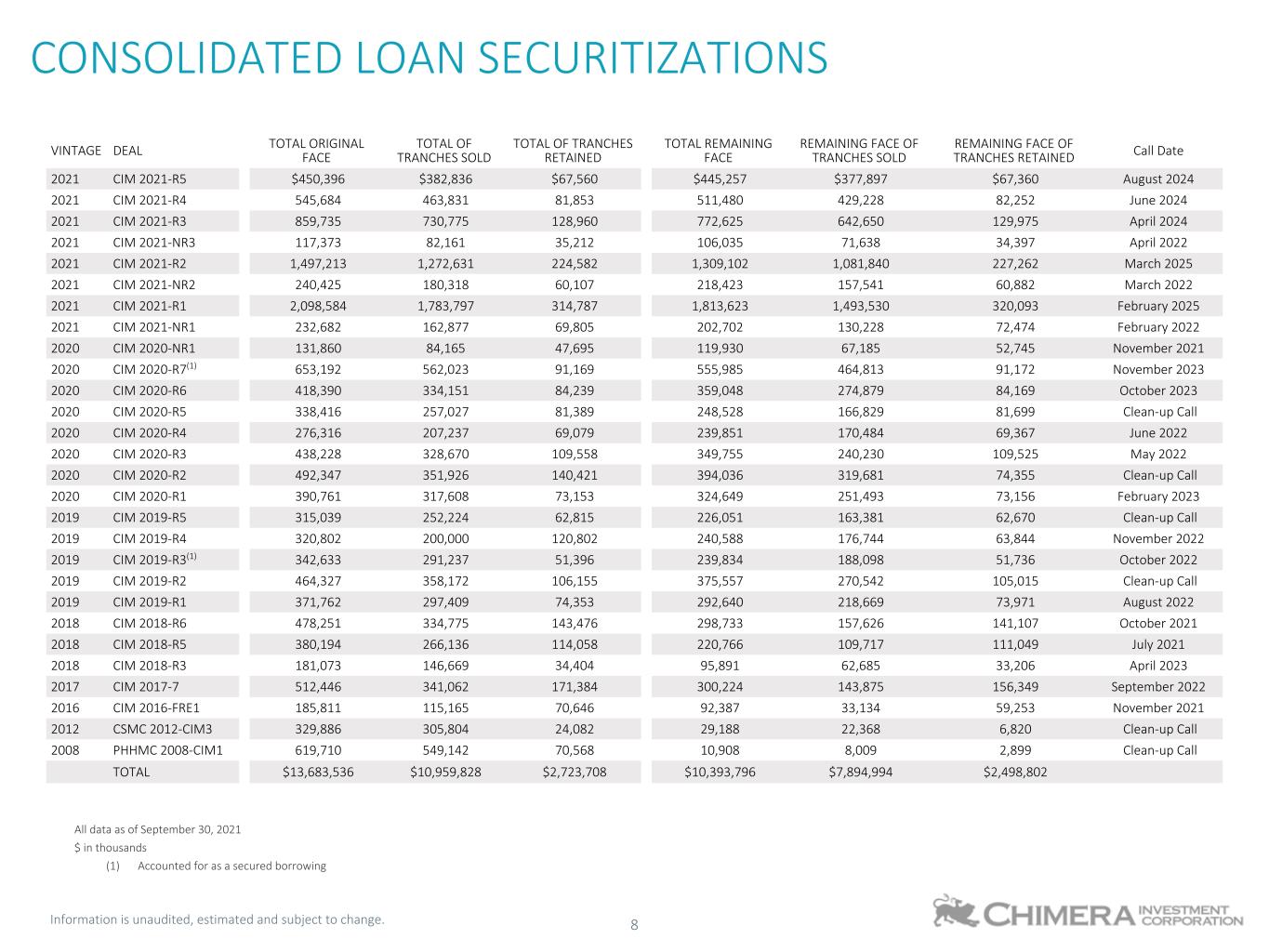

Information is unaudited, estimated and subject to change. 8 VINTAGE DEAL TOTAL ORIGINAL FACE TOTAL OF TRANCHES SOLD TOTAL OF TRANCHES RETAINED TOTAL REMAINING FACE REMAINING FACE OF TRANCHES SOLD REMAINING FACE OF TRANCHES RETAINED Call Date 2021 CIM 2021-R5 $450,396 $382,836 $67,560 $445,257 $377,897 $67,360 August 2024 2021 CIM 2021-R4 545,684 463,831 81,853 511,480 429,228 82,252 June 2024 2021 CIM 2021-R3 859,735 730,775 128,960 772,625 642,650 129,975 April 2024 2021 CIM 2021-NR3 117,373 82,161 35,212 106,035 71,638 34,397 April 2022 2021 CIM 2021-R2 1,497,213 1,272,631 224,582 1,309,102 1,081,840 227,262 March 2025 2021 CIM 2021-NR2 240,425 180,318 60,107 218,423 157,541 60,882 March 2022 2021 CIM 2021-R1 2,098,584 1,783,797 314,787 1,813,623 1,493,530 320,093 February 2025 2021 CIM 2021-NR1 232,682 162,877 69,805 202,702 130,228 72,474 February 2022 2020 CIM 2020-NR1 131,860 84,165 47,695 119,930 67,185 52,745 November 2021 2020 CIM 2020-R7(1) 653,192 562,023 91,169 555,985 464,813 91,172 November 2023 2020 CIM 2020-R6 418,390 334,151 84,239 359,048 274,879 84,169 October 2023 2020 CIM 2020-R5 338,416 257,027 81,389 248,528 166,829 81,699 Clean-up Call 2020 CIM 2020-R4 276,316 207,237 69,079 239,851 170,484 69,367 June 2022 2020 CIM 2020-R3 438,228 328,670 109,558 349,755 240,230 109,525 May 2022 2020 CIM 2020-R2 492,347 351,926 140,421 394,036 319,681 74,355 Clean-up Call 2020 CIM 2020-R1 390,761 317,608 73,153 324,649 251,493 73,156 February 2023 2019 CIM 2019-R5 315,039 252,224 62,815 226,051 163,381 62,670 Clean-up Call 2019 CIM 2019-R4 320,802 200,000 120,802 240,588 176,744 63,844 November 2022 2019 CIM 2019-R3(1) 342,633 291,237 51,396 239,834 188,098 51,736 October 2022 2019 CIM 2019-R2 464,327 358,172 106,155 375,557 270,542 105,015 Clean-up Call 2019 CIM 2019-R1 371,762 297,409 74,353 292,640 218,669 73,971 August 2022 2018 CIM 2018-R6 478,251 334,775 143,476 298,733 157,626 141,107 October 2021 2018 CIM 2018-R5 380,194 266,136 114,058 220,766 109,717 111,049 July 2021 2018 CIM 2018-R3 181,073 146,669 34,404 95,891 62,685 33,206 April 2023 2017 CIM 2017-7 512,446 341,062 171,384 300,224 143,875 156,349 September 2022 2016 CIM 2016-FRE1 185,811 115,165 70,646 92,387 33,134 59,253 November 2021 2012 CSMC 2012-CIM3 329,886 305,804 24,082 29,188 22,368 6,820 Clean-up Call 2008 PHHMC 2008-CIM1 619,710 549,142 70,568 10,908 8,009 2,899 Clean-up Call TOTAL $13,683,536 $10,959,828 $2,723,708 $10,393,796 $7,894,994 $2,498,802 All data as of September 30, 2021 $ in thousands (1) Accounted for as a secured borrowing CONSOLIDATED LOAN SECURITIZATIONS

chimerareit.com