EXHIBIT 99.1

Published on May 31, 2017

Exhibit 99.1

Annual Meeting 2017 June 2017

DISCLAIMER This material is not intended to be exhaustive, is preliminary in nature and may be subject to change. In addition, much of the information contained herein is based on various assumptions (some of which are beyond the control of Chimera Investment Corporation, the “Company”) and may be identified by reference to a future period or periods or by the use of forward-looking terminology, such as “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” “would,” “projected,” “tends,” “will” or similar expressions, or variations on those terms or the negative of those terms. The Company’s forward-looking statements are subject to numerous risks, uncertainties and other factors. You should review some of these factors that are described under the caption “Risk Factors” in our 2016 Form 10-K. Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise from time to time, and it is impossible for us to predict those events or how they may affect us. Except as required by law, we are not obligated to, and do not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Furthermore, none of the financial information contained in this material has been audited or approved by the Company’s independent registered public accounting firm.

Chimera is a residential mortgage REIT Information is unaudited, estimated and subject to change. Chimera develops and manages a portfolio of leveraged mortgage investments to produce an attractive quarterly dividend for shareholders All data as of March 31, 2017 Established in 2007Total Capital $3.5 Billion Total Portfolio $20.0 Billion Common Stock Price $20.18/ Dividend Yield 9.91%8.00% Fixed Series A Preferred Stock Price $25.17 8.00% Variable Series B Preferred Stock Price $25.39 3

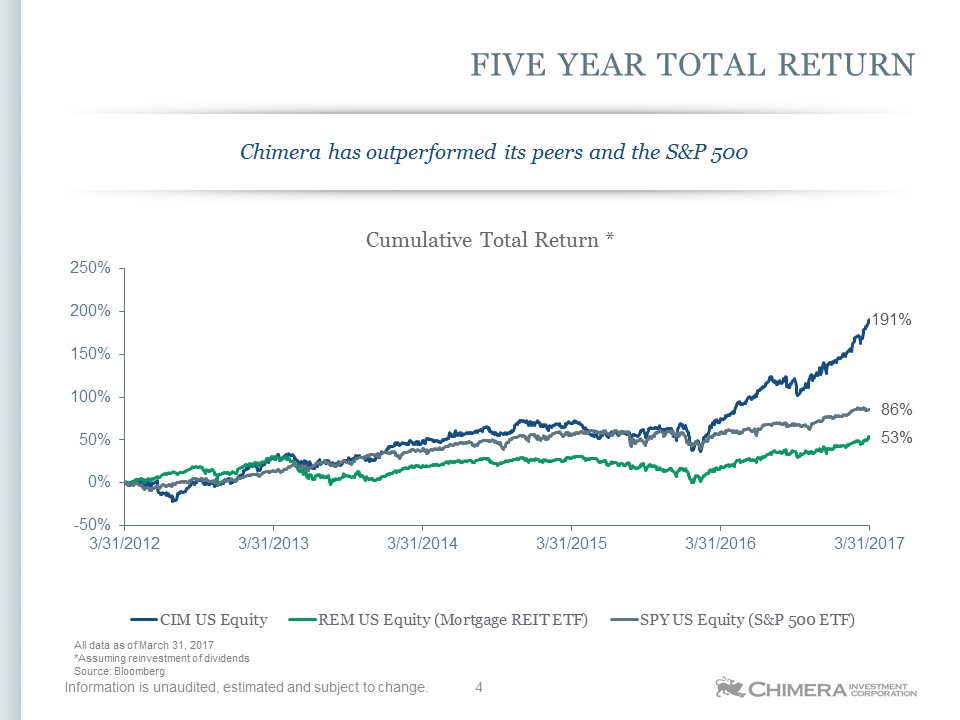

Five Year Total Return Information is unaudited, estimated and subject to change. Chimera has outperformed its peers and the S&P 500 All data as of March 31, 2017*Assuming reinvestment of dividendsSource: Bloomberg 4

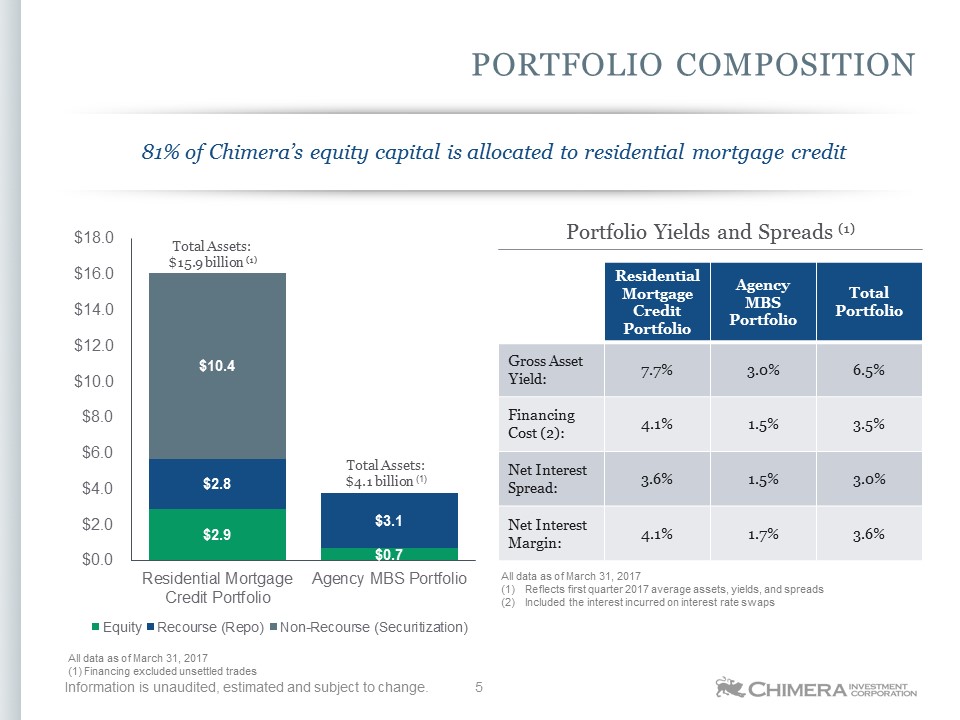

Portfolio Composition Information is unaudited, estimated and subject to change. 81% of Chimera’s equity capital is allocated to residential mortgage credit Total Assets: $15.9 billion (1) Total Assets: $4.1 billion (1) All data as of March 31, 2017(1) Financing excluded unsettled trades Residential Mortgage Credit Portfolio Agency MBS Portfolio Total Portfolio Gross Asset Yield: 7.7% 3.0% 6.5% Financing Cost (2): 4.1% 1.5% 3.5% Net Interest Spread: 3.6% 1.5% 3.0% Net Interest Margin: 4.1% 1.7% 3.6% All data as of March 31, 2017Reflects first quarter 2017 average assets, yields, and spreadsIncluded the interest incurred on interest rate swaps Portfolio Yields and Spreads (1) 5

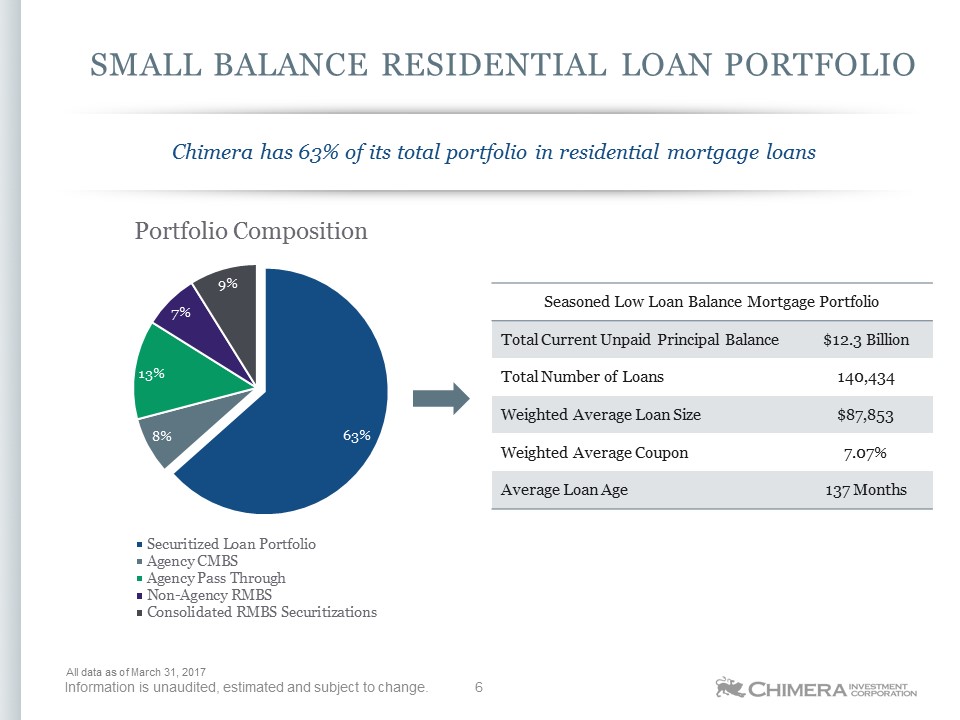

Small balance residential loan portfolio Information is unaudited, estimated and subject to change. Chimera has 63% of its total portfolio in residential mortgage loans All data as of March 31, 2017 Seasoned Low Loan Balance Mortgage Portfolio Total Current Unpaid Principal Balance $12.3 Billion Total Number of Loans 140,434 Weighted Average Loan Size $87,853 Weighted Average Coupon 7.07% Average Loan Age 137 Months 6

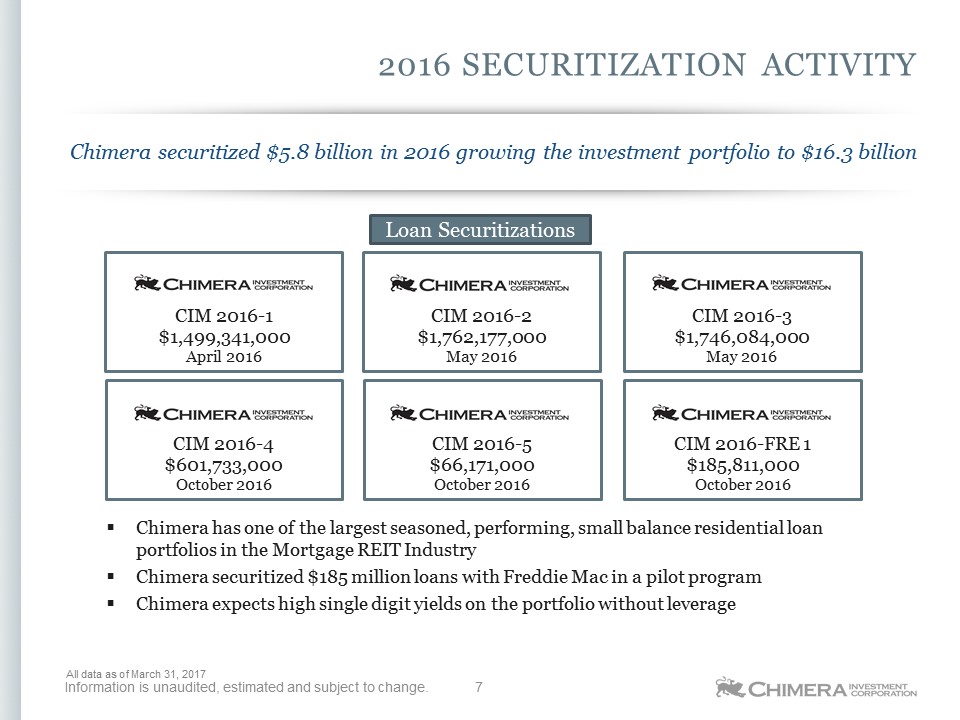

2016 Securitization Activity Information is unaudited, estimated and subject to change. Chimera securitized $5.8 billion in 2016 growing the investment portfolio to $16.3 billion Liquidation Preference $25.00 per share Loan Securitizations All data as of March 31, 2017 Chimera has one of the largest seasoned, performing, small balance residential loan portfolios in the Mortgage REIT IndustryChimera securitized $185 million loans with Freddie Mac in a pilot programChimera expects high single digit yields on the portfolio without leverage 7

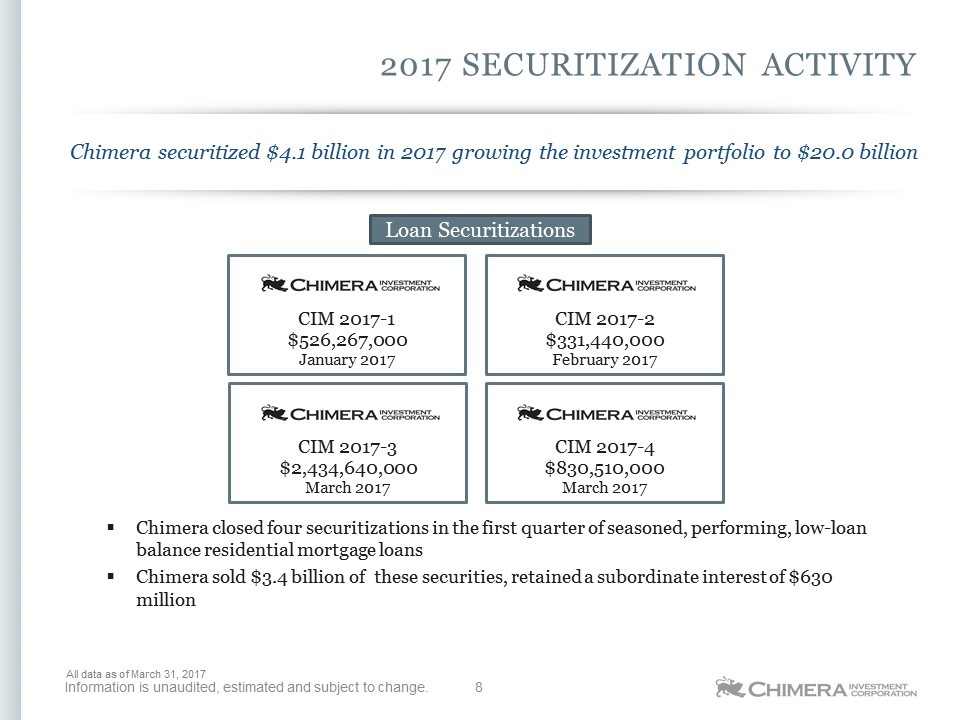

2017 Securitization Activity Information is unaudited, estimated and subject to change. Chimera securitized $4.1 billion in 2017 growing the investment portfolio to $20.0 billion Liquidation Preference $25.00 per share Loan Securitizations All data as of March 31, 2017 Chimera closed four securitizations in the first quarter of seasoned, performing, low-loan balance residential mortgage loansChimera sold $3.4 billion of these securities, retained a subordinate interest of $630 million 8

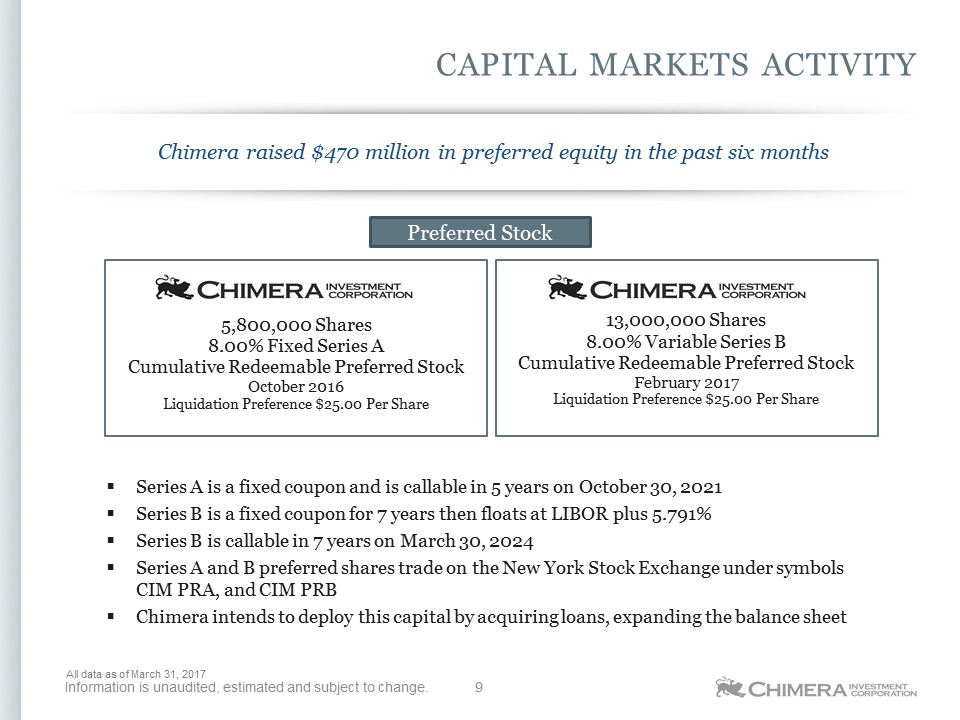

Capital Markets Activity Information is unaudited, estimated and subject to change. Chimera raised $470 million in preferred equity in the past six months Liquidation Preference $25.00 per share All data as of March 31, 2017 Preferred Stock Series A is a fixed coupon and is callable in 5 years on October 30, 2021 Series B is a fixed coupon for 7 years then floats at LIBOR plus 5.791% Series B is callable in 7 years on March 30, 2024Series A and B preferred shares trade on the New York Stock Exchange under symbols CIM PRA, and CIM PRBChimera intends to deploy this capital by acquiring loans, expanding the balance sheet 9

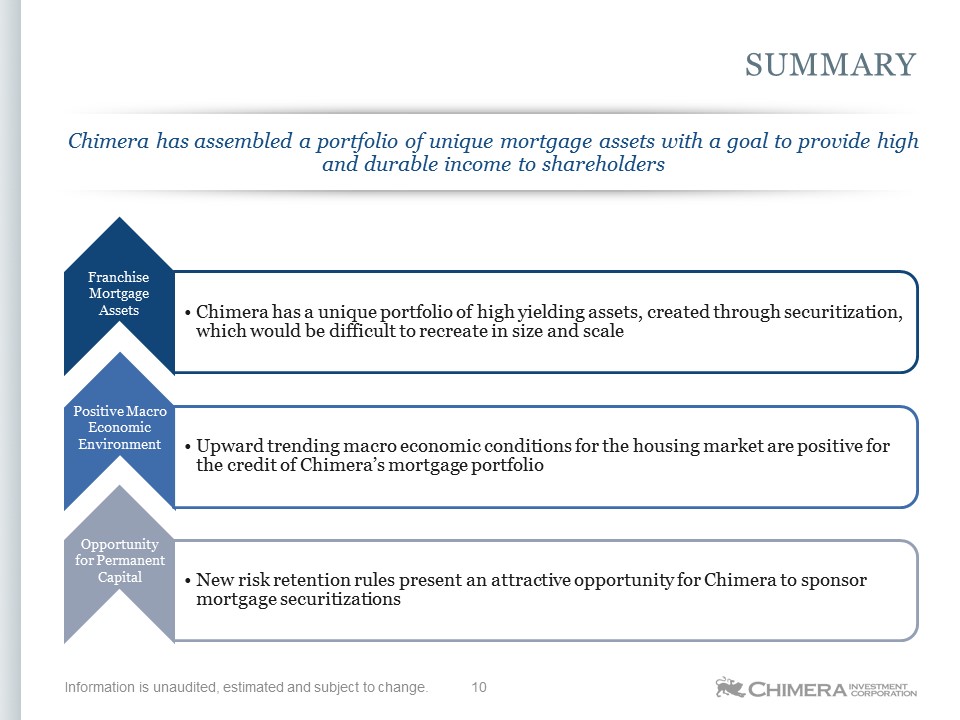

Summary Information is unaudited, estimated and subject to change. Chimera has assembled a portfolio of unique mortgage assets with a goal to provide high and durable income to shareholders Franchise Mortgage Assets Positive Macro Economic Environment Opportunity for Permanent Capital 10